Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the goal is to retire by 65 Jamie Lee and Ross, now 57 and still very active, have plenty of time on their hands now

the goal is to retire by 65

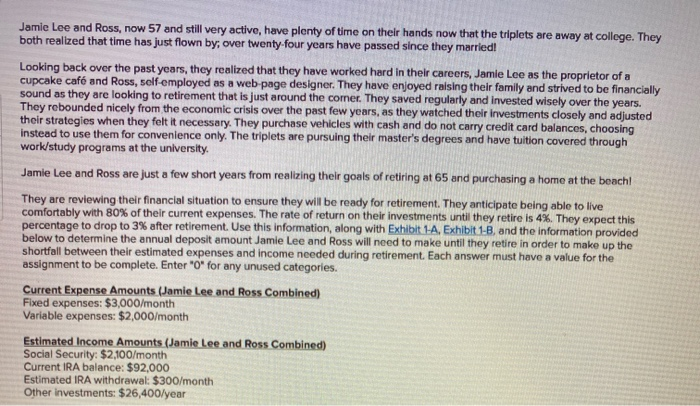

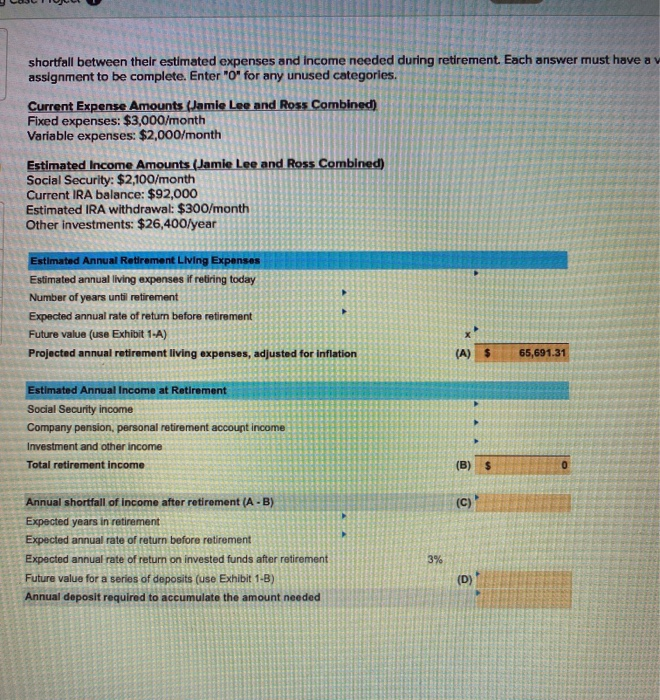

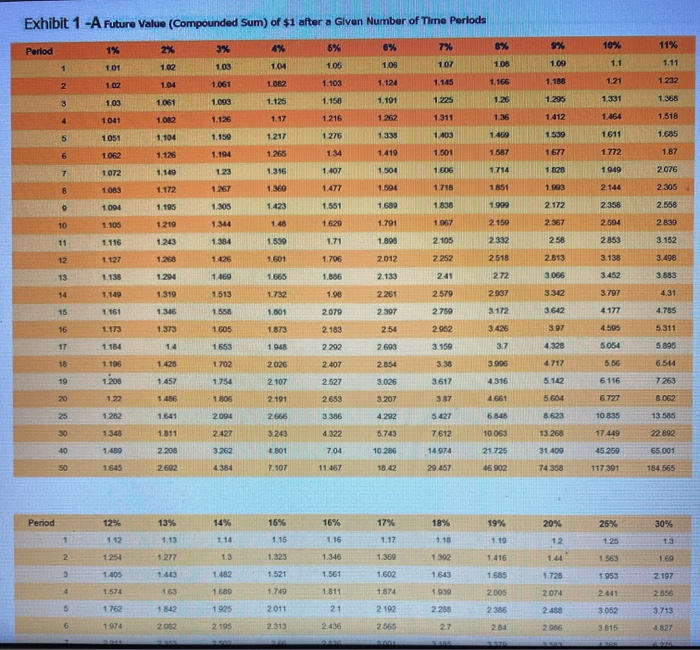

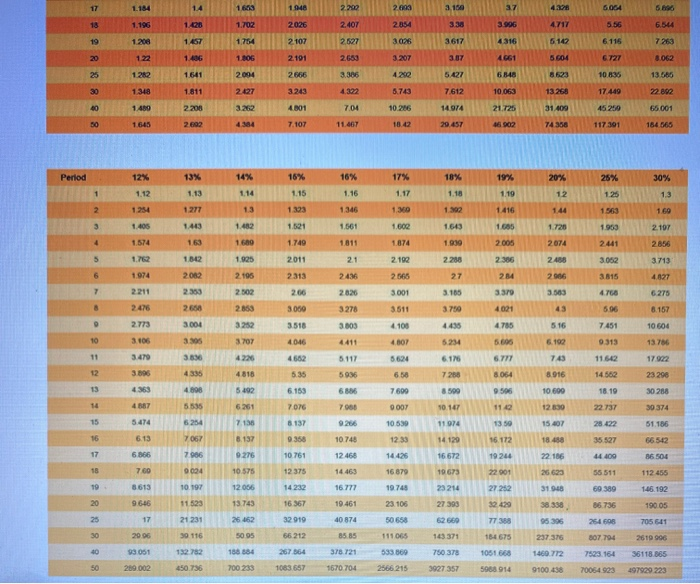

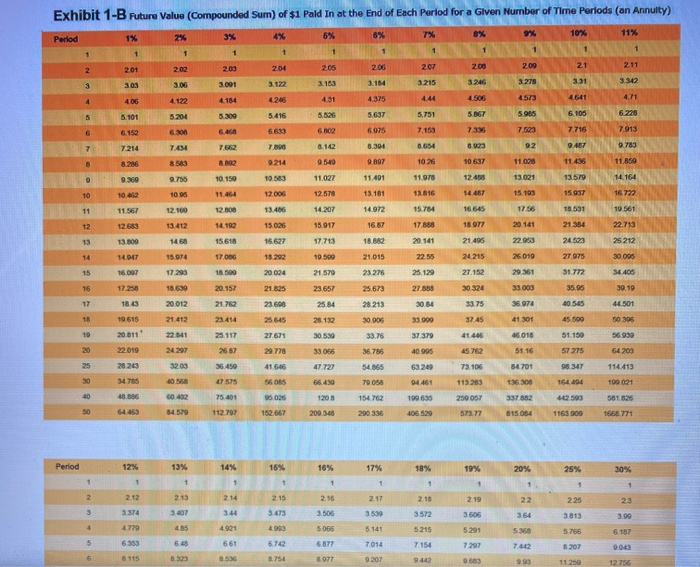

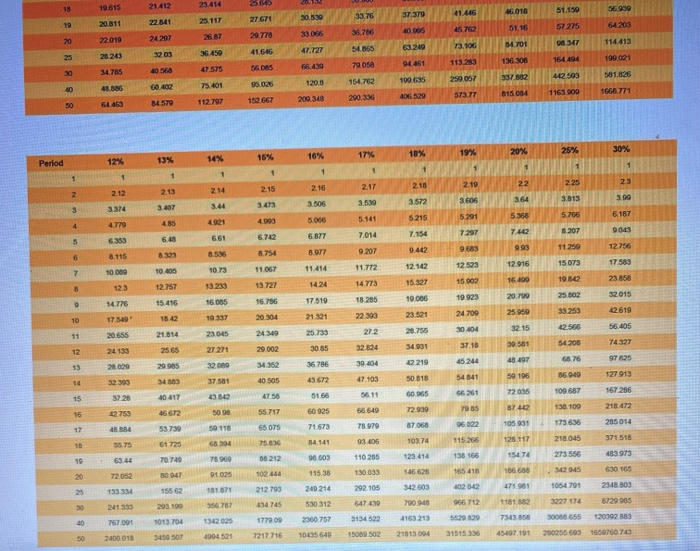

Jamie Lee and Ross, now 57 and still very active, have plenty of time on their hands now that the triplets are away at college. They both realized that time has just flown by, over twenty-four years have passed since they married! Looking back over the past years, they realized that they have worked hard in their careers, Jamie Lee as the proprietor of a cupcake caf and Ross, self-employed as a web page designer. They have enjoyed raising their family and strived to be financially sound as they are looking to retirement that is just around the comer. They saved regularly and invested wisely over the years. They rebounded nicely from the economic crisis over the past few years, as they watched their investments closely and adjusted their strategies when they felt it necessary. They purchase vehicles with cash and do not carry credit card balances, choosing instead to use them for convenience only. The triplets are pursuing their master's degrees and have tuition covered through work/study programs at the university. Jamie Lee and Ross are just a few short years from realizing their goals of retiring at 65 and purchasing a home at the beach! They are reviewing their financial situation to ensure they will be ready for retirement. They anticipate being able to live comfortably with 80% of their current expenses. The rate of return on their investments until they retire is 4%. They expect this percentage to drop to 3% after retirement. Use this information, along with Exhibit 1-A Exhibit 1-B, and the information provided below to determine the annual deposit amount Jamie Lee and Ross will need to make until they retire in order to make up the shortfall between their estimated expenses and income needed during retirement. Each answer must have a value for the assignment to be complete. Enter "O" for any unused categories. Current Expense Amounts (Jamie Lee and Ross Combined) Fixed expenses: $3,000/month Variable expenses: $2,000/month Estimated Income Amounts (Jamie Lee and Ross Combined) Social Security: $2,100/month Current IRA balance: $92,000 Estimated IRA withdrawal: $300/month Other investments: $26,400/year shortfall between their estimated expenses and income needed during retirement. Each answer must have a v assignment to be complete. Enter "O" for any unused categories Current Expense Amounts (Jamie Lee and Ross Combined) Fixed expenses: $3,000/month Variable expenses: $2,000/month Estimated Income Amounts (Jamie Lee and Ross Combine Social Security: $2,100/month Current IRA balance: $92,000 Estimated IRA withdrawal: $300/month Other investments: $26,400/year Estimated Annual Retirement Living Expenses Estimated annual living expenses if retiring today Number of years until retirement Expected annual rate of return before retirement Future value (use Exhibit 1-A) Projected annual retirement living expenses, adjusted for inflation 65,691.31 Estimated Annual Income at Retirement Social Security income Company pension, personal retirement account income Investment and other income Total retirement income Annual shortfall of income after retirement (A-B) Expected years in retirement Expected annual rate of return before retirement Expected annual rate of return on invested funds after retirement Future value for a series of deposits (use Exhibit 1-B) Annual deposit required to accumulate the amount needed Exhibit 1 -A Future Value (Compounded Sum) of $1 after a Glven Number of Time Periods Period 7% 6% 10% 11% 104 1.11 1.103 1222 1093 1.158 1.366 1216 1685 123 2.076 2 305 2.556 1 898 2853 3152 171 1.796 1.586 2012 3 133 3.452 1.513 1.90 2.261 3.797 2 2.079 2397 4 177 1.173 2.183 254 1154 2292 2693 5054 556 . 2 407 6564 2020 2107 1754 3617 7259 8 8 13 SAS 5243 5703 10206 1 8.42 4384 11 467 15% 1953 172 1974 2313 2.603 6054 5. 2.407 6544 2 9 2627 7263 2.650 8069 8 10 R35 13.585 8 5.743 17.449 22.02 8 10.2006 45250 117301 65.001 164 165 8 11.467 18.42 20.457 Period 13% 1.13 1 277 1405 1.561 1.600 2.197 1 574 163 2856 1542 2011 2192 3.052 3713 1974 265 4027 2313 200 2436 2826 2.211 3001 3.105 6275 3.000 3278 3511 8157 2.773 3518 4100 7.451 10 604 4807 0313 5624 743 17 22 5117 5936 6 11.542 14562 6.58 8 916 23 20 4363 10 690 18 19 3028 22.737 30374 12.30 15.07 5.414 9266 28422 61 166 7600 0007 10599 12 33 14426 16879 19745 10748 12 468 35 527 6.866 44 409 86 504 12375 14463 55 511 112 455 8615 16.777 23214 69 389 145. 192 9646 23. 106 86.736 190 05 16367 32 919 40 874 62 660 254 698 705 6.01 50 658 111065 66 212 85 85 143371 237375 807 794 261996 132782 267 364 376721 593 869 750 378 1051 668 1469772 36118.865 93.051 209.002 7523 164 70064 923 50 450.730 700233 1083 657 1670 704 2566 215 3927 357 508 914 9100 438 497929 223 Exhibit 1-B Future Value (Compounded Sum) of $1 Pald In at the End of Each Perlod for a Given Number of Time Periods (an Annuity) Period 202 203 204 2 3895 9214 1069 9.750 100 12 160 10.452 11.567 12.678 10.50 11.464 12.00 14100 1053 12.006 13.486 14207 14072 15000 15017 13.412 1 130 15618 5.627 1773 18 14DET 150 17006 2015 16.097 1723 27 152 18500 20.157 17.258 20024 21.825 23.606 2 1579 23.657 25.84 25 673 20012 2170 26 213 375 21412 19615 2011 33.75 27671 29778 30530 33066 67 57 275 64 203 47.727 54865 08347 114413 GN 7005 1644 10021 154 152667 200343 290 336 0 629 1163 9098 771 3 3473 3505 3572 3.813 5.755 5.207 661 50 877 701 200 790 154.70 290 335 6,877 11.414 17.519 17563 2356 32015 0619 56.405 74307 97625 127 913 167 256 66 849 216.472 55075 756 34 141 58212 371.518 483973 11025 123 102 212.793 102 042 1054791 2348 803 115.38 240 214 292 105 42603 6478 2360757313452 21623 10055 640 15000 50221813004 76701 1013704 130202 TTD 0 743358 SS 2012 315153354540101200955693 1650160 1004521 7217716 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started