Question

Choose any TWO companies listed in the property sector of the Main Market of Bursa Malaysia. Analyse the companies financial position and performance based on

Choose any TWO companies listed in the property sector of the Main Market of Bursa Malaysia. Analyse the companies’ financial position and performance based on the relevant profitability, debt, and market ratios over the past five years (i.e. 2016 – 2020). Comment on the companies’ financial position and performance from the viewpoint of a prospective investor.

The answer should highlight the following aspects:

Introduction of the property sector in Malaysia;

Introduction of the chosen companies;

Analysis of the companies’ profitability ratios;

Analysis of the companies’ debt ratios;

Analysis of the companies’ market ratios;

Expectation of the companies’ financial position for year 2023;

Comment on the companies’ financial performance from the viewpoint of a prospective investor; and

Conclusion.

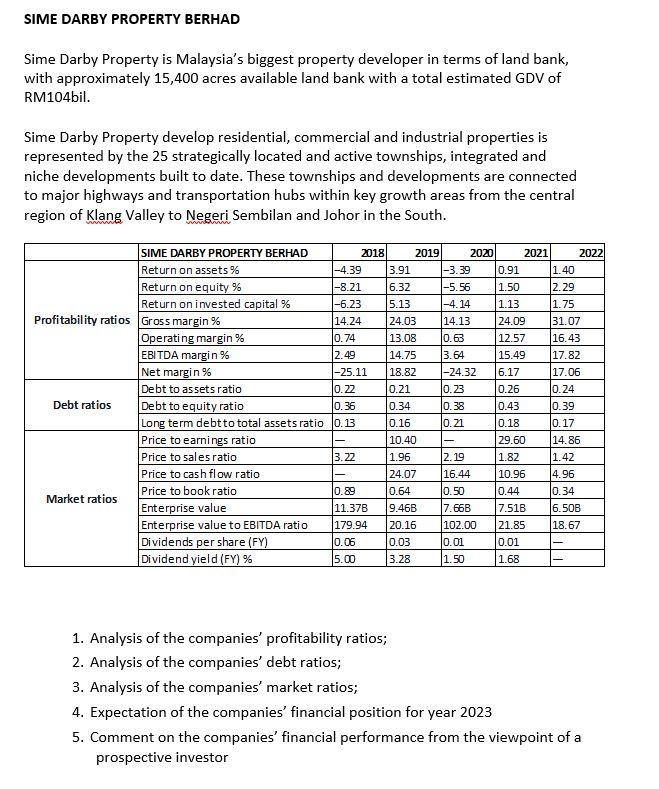

SIME DARBY PROPERTY BERHAD Sime Darby Property is Malaysia's biggest property developer in terms of land bank, with approximately 15,400 acres available land bank with a total estimated GDV of RM104bil. Sime Darby Property develop residential, commercial and industrial properties is represented by the 25 strategically located and active townships, integrated and niche developments built to date. These townships and developments are connected to major highways and transportation hubs within key growth areas from the central region of Klang Valley to Negeri Sembilan and Johor in the South. Debt ratios SIME DARBY PROPERTY BERHAD Return on assets % Return on equity % Return on invested capital % Profitability ratios Gross margin % Market ratios Operating margin % EBITDA margin % Net margin% Debt to assets ratio 3.91 -3.39 6.32 -5.56 5.13 -4.14 24.03 14.13 13.08 0.63 14.75 3.64 -25.11 18.82 -24.32 0.22 0.21 0.23 Debt to equity ratio 0.36 0.34 0.38 Long term debt to total assets ratio 0.13 0.16 0.21 10.40 1.96 24.07 0.64 9.46B 20.16 0.03 3.28 Price to earnings ratio Price to sales ratio Price to cash flow ratio Price to book ratio Enterprise value Enterprise value to EBITDA ratio Dividends per share (FY) Dividend yield (FY) % -4.39 -8.21 -6.23 14.24 0.74 2.49 2018 3.22 0.89 11.378 179.94 0.06 5.00 2019 1. Analysis of the companies' profitability ratios; 2. Analysis of the companies' debt ratios; 3. Analysis of the companies' market ratios; 2020 - 2.19 16.44 0.50 7.668 102.00 0.01 1.50 2021 0.91 1.50 1.13 24.09 12.57 15.49 6.17 0.26 0.43 0.18 29.60 1.82 10.96 0.44 7.518 21.85 0.01 1.68 2022 1.40 2.29 1.75 31.07 16.43 17.82 17.06 0.24 0.39 0.17 14.86 1.42 4.96 0.34 6.50B 18.67 - 4. Expectation of the companies' financial position for year 2023 5. Comment on the companies' financial performance from the viewpoint of a prospective investor

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Introduction of the property sector in Malaysia The property sector in Malaysia plays a crucial role in the countrys economy contributing significantly to its GDP It encompasses various segments inclu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started