Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The global equities team at your becriae followin equities team at your bank is nt costs when they meet the considering investing in Remy Corporation.

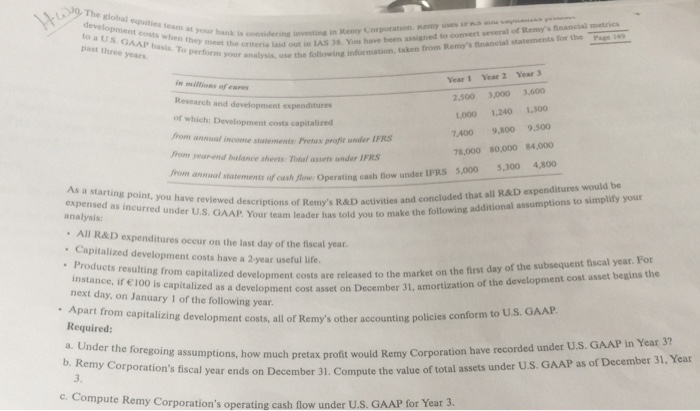

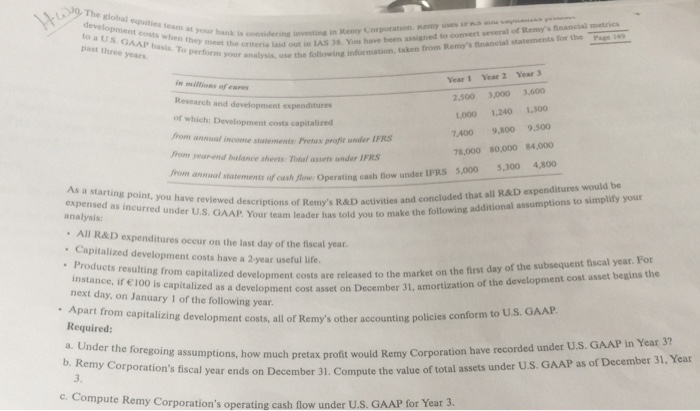

The global equities team at your becriae followin equities team at your bank is nt costs when they meet the considering investing in Remy Corporation. kemy uses IERS SIu veycava criteria laid out in 1AS 38. You have been assigned to convert several of Remy's financial metrics past three years our analysis, use the following information, taken from Remy's financial statements for the Pae Year 2 Year 3 Year I in millions of eares Research and development expenditures of which: Development costs capitalized 2.500 3,000 3,600 1,000 1,240 1,300 7,400 9,800 9,500 78,000 80,000 84,000 annual income statements: Pretax profit under IFRs veanend balance sheets Total assets under IFRS from rom annual statements of cash flow Operating cash flow under I FRS 5,000 5,300 4,800 i As a starting point, you have reviewed expensed as incurred under U.S. GAAP. Your analysis: descriptions of Remy's R&D activities and concluded that all R&D expenditures would be told you to r team leader has told you to make the following additional assumptions to simplify your AlL R&D expenditures occur on the last day of the fiscal year. Capitalized development costs have a 2-year useful life. Products resulting from capitalized development costs are re leased to the market on the first day of the subsequent fiscal year. For ui a development cost asset on December 31, amortization of the development cost asset begins the next day, on January 1 of the following year Apart from capitalizing Required: development costs, all of Remy's other accounting policies conform to U .S. GAAP ow much pretax profit would Remy Corporation have recorded under U.S. GAAP in Year 3? 3, a year ends on December 31. Compute the value of total assets under U.S. GAAP as of December 31, Year ute Remy Corporation's operating cash flow under U.S. GAAP for Year 3. The global equities team at your becriae followin equities team at your bank is nt costs when they meet the considering investing in Remy Corporation. kemy uses IERS SIu veycava criteria laid out in 1AS 38. You have been assigned to convert several of Remy's financial metrics past three years our analysis, use the following information, taken from Remy's financial statements for the Pae Year 2 Year 3 Year I in millions of eares Research and development expenditures of which: Development costs capitalized 2.500 3,000 3,600 1,000 1,240 1,300 7,400 9,800 9,500 78,000 80,000 84,000 annual income statements: Pretax profit under IFRs veanend balance sheets Total assets under IFRS from rom annual statements of cash flow Operating cash flow under I FRS 5,000 5,300 4,800 i As a starting point, you have reviewed expensed as incurred under U.S. GAAP. Your analysis: descriptions of Remy's R&D activities and concluded that all R&D expenditures would be told you to r team leader has told you to make the following additional assumptions to simplify your AlL R&D expenditures occur on the last day of the fiscal year. Capitalized development costs have a 2-year useful life. Products resulting from capitalized development costs are re leased to the market on the first day of the subsequent fiscal year. For ui a development cost asset on December 31, amortization of the development cost asset begins the next day, on January 1 of the following year Apart from capitalizing Required: development costs, all of Remy's other accounting policies conform to U .S. GAAP ow much pretax profit would Remy Corporation have recorded under U.S. GAAP in Year 3? 3, a year ends on December 31. Compute the value of total assets under U.S. GAAP as of December 31, Year ute Remy Corporation's operating cash flow under U.S. GAAP for Year 3

The global equities team at your becriae followin equities team at your bank is nt costs when they meet the considering investing in Remy Corporation. kemy uses IERS SIu veycava criteria laid out in 1AS 38. You have been assigned to convert several of Remy's financial metrics past three years our analysis, use the following information, taken from Remy's financial statements for the Pae Year 2 Year 3 Year I in millions of eares Research and development expenditures of which: Development costs capitalized 2.500 3,000 3,600 1,000 1,240 1,300 7,400 9,800 9,500 78,000 80,000 84,000 annual income statements: Pretax profit under IFRs veanend balance sheets Total assets under IFRS from rom annual statements of cash flow Operating cash flow under I FRS 5,000 5,300 4,800 i As a starting point, you have reviewed expensed as incurred under U.S. GAAP. Your analysis: descriptions of Remy's R&D activities and concluded that all R&D expenditures would be told you to r team leader has told you to make the following additional assumptions to simplify your AlL R&D expenditures occur on the last day of the fiscal year. Capitalized development costs have a 2-year useful life. Products resulting from capitalized development costs are re leased to the market on the first day of the subsequent fiscal year. For ui a development cost asset on December 31, amortization of the development cost asset begins the next day, on January 1 of the following year Apart from capitalizing Required: development costs, all of Remy's other accounting policies conform to U .S. GAAP ow much pretax profit would Remy Corporation have recorded under U.S. GAAP in Year 3? 3, a year ends on December 31. Compute the value of total assets under U.S. GAAP as of December 31, Year ute Remy Corporation's operating cash flow under U.S. GAAP for Year 3. The global equities team at your becriae followin equities team at your bank is nt costs when they meet the considering investing in Remy Corporation. kemy uses IERS SIu veycava criteria laid out in 1AS 38. You have been assigned to convert several of Remy's financial metrics past three years our analysis, use the following information, taken from Remy's financial statements for the Pae Year 2 Year 3 Year I in millions of eares Research and development expenditures of which: Development costs capitalized 2.500 3,000 3,600 1,000 1,240 1,300 7,400 9,800 9,500 78,000 80,000 84,000 annual income statements: Pretax profit under IFRs veanend balance sheets Total assets under IFRS from rom annual statements of cash flow Operating cash flow under I FRS 5,000 5,300 4,800 i As a starting point, you have reviewed expensed as incurred under U.S. GAAP. Your analysis: descriptions of Remy's R&D activities and concluded that all R&D expenditures would be told you to r team leader has told you to make the following additional assumptions to simplify your AlL R&D expenditures occur on the last day of the fiscal year. Capitalized development costs have a 2-year useful life. Products resulting from capitalized development costs are re leased to the market on the first day of the subsequent fiscal year. For ui a development cost asset on December 31, amortization of the development cost asset begins the next day, on January 1 of the following year Apart from capitalizing Required: development costs, all of Remy's other accounting policies conform to U .S. GAAP ow much pretax profit would Remy Corporation have recorded under U.S. GAAP in Year 3? 3, a year ends on December 31. Compute the value of total assets under U.S. GAAP as of December 31, Year ute Remy Corporation's operating cash flow under U.S. GAAP for Year 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started