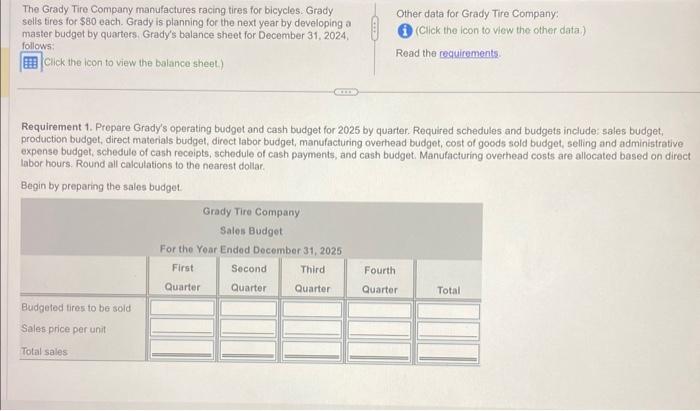

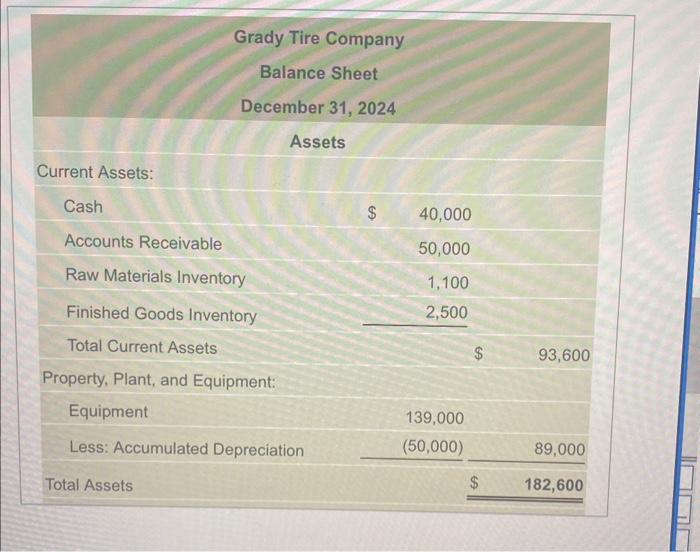

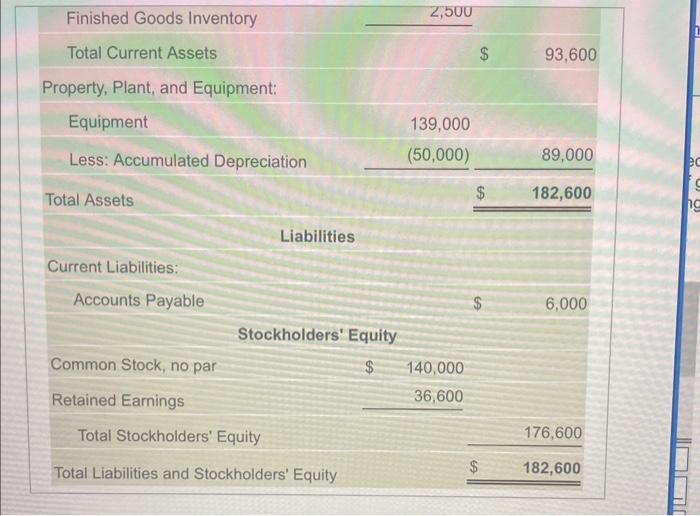

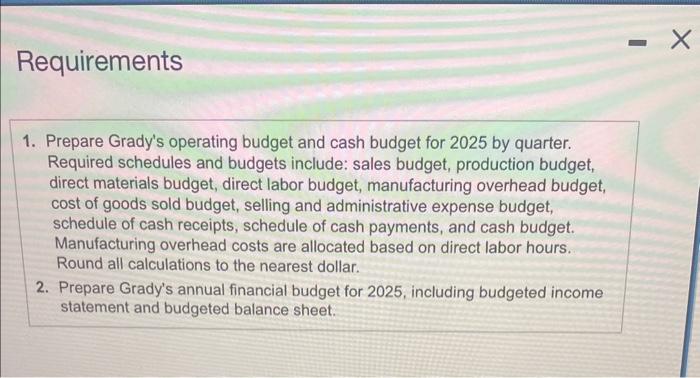

The Grady Tire Company manufactures racing tires for bicycles. Grady sells tres for $80 each. Grady is planning for the next year by developing a master budget by quarters. Grady's balance sheet for December 31, 2024. follows: Read the requirements. Click the lcon to view the balance sheet.) Requirement 1. Prepare Grady's operating budget and cash budget for 2025 by quarter. Required schedules and budgets include; 5 ales budget; production budget, direct materials budgel, direct labor budget, manufacturing overhead budget, cost of goods sold budget, selling and administrative expense budget, schedule of cash receipts, schedule of cash payments, and cash budget. Manufacturing overhead costs are allocated based on direct labor hours. Round all calculations to the nearest dollat. Begin by preparing the sales budget Grady Tire Company Balance Sheet December 31, 2024 Assets Current Assets: \begin{tabular}{lrr} Cash & $ & 40,000 \\ \hline Accounts Receivable & 50,000 \\ \hline Raw Materials Inventory & 1,100 \\ \hline Finished Goods Inventory & 2,500 \\ \hline \end{tabular} Total Current Assets Property, Plant, and Equipment: \begin{tabular}{lrr} \hline Equipment & 139,000 \\ \hline Less: Accumulated Depreciation & (50,000) & 89,000 \\ \hline Total Assets & $182,600 \\ \hline \hline \end{tabular} Finished Goods Inventory Total Current Assets $93,600 Property, Plant, and Equipment: \begin{tabular}{lrr} \hline Equipment & 139,000 & \\ \hline Less: Accumulated Depreciation & (50,000) & 89,000 \\ \hline Total Assets & $182,600 \\ \hline \hline \end{tabular} Liabilities Current Liabilities: Accounts Payable $6,000 Stockholders' Equity Common Stock, no par Retained Earnings $140,00036,600 \begin{tabular}{rr} r & 176,600 \\ \hline$182,600 \\ \hline \end{tabular} Requirements 1. Prepare Grady's operating budget and cash budget for 2025 by quarter. Required schedules and budgets include: sales budget, production budget, direct materials budget, direct labor budget, manufacturing overhead budget, cost of goods sold budget, selling and administrative expense budget, schedule of cash receipts, schedule of cash payments, and cash budget. Manufacturing overhead costs are allocated based on direct labor hours. Round all calculations to the nearest dollar. 2. Prepare Grady's annual financial budget for 2025 , including budgeted income statement and budgeted balance sheet. The Grady Tire Company manufactures racing tires for bicycles. Grady sells tres for $80 each. Grady is planning for the next year by developing a master budget by quarters. Grady's balance sheet for December 31, 2024. follows: Read the requirements. Click the lcon to view the balance sheet.) Requirement 1. Prepare Grady's operating budget and cash budget for 2025 by quarter. Required schedules and budgets include; 5 ales budget; production budget, direct materials budgel, direct labor budget, manufacturing overhead budget, cost of goods sold budget, selling and administrative expense budget, schedule of cash receipts, schedule of cash payments, and cash budget. Manufacturing overhead costs are allocated based on direct labor hours. Round all calculations to the nearest dollat. Begin by preparing the sales budget Grady Tire Company Balance Sheet December 31, 2024 Assets Current Assets: \begin{tabular}{lrr} Cash & $ & 40,000 \\ \hline Accounts Receivable & 50,000 \\ \hline Raw Materials Inventory & 1,100 \\ \hline Finished Goods Inventory & 2,500 \\ \hline \end{tabular} Total Current Assets Property, Plant, and Equipment: \begin{tabular}{lrr} \hline Equipment & 139,000 \\ \hline Less: Accumulated Depreciation & (50,000) & 89,000 \\ \hline Total Assets & $182,600 \\ \hline \hline \end{tabular} Finished Goods Inventory Total Current Assets $93,600 Property, Plant, and Equipment: \begin{tabular}{lrr} \hline Equipment & 139,000 & \\ \hline Less: Accumulated Depreciation & (50,000) & 89,000 \\ \hline Total Assets & $182,600 \\ \hline \hline \end{tabular} Liabilities Current Liabilities: Accounts Payable $6,000 Stockholders' Equity Common Stock, no par Retained Earnings $140,00036,600 \begin{tabular}{rr} r & 176,600 \\ \hline$182,600 \\ \hline \end{tabular} Requirements 1. Prepare Grady's operating budget and cash budget for 2025 by quarter. Required schedules and budgets include: sales budget, production budget, direct materials budget, direct labor budget, manufacturing overhead budget, cost of goods sold budget, selling and administrative expense budget, schedule of cash receipts, schedule of cash payments, and cash budget. Manufacturing overhead costs are allocated based on direct labor hours. Round all calculations to the nearest dollar. 2. Prepare Grady's annual financial budget for 2025 , including budgeted income statement and budgeted balance sheet