Answered step by step

Verified Expert Solution

Question

1 Approved Answer

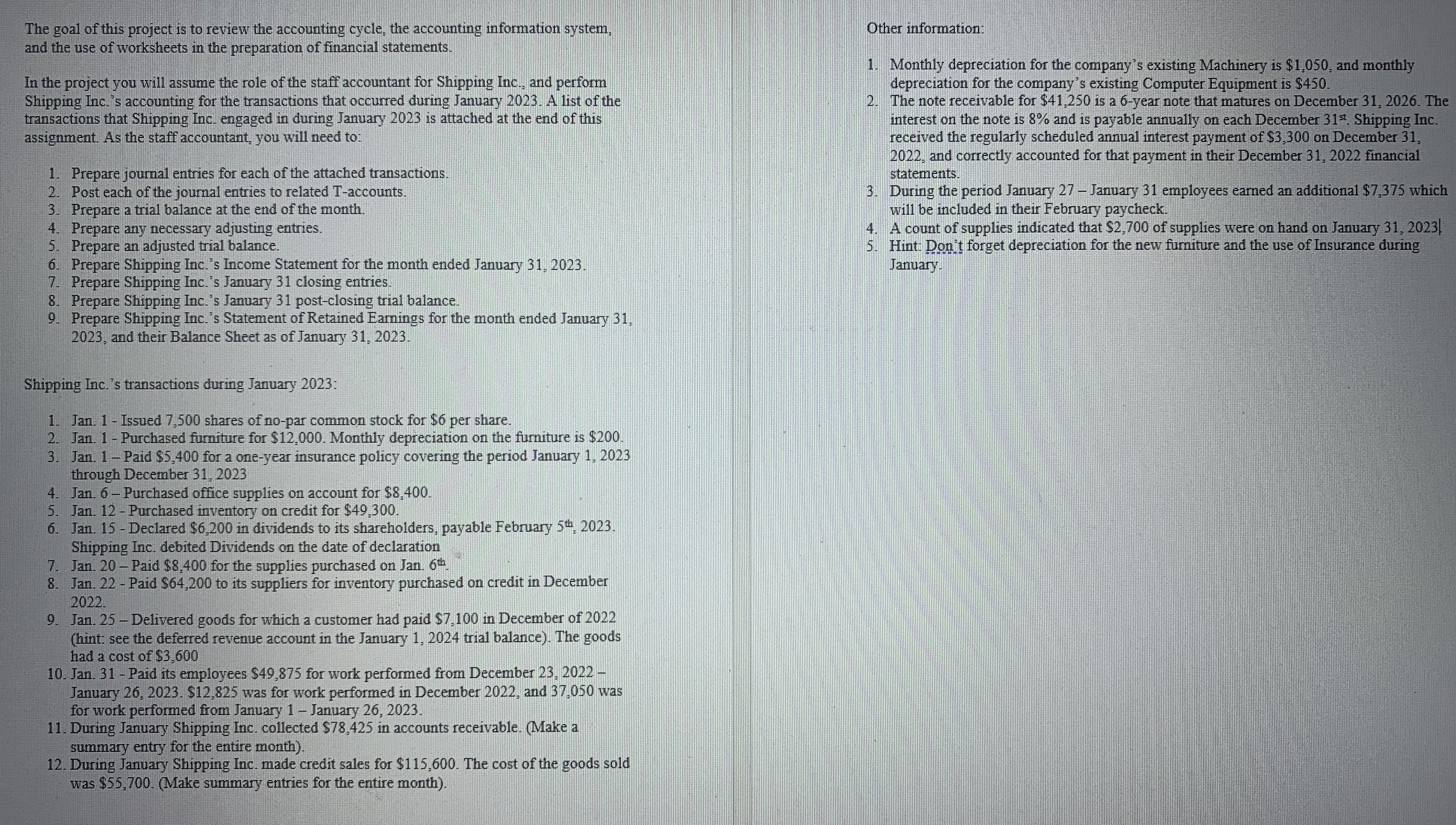

The goal of this project is to review the accounting cycle, the accounting information system, and the use of worksheets in the preparation of financial

The goal of this project is to review the accounting cycle, the accounting information system, and the use of worksheets in the preparation of financial statements.In the project you will assume the role of the staff accountant for Shipping Inc., and perform Shipping Inc.s accounting for the transactions that occurred during January A list of the transactions that Shipping Inc. engaged in during January is attached at the end of this assignment. As the staff accountant, you will need to:

Prepare journal entries for each of the attached transactions.

Post each of the journal entries to related Taccounts.

Prepare a trial balance at the end of the month.

Prepare any necessary adjusting entries Prepare an adjusted trial balance.

Prepare Shipping Inc.s Income Statement for the month ended January

Prepare Shipping Inc.s January closing entries.

Prepare Shipping Inc.s January postclosing trial balance.

Prepare Shipping Inc.s Statement of Retained Earnings for the month ended January and their Balance Sheet as of January

Shipping Inc.s transactions during January :

Jan. Issued shares of nopar common stock for $ per share.

Jan. Purchased furniture for $ Monthly depreciation on the furniture is $

Jan. Paid $ for a oneyear insurance policy covering the period January through December

Jan. Purchased office supplies on account for $

Jan. Purchased inventory on credit for $

Jan Declared $ in dividends to its shareholders, payable February th Shipping Inc. debited Dividends on the date of declaration

Jan. Paid $ for the supplies purchased on Jan. th

Jan. Paid $ to its suppliers for inventory purchased on credit in December

Jan. Delivered goods for which a customer had paid $ in December of hint: see the deferred revenue account in the January trial balance The goods had a cost of $

Jan. Paid its employees $ for work performed from December January $ was for work performed in December and was for work performed from January January

During January Shipping Inc. collected $ in accounts receivable. Make a summary entry for the entire month

During January Shipping Inc. made credit sales for $ The cost of the goods sold was $Make summary entries for the entire month

Other information:

Monthly depreciation for the companys existing Machinery is $ and monthly depreciation for the companys existing Computer Equipment is $

The note receivable for $ is a year note that matures on December The interest on the note is and is payable annually on each December st Shipping Inc. received the regularly scheduled annual interest payment of $ on December and correctly accounted for that payment in their December financial statements.

During the period January January employees earned an additional $ which will be included in their February paycheck.

A count of supplies indicated that $ of supplies were on hand on January

Hint: Dont forget depreciation for the new furniture and the use of Insurance during January.

PLEASE ANSWER STEPS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started