Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Glover Scholastic Aid Foundation has received a 2 0 million global government bond portfolio from a Greek donor. This bond ortfolio will be held

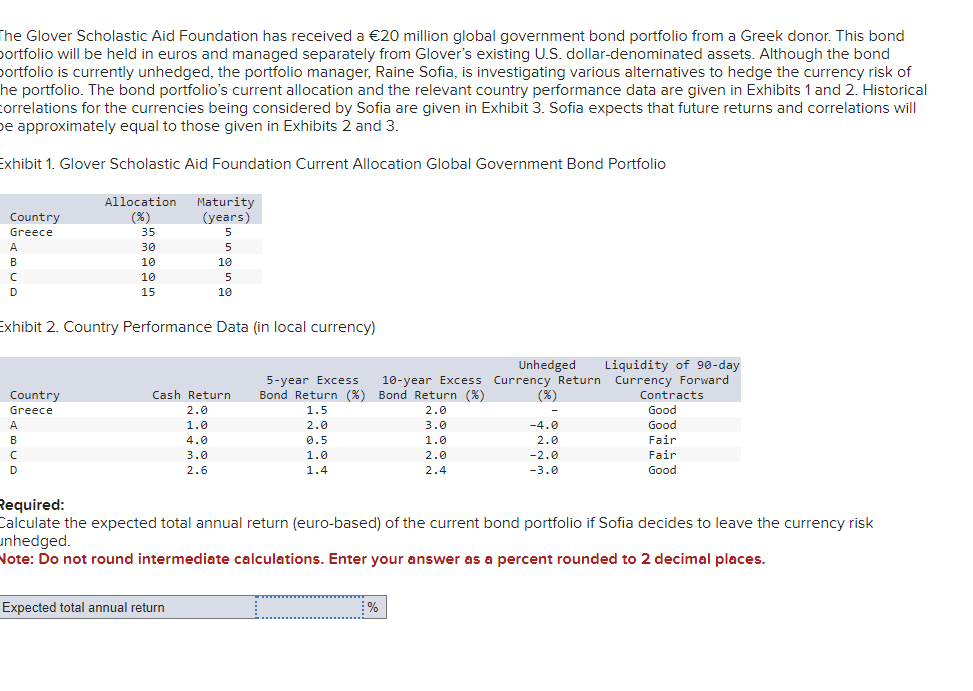

The Glover Scholastic Aid Foundation has received a million global government bond portfolio from a Greek donor. This bond

ortfolio will be held in euros and managed separately from Glover's existing US dollardenominated assets. Although the bond

portfolio is currently unhedged, the portfolio manager, Raine Sofia, is investigating various alternatives to hedge the currency risk of

he portfolio. The bond portfolio's current allocation and the relevant country performance data are given in Exhibits and Historical

correlations for the currencies being considered by Sofia are given in Exhibit Sofia expects that future returns and correlations will

eapproximately equal to those given in Exhibits and

Exhibit Glover Scholastic Aid Foundation Current Allocation Global Government Bond Portfolio

Exhibit Country Performance Data in local currency

Required:

Calculate the expected total annual return eurobased of the current bond portfolio if Sofia decides to leave the currency risk

unedged.

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to decimal places.

Expected total annual return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started