Suppose Petroxy Oil Co. is going public and, based on the bookbuilding process, decides it will be issuing 750,000 shares of common stock to

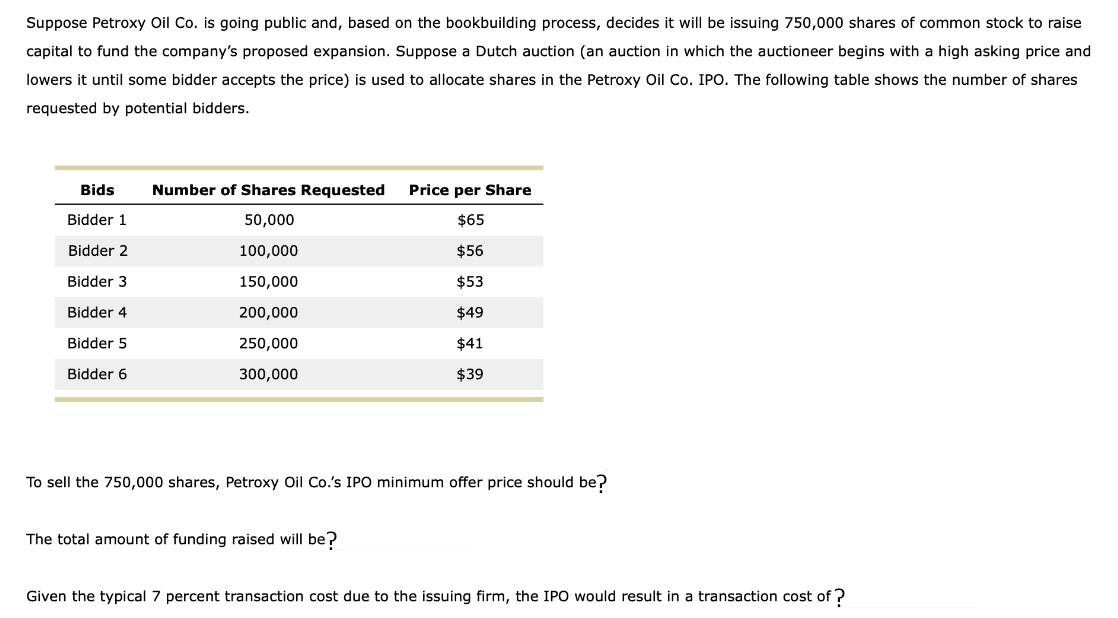

Suppose Petroxy Oil Co. is going public and, based on the bookbuilding process, decides it will be issuing 750,000 shares of common stock to raise capital to fund the company's proposed expansion. Suppose a Dutch auction (an auction in which the auctioneer begins with a high asking price and lowers it until some bidder accepts the price) is used to allocate shares in the Petroxy Oil Co. IPO. The following table shows the number of shares requested by potential bidders. Bids Bidder 1 Bidder 2 Bidder 3 Bidder 4 Bidder 5 Bidder 6 Number of Shares Requested Price per Share 50,000 $65 100,000 150,000 200,000 250,000 300,000 $56 $53 The total amount of funding raised will be? $49 $41 $39 To sell the 750,000 shares, Petroxy Oil Co.'s IPO minimum offer price should be? Given the typical 7 percent transaction cost due to the issuing firm, the IPO would result in a transaction cost of ?

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a To sell the 750000 shares we need to determine the clearing price at which the total demand equals the number of shares offered We start with the hi...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started