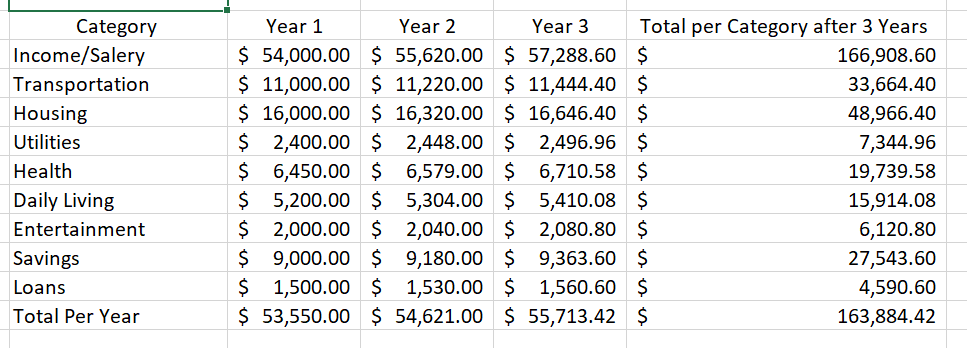

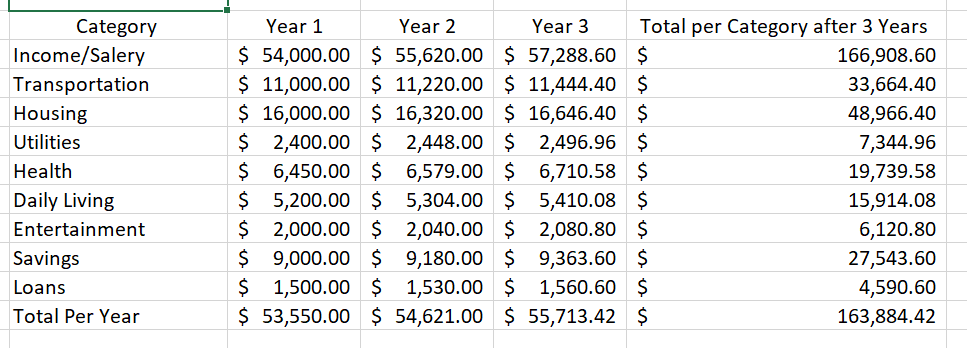

The goal of this project is to help you plan for your financial future. The first step in creating a plan is to derive your cash flow. In this project, your planning horizon is 3 years. The starting point of your cash flow is the first month after you graduate. The provided Excel program lists all the data categories that you need to know to create your cash flow. You should use the Excel program to create the following scenario. You start your life after graduation with a full time job that pays $54,000 a year after deducting federal income taxes, state income taxes, Medicare fees (tax), and Social Security fees (tax). Your salary increases by 3% every year. You are free to determine the value of every other revenue (income) or cost (expenses) item. All the entered values must be close to reality and actual values (what happens in real life). You must enter values for all basic items such as food, medical, etc. Leaving these items as zero will generate a zero grade for your project. You must also take into account that the prices of basic goods increase every year due to inflation. So the costs that you enter for these items must show an increment of at least 2% per year. Perform the following steps: 1- Calculate the PW and AW of your 3-year cash flow using interest rate scenarios of 2%. 2- Calculate the ROR of your cash flow given a reinvestment rate of 5%. 3- How much in savings you should have at the time of graduation in order to make sure that your cumulative cash flow during the three-year planning horizon will not become negative. Category Income/Salery Transportation Housing Utilities Health Daily Living Entertainment Savings Loans Total Per Year Year 1 Year 2 Year 3 Total per Category after 3 Years $ 54,000.00 $ 55,620.00 $ 57,288.60 $ 166,908.60 $ 11,000.00 $ 11,220.00 $ 11,444.40 $ 33,664.40 $ 16,000.00 $ 16,320.00 $ 16,646.40 $ 48,966.40 $ 2,400.00 $ 2,448.00 $ 2,496.96 $ 7,344.96 $ 6,450.00 $ 6,579.00 $ 6,710.58 $ 19,739.58 $ 5,200.00 $ 5,304.00 $ 5,410.08 $ 15,914.08 $ 2,000.00 $ 2,040.00 $ 2,080.80 $ 6,120.80 $ 9,000.00 $ 9,180.00 $ 9,363.60 $ 27,543.60 $ 1,500.00 $ 1,530.00 $ 1,560.60 $ 4,590.60 $ 53,550.00 $ 54,621.00 $ 55,713.42 $ 163,884.42 The goal of this project is to help you plan for your financial future. The first step in creating a plan is to derive your cash flow. In this project, your planning horizon is 3 years. The starting point of your cash flow is the first month after you graduate. The provided Excel program lists all the data categories that you need to know to create your cash flow. You should use the Excel program to create the following scenario. You start your life after graduation with a full time job that pays $54,000 a year after deducting federal income taxes, state income taxes, Medicare fees (tax), and Social Security fees (tax). Your salary increases by 3% every year. You are free to determine the value of every other revenue (income) or cost (expenses) item. All the entered values must be close to reality and actual values (what happens in real life). You must enter values for all basic items such as food, medical, etc. Leaving these items as zero will generate a zero grade for your project. You must also take into account that the prices of basic goods increase every year due to inflation. So the costs that you enter for these items must show an increment of at least 2% per year. Perform the following steps: 1- Calculate the PW and AW of your 3-year cash flow using interest rate scenarios of 2%. 2- Calculate the ROR of your cash flow given a reinvestment rate of 5%. 3- How much in savings you should have at the time of graduation in order to make sure that your cumulative cash flow during the three-year planning horizon will not become negative. Category Income/Salery Transportation Housing Utilities Health Daily Living Entertainment Savings Loans Total Per Year Year 1 Year 2 Year 3 Total per Category after 3 Years $ 54,000.00 $ 55,620.00 $ 57,288.60 $ 166,908.60 $ 11,000.00 $ 11,220.00 $ 11,444.40 $ 33,664.40 $ 16,000.00 $ 16,320.00 $ 16,646.40 $ 48,966.40 $ 2,400.00 $ 2,448.00 $ 2,496.96 $ 7,344.96 $ 6,450.00 $ 6,579.00 $ 6,710.58 $ 19,739.58 $ 5,200.00 $ 5,304.00 $ 5,410.08 $ 15,914.08 $ 2,000.00 $ 2,040.00 $ 2,080.80 $ 6,120.80 $ 9,000.00 $ 9,180.00 $ 9,363.60 $ 27,543.60 $ 1,500.00 $ 1,530.00 $ 1,560.60 $ 4,590.60 $ 53,550.00 $ 54,621.00 $ 55,713.42 $ 163,884.42