Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The government wants to encourage homeownership and has enacted on a program that will supply low-income households with housing that is 50% the price of

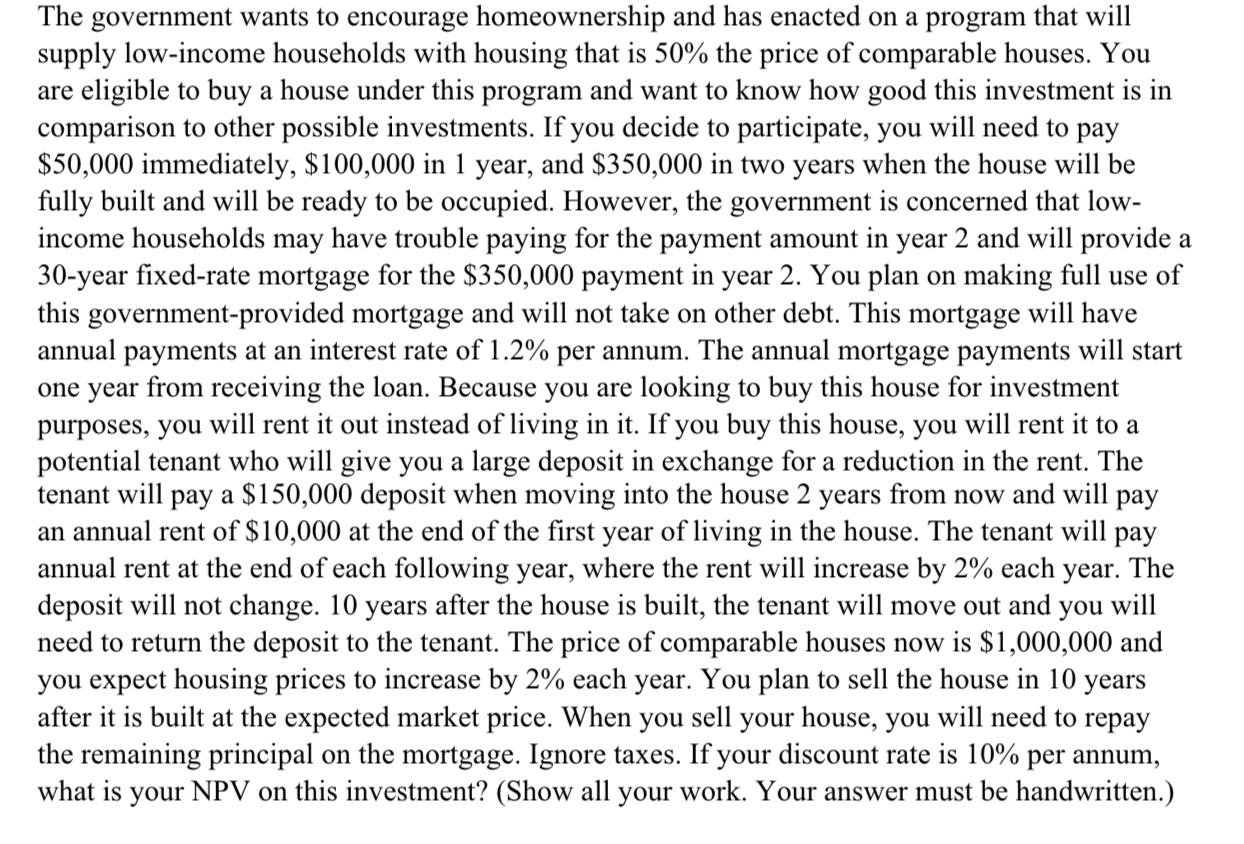

The government wants to encourage homeownership and has enacted on a program that will supply low-income households with housing that is 50% the price of comparable houses. You are eligible to buy a house under this program and want to know how good this investment is in comparison to other possible investments. If you decide to participate, you will need to pay $50,000 immediately, $100,000 in 1 year, and $350,000 in two years when the house will be fully built and will be ready to be occupied. However, the government is concerned that low-income households may have trouble paying for the payment amount in year 2 and will provide a 30 -year fixed-rate mortgage for the $350,000 payment in year 2 . You plan on making full use of this government-provided mortgage and will not take on other debt. This mortgage will have annual payments at an interest rate of 1.2% per annum. The annual mortgage payments will start one year from receiving the loan. Because you are looking to buy this house for investment purposes, you will rent it out instead of living in it. If you buy this house, you will rent it to a potential tenant who will give you a large deposit in exchange for a reduction in the rent. The tenant will pay a $150,000 deposit when moving into the house 2 years from now and will pay an annual rent of $10,000 at the end of the first year of living in the house. The tenant will pay annual rent at the end of each following year, where the rent will increase by 2% each year. The deposit will not change. 10 years after the house is built, the tenant will move out and you will need to return the deposit to the tenant. The price of comparable houses now is $1,000,000 and you expect housing prices to increase by 2% each year. You plan to sell the house in 10 years after it is built at the expected market price. When you sell your house, you will need to repay the remaining principal on the mortgage. Ignore taxes. If your discount rate is 10% per annum, what is your NPV on this investment? (Show all your work. Your answer must be handwritten.)

The government wants to encourage homeownership and has enacted on a program that will supply low-income households with housing that is 50% the price of comparable houses. You are eligible to buy a house under this program and want to know how good this investment is in comparison to other possible investments. If you decide to participate, you will need to pay $50,000 immediately, $100,000 in 1 year, and $350,000 in two years when the house will be fully built and will be ready to be occupied. However, the government is concerned that low-income households may have trouble paying for the payment amount in year 2 and will provide a 30 -year fixed-rate mortgage for the $350,000 payment in year 2 . You plan on making full use of this government-provided mortgage and will not take on other debt. This mortgage will have annual payments at an interest rate of 1.2% per annum. The annual mortgage payments will start one year from receiving the loan. Because you are looking to buy this house for investment purposes, you will rent it out instead of living in it. If you buy this house, you will rent it to a potential tenant who will give you a large deposit in exchange for a reduction in the rent. The tenant will pay a $150,000 deposit when moving into the house 2 years from now and will pay an annual rent of $10,000 at the end of the first year of living in the house. The tenant will pay annual rent at the end of each following year, where the rent will increase by 2% each year. The deposit will not change. 10 years after the house is built, the tenant will move out and you will need to return the deposit to the tenant. The price of comparable houses now is $1,000,000 and you expect housing prices to increase by 2% each year. You plan to sell the house in 10 years after it is built at the expected market price. When you sell your house, you will need to repay the remaining principal on the mortgage. Ignore taxes. If your discount rate is 10% per annum, what is your NPV on this investment? (Show all your work. Your answer must be handwritten.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started