The government is set a big project and incorporated AA Ltd to fulfil the gap in energy supply. After several rounds of bidding, eventually the

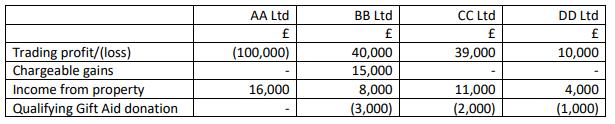

The government is set a big project and incorporated AA Ltd to fulfil the gap in energy supply. After several rounds of bidding, eventually the ordinary share capital of AA Ltd (a trading company) is owned 32% by BB Ltd, 35% by CC Ltd and 23% by DD Ltd. The remaining 10% is owned by various individuals, none of whom own more than 1%. BB Ltd is registered and trading at 32 Queensway, Nottingham. CC Ltd is registered and trading at 15 Dock Street, London, and DD Ltd is registered and trading at 3 Mock Lane, Manchester. All three companies prepare accounts to 31 July. Results for the year to 31 July are as follows:

As it is the first year of trading, AA Ltd was lack of capacity of supplying energy and made a trading loss. However, they utilised some spared space and generated income from property

REQUIRED :

a) Calculate AA Ltd’s trading loss available for group relief.

b) Calculate AA Ltd’s trading loss available for each of BB Ltd, CC ltd, and DD Ltd.

c) Calculate each company’s available profit for group relief.

d) Calculate maximum each company’s possible group relief claims.

Trading profit/(loss) Chargeable gains Income from property Qualifying Gift Aid donation AA Ltd (100,000) 16,000 BB Ltd 40,000 15,000 8,000 (3,000) CC Ltd 39,000 11,000 (2,000) DD Ltd 10,000 4,000 (1,000)

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a AA Ltds trading loss available for group relief is 10000000 b The tra...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started