Question: The Globally Diversified Multi Assets Fund has a standard deviation of 30%. Expected rate of return on the market is 13% and Market Standard

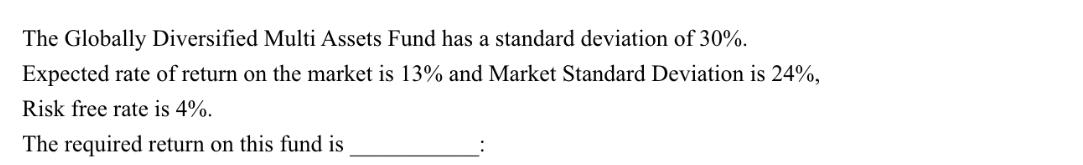

The Globally Diversified Multi Assets Fund has a standard deviation of 30%. Expected rate of return on the market is 13% and Market Standard Deviation is 24%, Risk free rate is 4%. The required return on this fund is

Step by Step Solution

There are 3 Steps involved in it

To calculate the required return for the Globally Diversified Multi Assets Fund you can use the Capi... View full answer

Get step-by-step solutions from verified subject matter experts