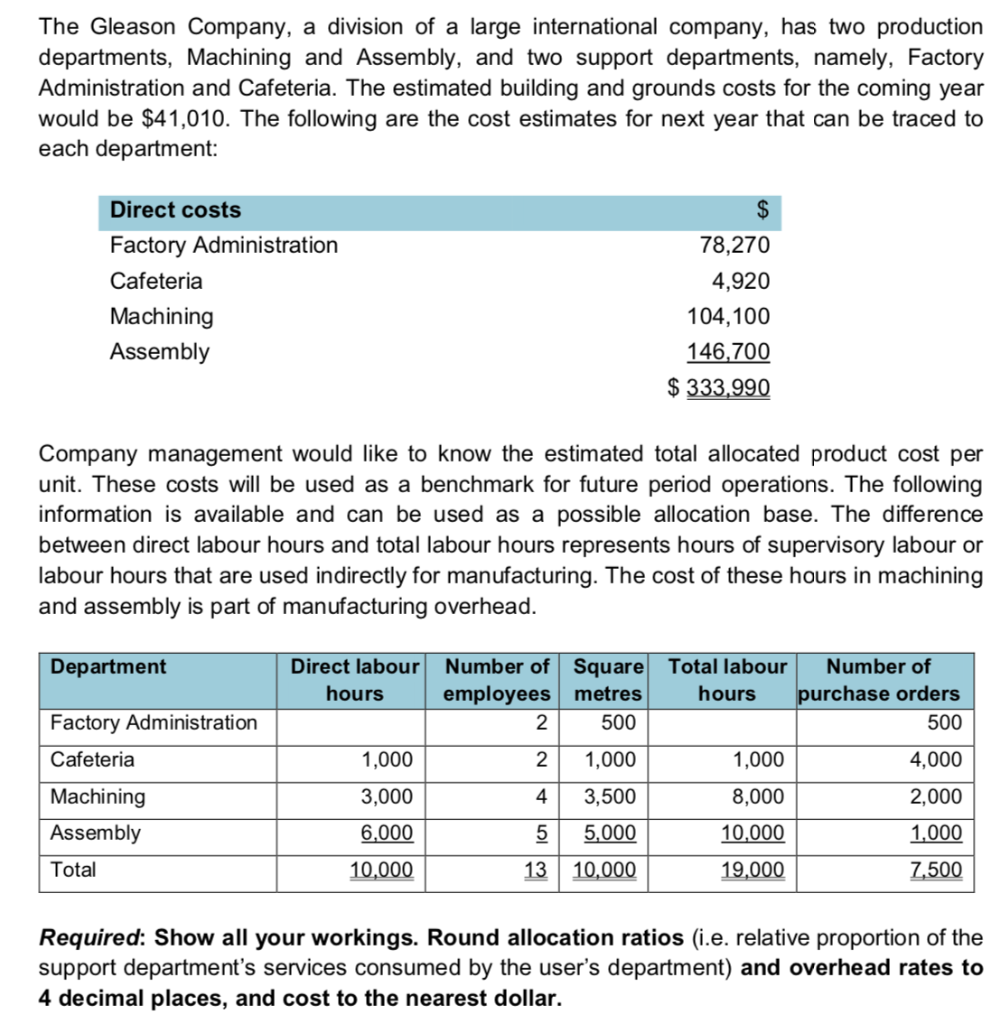

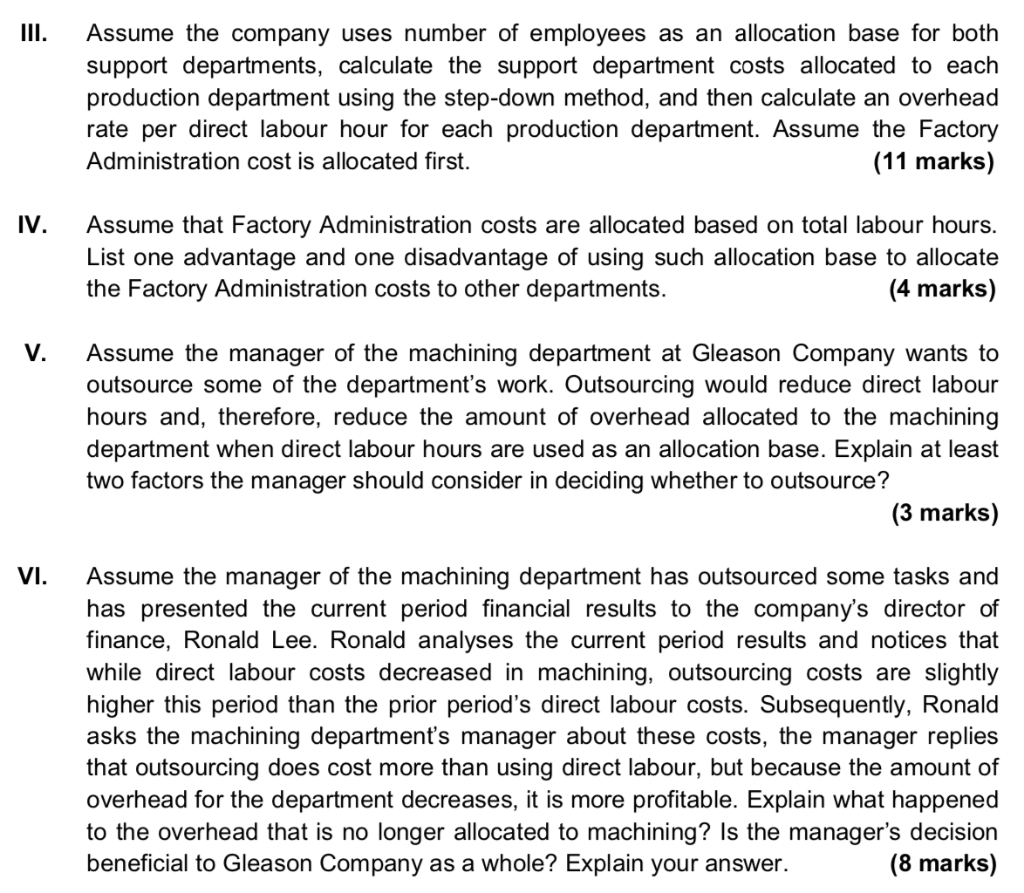

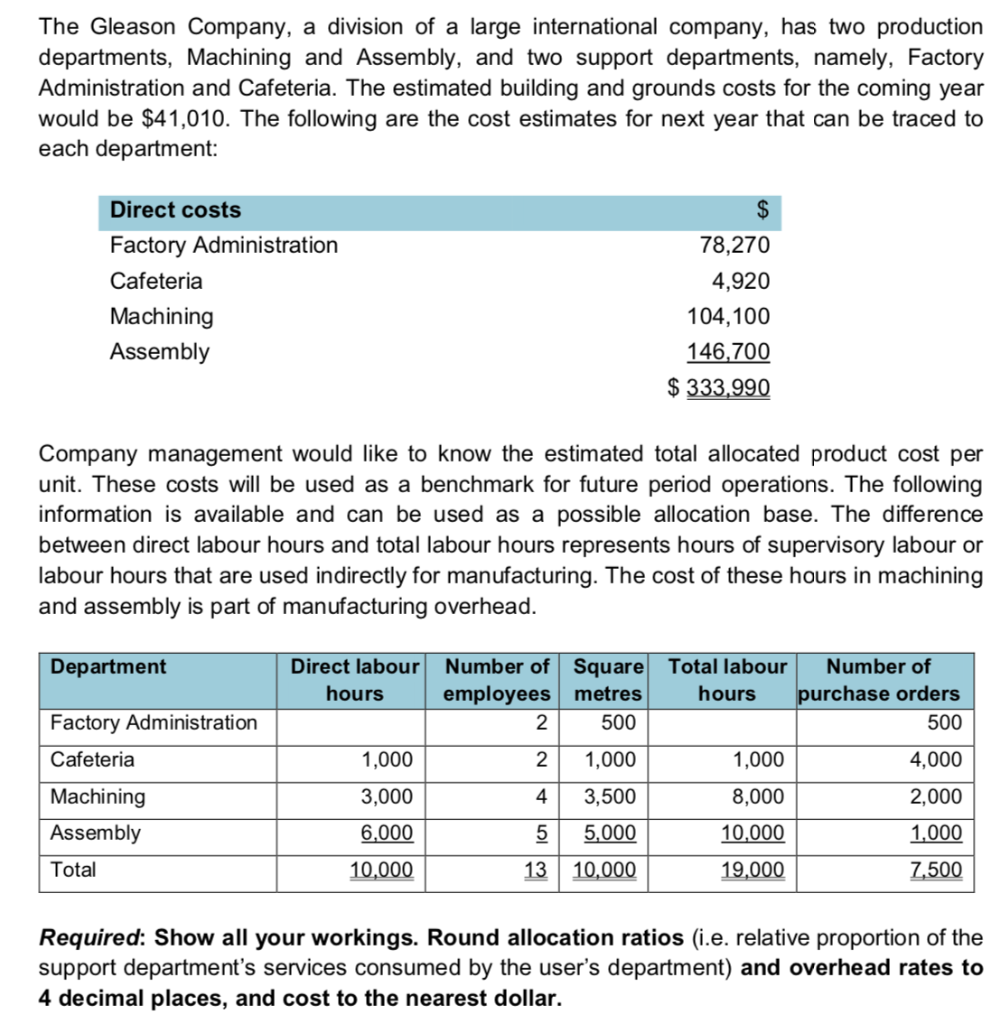

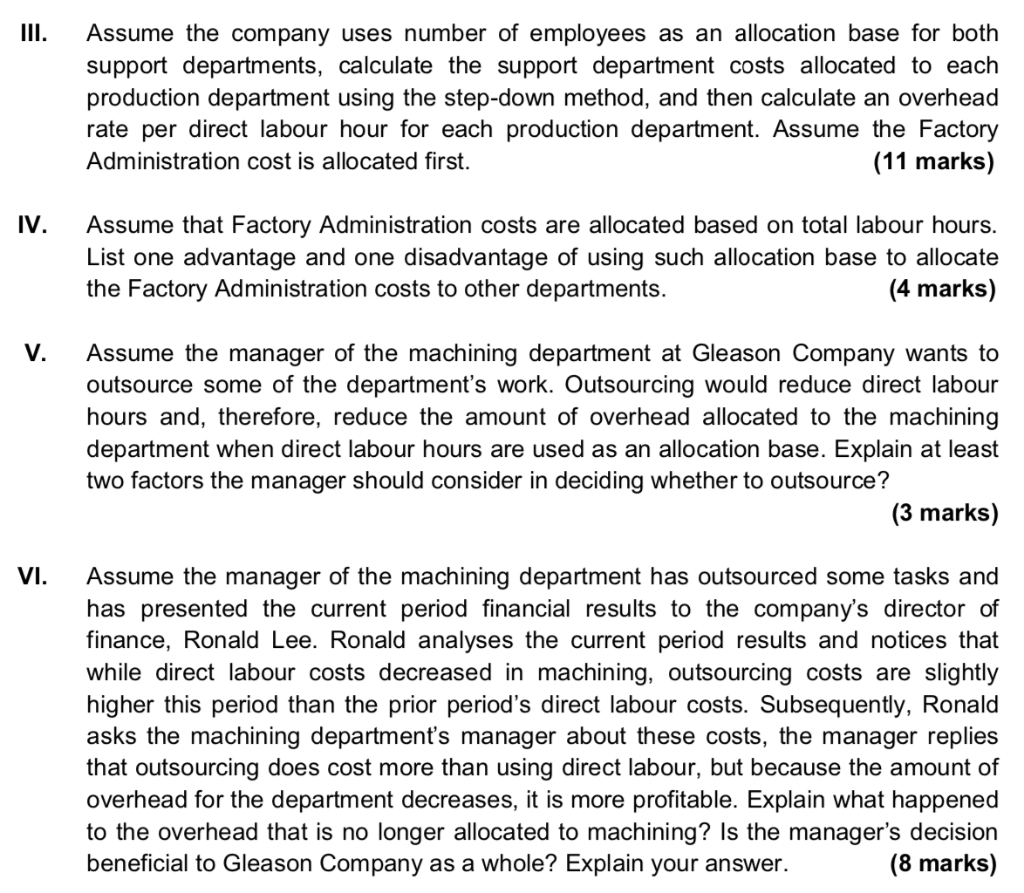

The Gleason Company, a division of a large international company, has two production departments, Machining and Assembly, and two support departments, namely, Factory Administration and Cafeteria. The estimated building and grounds costs for the coming year would be $41,010. The following are the cost estimates for next year that can be traced to each department: Direct costs Factory Administration Cafeteria Machiningg Assembly 78,270 4,920 104,100 146,700 $ 333,990 Company management would like to know the estimated total allocated product cost per unit. These costs will be used as a benchmark for future period operations. The following information is available and can be used as a possible allocation base. The difference between direct labour hours and total labour hours represents hours of supervisory labour or labour hours that are used indirectly for manufacturing. The cost of these hours in machining and assembly is part of manufacturing overhead. Department Direct labourNumber of Square Total labourNumber of hours employees metres 2 hours urchase orders 500 4,000 2,000 1000 Z,500 500 2 1,000 43,500 5 5,000 13 10,000 Factory Administration Cafeteria Machining Assembly Total 1,000 3,000 6,000 10,000 1,000 8,000 10,000 19,000 Required: Show all your workings. Round allocation ratios (i.e. relative proportion of the support department's services consumed by the user's department) and overhead rates to 4 decimal places, and cost to the nearest dollar. III. Assume the company uses number of employees as an allocation base for both support departments, calculate the support department costs allocated to each production department using the step-down method, and then calculate an overhead rate per direct labour hour for each production department. Assume the Factory Administration cost is allocated first. (11 marks) IV. Assume that Factory Administration costs are allocated based on total labour hours. List one advantage and one disadvantage of using such allocation base to allocate the Factory Administration costs to other departments. (4 marks) V. Assume the manager of the machining department at Gleason Company wants to outsource some of the department's work. Outsourcing would reduce direct labour hours and, therefore, reduce the amount of overhead allocated to the machining department when direct labour hours are used as an allocation base. Explain at least two factors the manager should consider in deciding whether to outsource? (3 marks) VI. Assume the manager of the machining department has outsourced some tasks and has presented the current period financial results to the company's director of finance, Ronald Lee. Ronald analyses the current period results and notices that while direct labour costs decreased in machining, outsourcing costs are slightly higher this period than the prior period's direct labour costs. Subsequently, Ronald asks the machining department's manager about these costs, the manager replies that outsourcing does cost more than using direct labour, but because the amount of overhead for the department decreases, it is more profitable. Explain what happened to the overhead that is no longer allocated to machining? Is the manager's decision beneficial to Gleason Company as a whole? Explain your answer. (8 marks)