Answered step by step

Verified Expert Solution

Question

1 Approved Answer

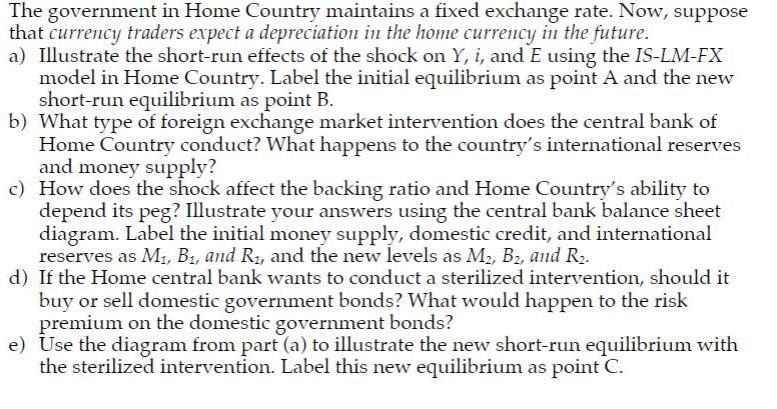

The government in Home Country maintains a fixed exchange rate. Now, suppose that currency traders expect a depreciation in the home currency in the

The government in Home Country maintains a fixed exchange rate. Now, suppose that currency traders expect a depreciation in the home currency in the future. a) Illustrate the short-run effects of the shock on Y, i, and E using the IS-LM-FX model in Home Country. Label the initial equilibrium as point A and the new short-run equilibrium as point B. b) What type of foreign exchange market intervention does the central bank of Home Country conduct? What happens to the country's international reserves and money supply? c) How does the shock affect the backing ratio and Home Country's ability to depend its peg? Illustrate your answers using the central bank balance sheet diagram. Label the initial money supply, domestic credit, and international reserves as M1, B1, and R1, and the new levels as M2, B2, and R2. d) If the Home central bank wants to conduct a sterilized intervention, should it buy or sell domestic government bonds? What would happen to the risk premium on the domestic government bonds? e) Use the diagram from part (a) to illustrate the new short-run equilibrium with the sterilized intervention. Label this new equilibrium as point C.

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

A If currency dealers believe that the home currency will depreciate in the near future Foreign exchange prices decline as a consequence of a decrease ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started