Question

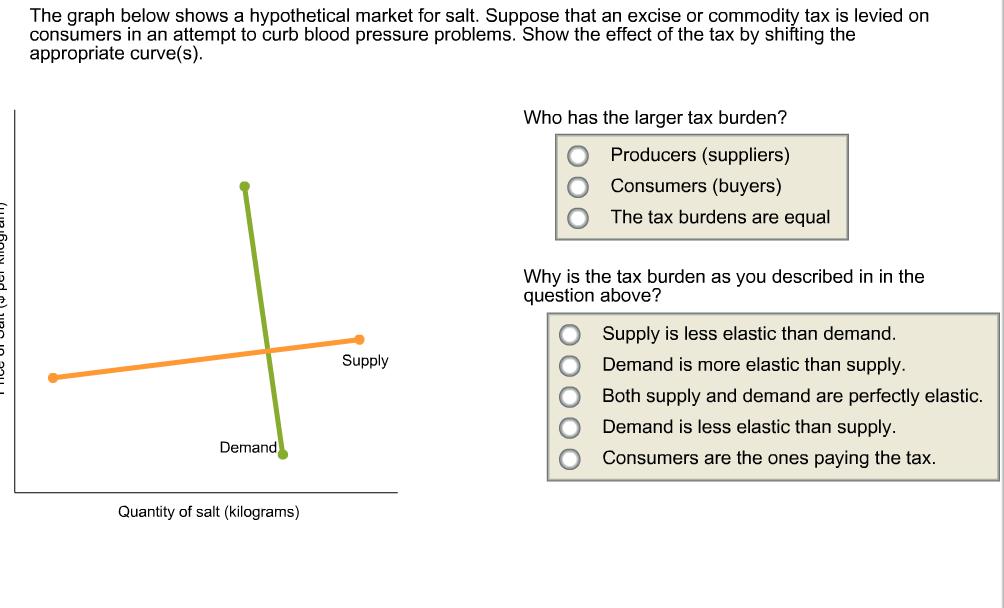

The graph below shows a hypothetical market for salt. Suppose that an excise or commodity tax is levied on consumers in an attempt to

The graph below shows a hypothetical market for salt. Suppose that an excise or commodity tax is levied on consumers in an attempt to curb blood pressure problems. Show the effect of the tax by shifting the appropriate curve(s). Who has the larger tax burden? Producers (suppliers) Consumers (buyers) The tax burdens are equal Why is the tax burden as you described in in the question above? Supply is less elastic than demand. Supply Demand is more elastic than supply. Both supply and demand are perfectly elastic. Demand is less elastic than supply. Demand Consumers are the ones paying the tax. Quantity of salt (kilograms) 000

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Elementary Statistics A Step By Step Approach

Authors: Allan G. Bluman

10th Edition

1259755330, 1259755339, 978-1259755330

Students also viewed these Chemical Engineering questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App