Answered step by step

Verified Expert Solution

Question

1 Approved Answer

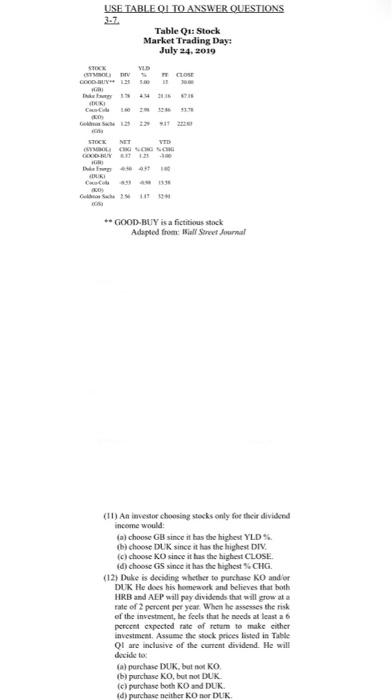

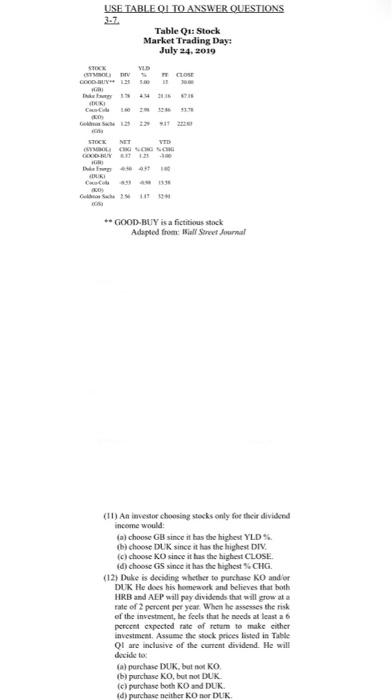

The graph corresponses with wuestions 11 and 12. Can i please get help with these in a detailed manner . thank you USE TABLE OITO

The graph corresponses with wuestions 11 and 12. Can i please get help with these in a detailed manner .

USE TABLE OITO ANSWER QUESTIONS 3.7. Table Q1: Stock Market Trading Day: July 24, 2019 STOCK VID CLOSE COOBY The N25 KI STOCK NET VTB LCHON GUY IT the 404 **GOOD-BUY is a fictitious stock Adapted from all Street Journal (11) An investor choosing stocks only for their dividend income would (a) choose GB since it has the highest YLD b) choose DUK since it has the highest DIV. choose KO since it has the highest CLOSE (d) choose GS since it has the highest CHG. (12) Duke is deciding whether to purchase KO ander DUK He does his homework and believes that both HRB and AEP will pay dividends that will grow at a rate of 2 percent per year. When he assesses the risk of the investment, he feels that he needs at least a 6 percent expected tale of return to make either investment. Assume the stock prices listed in Table QI are inclusive of the current dividend. He will decide (a) purchase DUK, but not KO. (b) purchase KO, but not DUK (c) purchase both Ko and DUK (d) purchase neither KODUK USE TABLE OITO ANSWER QUESTIONS 3.7. Table Q1: Stock Market Trading Day: July 24, 2019 STOCK VID CLOSE COOBY The N25 KI STOCK NET VTB LCHON GUY IT the 404 **GOOD-BUY is a fictitious stock Adapted from all Street Journal (11) An investor choosing stocks only for their dividend income would (a) choose GB since it has the highest YLD b) choose DUK since it has the highest DIV. choose KO since it has the highest CLOSE (d) choose GS since it has the highest CHG. (12) Duke is deciding whether to purchase KO ander DUK He does his homework and believes that both HRB and AEP will pay dividends that will grow at a rate of 2 percent per year. When he assesses the risk of the investment, he feels that he needs at least a 6 percent expected tale of return to make either investment. Assume the stock prices listed in Table QI are inclusive of the current dividend. He will decide (a) purchase DUK, but not KO. (b) purchase KO, but not DUK (c) purchase both Ko and DUK (d) purchase neither KODUK thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started