Question

The GreatOreCo mining company wishes to determine whether it should proceed to develop a copper mine for a lease that it owns. There would be

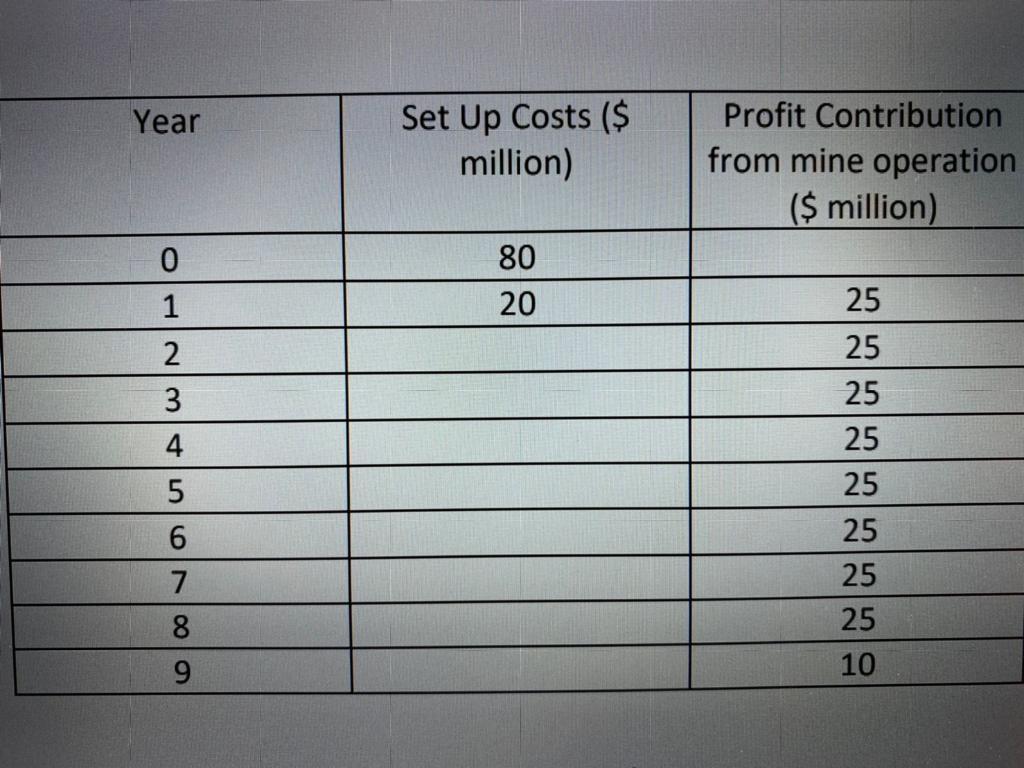

The GreatOreCo mining company wishes to determine whether it should proceed to develop a copper mine for a lease that it owns. There would be substantial development costs involved, and the mine would be expected to have a life span of nine years. The company would also be faced with environmental rehabilitation costs when the mine is closed down, and this is reflected by a smaller contribution in the mine’s final year of operation. Projected costs and yields have been determined and the resulting cash flows are summarised in the table below:

An alternative investment of roughly the same size as the copper mine would be to invest in a sand mining project in Iraq. This sand mining investment has been evaluated to have an internal rate of return of j1 = 22.5% p.a

1 Assuming that GreatOreCo does not have access to sufficient funds to undertake both investments and must choose between them, explain which investment GreatOreCo should make.

2 Identify and explain an additional consideration that might alter this decision.

Set Up Costs ($ million) Profit Contribution from mine operation ($ million) Year 80 1 20 25 25 3 25 4 25 5 25 25 7 25 8. 25 9. 10

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Solution IRR of Copper Mine The copper mining project has a lower IRR ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6362d8aed6feb_237223.pdf

180 KBs PDF File

6362d8aed6feb_237223.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started