Question

The GreatOreCo mining company wishes to determine whether it should proceed to develop a copper mine for a lease that it owns. There would be

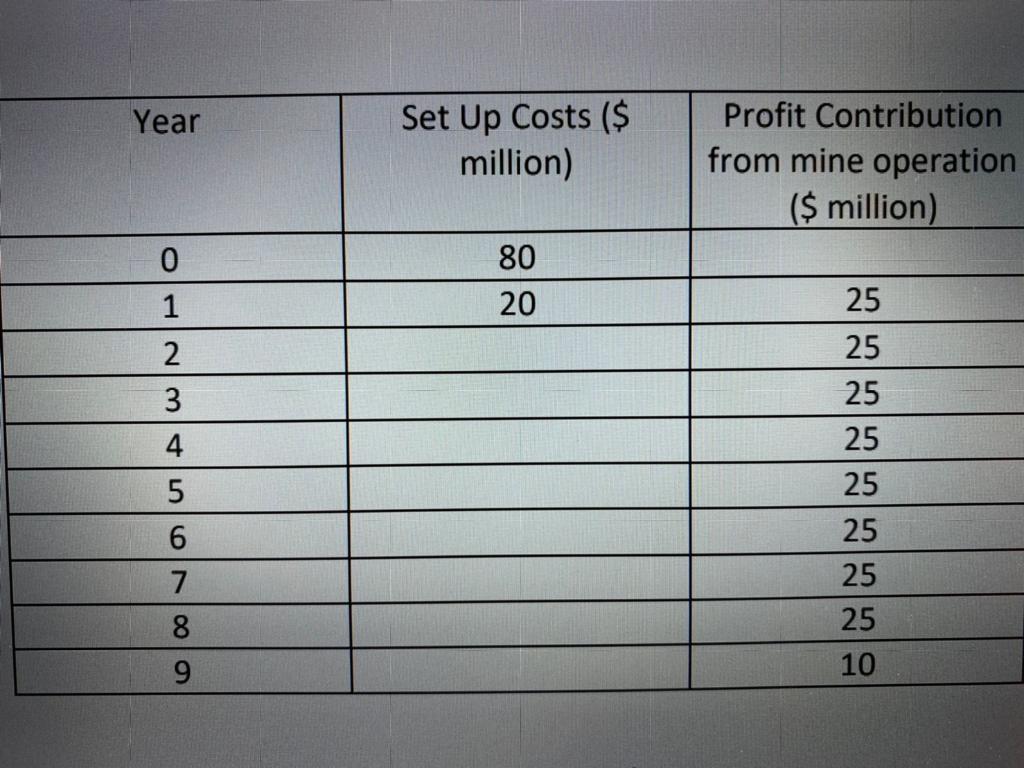

The GreatOreCo mining company wishes to determine whether it should proceed to develop a copper mine for a lease that it owns. There would be substantial development costs involved, and the mine would be expected to have a life span of nine years. The company would also be faced with environmental rehabilitation costs when the mine is closed down, and this is reflected by a smaller contribution in the mines final year of operation. Projected costs and yields have been determined and the resulting cash flows are summarised in the table below: An alternative investment of roughly the same size as the copper mine would be to invest in a sand mining project in Iraq. This sand mining investment has been evaluated to have an internal rate of return of j1 = 22.5% p.a.

An alternative investment of roughly the same size as the copper mine would be to invest in a sand mining project in Iraq. This sand mining investment has been evaluated to have an internal rate of return of j1 = 22.5% p.a.

Question: Assuming that GreatOreCo does not have access to sufficient funds to undertake both investments and must choose between them, explain which investment GreatOreCo should make. Identify and explain an additional consideration that might alter this decision.

Year Set Up Costs ($ million) Profit Contribution from mine operation ($ million) 80 20 0 1 2 3 4 5 25 25 25 25 25 25 25 25 10 6 7 8 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started