Answered step by step

Verified Expert Solution

Question

1 Approved Answer

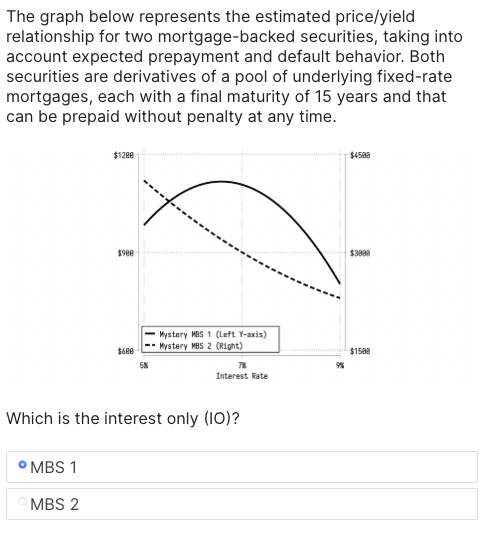

The graph below represents the estimated price / yield relationship for two mortgage - backed securities , taking into account expected prepayment and default behavior.

The graph below represents the estimated priceyield relationship for two mortgagebacked securities taking into account expected prepayment and default behavior. Both securities are derivatives of a pool of underlying fixedrate mortgages, each with a final maturity of years and that can be prepaid without penalty at any time.

A Which is the interest only

a MBS

b MBS

B Which of these securities has a negative effective duration when interest rate is at

a MBS

b MBS

CWhich of these secruities has a negative convexity when interest rate is at

a MBS

b MBS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started