The Gilliam Corp. has the following balance sheet and income statement. Compute the profitability, asset utilization, liquidity, and debt utilization ratios. GILLIAM CORPORATION Balance Sheet

The Gilliam Corp. has the following balance sheet and income statement. Compute the profitability, asset utilization, liquidity, and debt utilization ratios.

GILLIAM CORPORATION Balance Sheet December 31, 201X Assets Cument assets: Cash Marketable seourities Accounts recelvatile (ne Iventory Total cumrent assets S. 70,000 40.000 250.000 200.000 $ s00.000 Investments 100,000 Net plant and equomert Total ansets 440,000 SA100.000 Liabilities and Stockholders Equity Curent lablties Accounts payable 130.000 Notes payatle 120.000 Acorued taxes Total curent abites 30.000 200.000 Long-term labtes Bonds payatle 200.000 Total labtes $ 400.000 Stockholders equity Prefered stock, $100 par value Common stock. S5 par value 150.000 50.000 200.000 Capital paid in escess of par Retained eaminga Total stockhokders equty Total kabiies and stockholders equity 220.000 620,000 $1,100.000

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

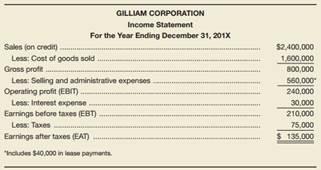

profitability ratios 1 Profit margin Net incomeSales 135000 2400000 563 2 Return on assets Net incom...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started