Answered step by step

Verified Expert Solution

Question

1 Approved Answer

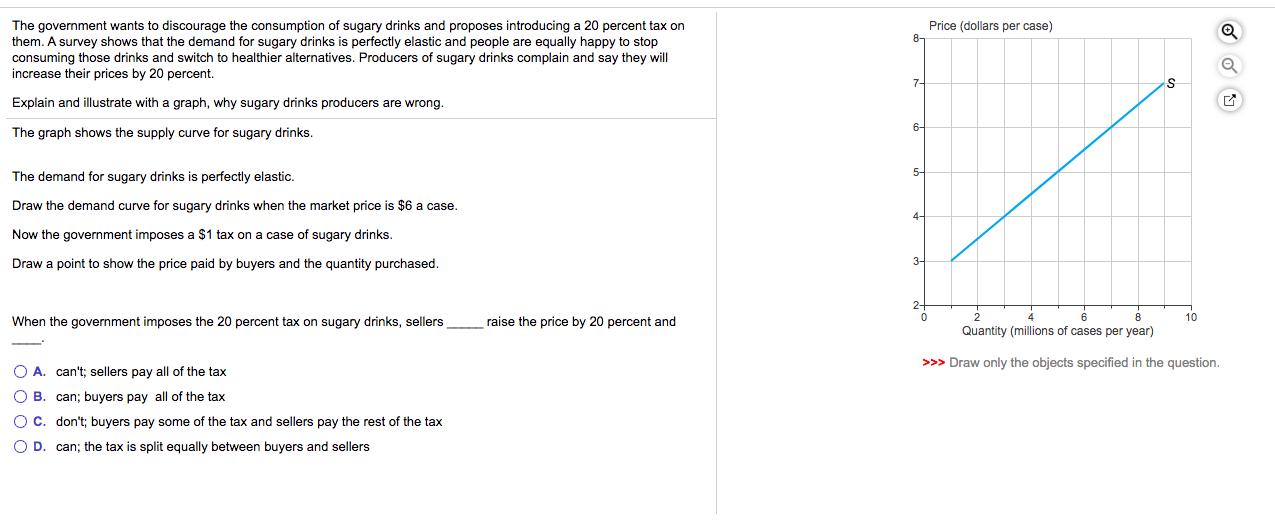

The government wants to discourage the consumption of sugary drinks and proposes introducing a 20 percent tax on them. A survey shows that the

The government wants to discourage the consumption of sugary drinks and proposes introducing a 20 percent tax on them. A survey shows that the demand for sugary drinks is perfectly elastic and people are equally happy to stop consuming those drinks and switch to healthier alternatives. Producers of sugary drinks complain and say they will increase their prices by 20 percent. Price (dollars per case) 7- Explain and illustrate with a graph, why sugary drinks producers are wrong. 6- The graph shows the supply curve for sugary drinks. 5- The demand for sugary drinks is perfectly elastic. Draw the demand curve for sugary drinks when the market price is $6 a case. 4- Now the government imposes a $1 tax on a case of sugary drinks. Draw a point to show the price paid by buyers and the quantity purchased. 3- 8 Quantity (millions of cases per year) 10 When the government imposes the 20 percent tax on sugary drinks, sellers raise the price by 20 percent and >>> Draw only the objects specified in the question. O A. can't; sellers pay all of the tax O B. can; buyers pay all of the tax O C. don't; buyers pay some of the tax and sellers pay the rest of the tax O D. can; the tax is split equally between buyers and sellers

Step by Step Solution

★★★★★

3.58 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution The incidence of tax is determined by the relative elasticities of demand and supply In thi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started