Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Government of Canada auctioned a new benchmark 2 year bond, to settle on October 2nd, 2020. The bond has a maturity of November

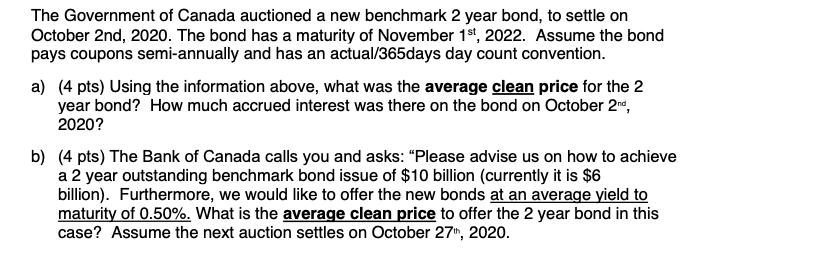

The Government of Canada auctioned a new benchmark 2 year bond, to settle on October 2nd, 2020. The bond has a maturity of November 1st, 2022. Assume the bond pays coupons semi-annually and has an actual/365days day count convention. a) (4 pts) Using the information above, what was the average clean price for the 2 year bond? How much accrued interest was there on the bond on October 2nd, 2020? b) (4 pts) The Bank of Canada calls you and asks: "Please advise us on how to achieve a 2 year outstanding benchmark bond issue of $10 billion (currently it is $6 billion). Furthermore, we would like to offer the new bonds at an average yield to maturity of 0.50%. What is the average clean price to offer the 2 year bond in this case? Assume the next auction settles on October 27th, 2020. Term Coupon Issue Average Average Rate Amount Price Low High Auction Yield Yield Yield Coverage 2Y 0.25% 6 billion ? 0.274 0.270 0.275 3.032

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer a 1 Calculate the first coupon payment Coupon payment 100 x 00025 2 0125 2 Calculate the seco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started