Answered step by step

Verified Expert Solution

Question

1 Approved Answer

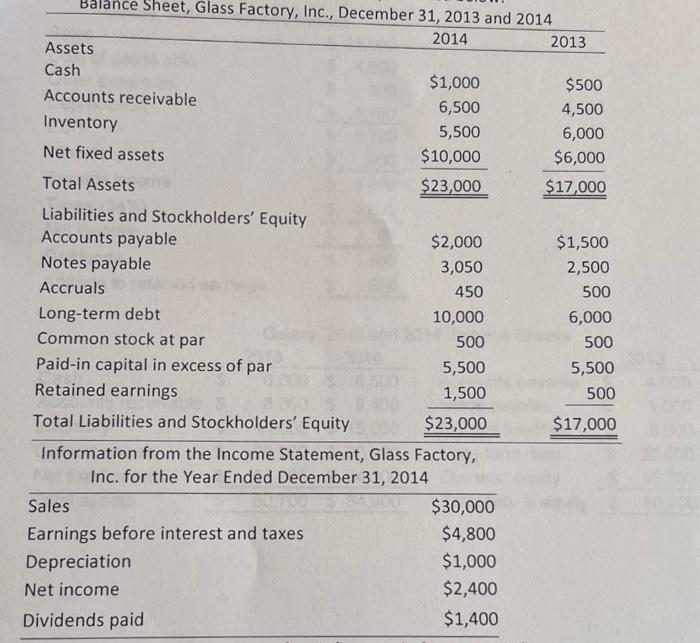

The Glass Factory, Inc. has just ended the 2014 production year. The balance sheet and partial information from the income statement are presented below. a)

The Glass Factory, Inc. has just ended the 2014 production year. The balance sheet and partial information from the income statement are presented below.

a) Prepare a partial statement of cash flows only for net cash flow from operating activity, and

b) calculate the equity multiplier of Glass Factory for the year ended on December 31, 2014

Balance Sheet, Glass Factory, Inc., December 31, 2013 and 2014 2014 Assets. Cash Accounts receivable Inventory Net fixed assets Total Assets Liabilities and Stockholders' Equity Accounts payable Notes payable Accruals my $1,000 6,500 5,500 $10,000 $23,000 Long-term debt 10,000 Common stock at par 500 Paid-in capital in excess of par 5,500 Retained earnings 1,500 Total Liabilities and Stockholders' Equity $23,000 Information from the Income Statement, Glass Factory, Inc. for the Year Ended December 31, 2014 Sales Earnings before interest and taxes Depreciation Net income Dividends paid $2,000 3,050 450 $30,000 $4,800 $1,000 $2,400 $1,400 2013 $500 4,500 6,000 $6,000 $17,000 $1,500 2,500 500 6,000 500 5,500 500 $17,000

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Partial Statement of Cash Flows for Net Cash Flow from Operating Activ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started