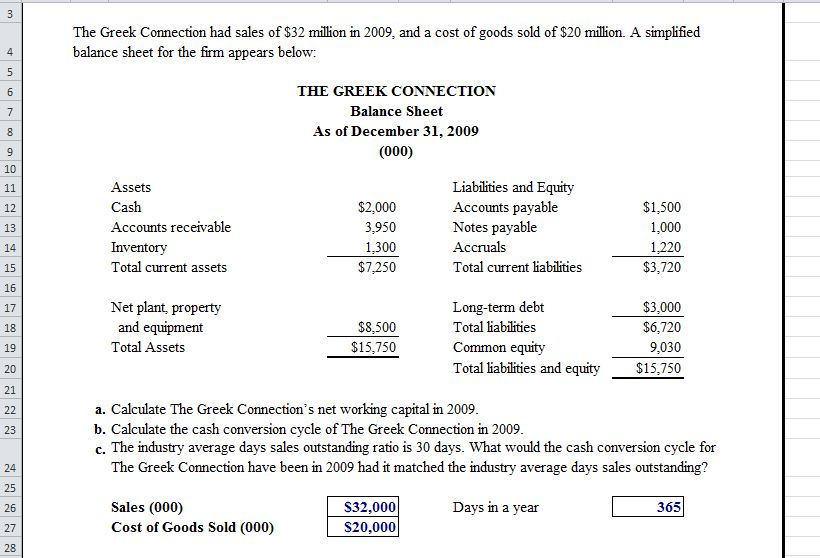

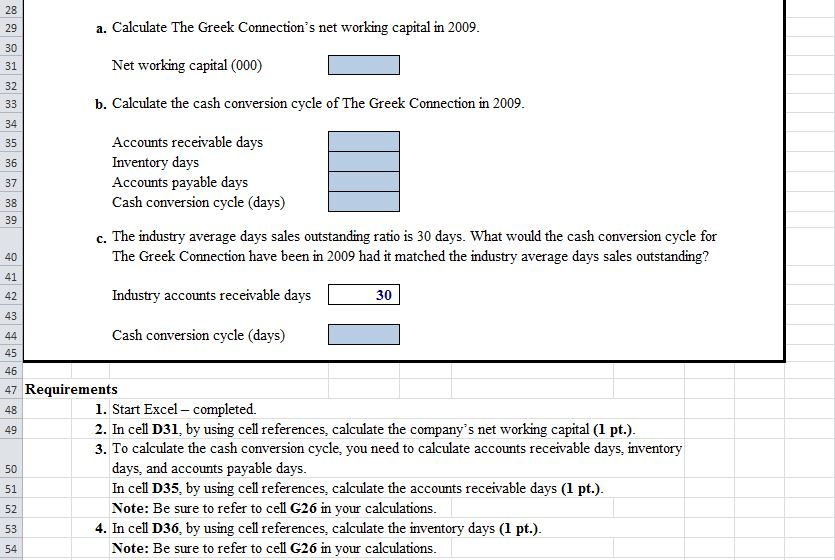

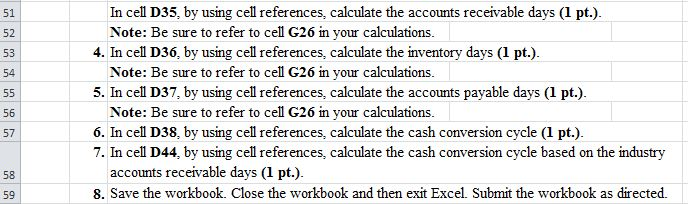

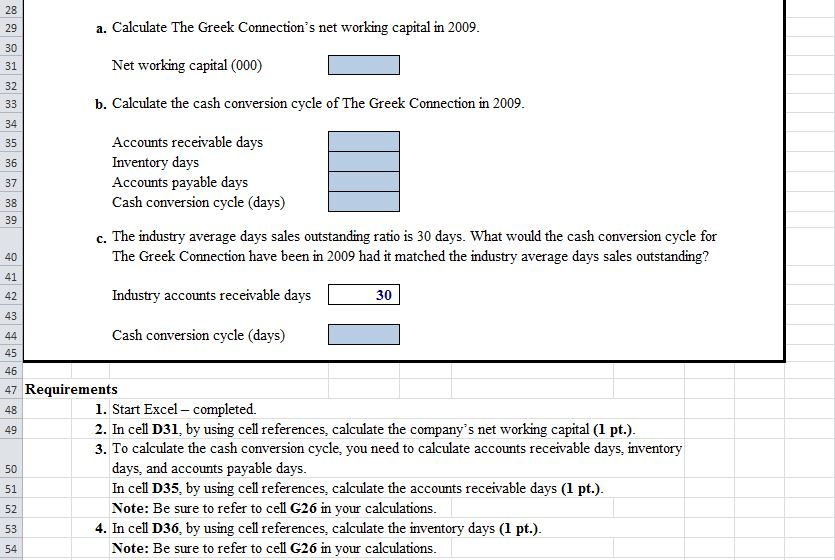

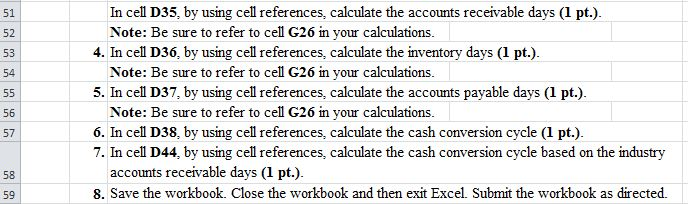

The Greek Connection had sales of $32 milion in 2009, and a cost of goods sold of $20 million. A simplified balance sheet for the firm appears below: THE GREEK CONNECTION Balance Sheet As of December 31, 2009 (000) 10 Assets Cash Accounts receivable Inventory Total current assets $2,000 3,950 1,300 $7,250 Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities $1,500 1,000 1,220 $3,720 12 14 15 16 17 18 19 20 21 Long-term debt Total liabilities Common equity Total liabilities and equity$15,750 Net plant, property and equipment Total Assets $8,500 $15,750 $3,000 $6,720 9,030 a. Calculate The Greek Connection's net working capital in 2009 b. Calculate the cash conversion cycle of The Greek Connection in 2009 c. The industry average days sales outstanding ratio is 30 days. What would the cash conversion cycle for The Greek Connection have been in 2009 had it matched the industry average days sales outstanding 25 Days in a year Sales (000) Cost of Goods Sold (000) S32,000 S20,000 26 365 a. Calculate The Greek Connection's net working capital in 2009 29 30 31 32 Net working capital (000) b. Calculate the cash conversion cycle of The Greek Connection in 2009 34 Accounts receivable days Inventory days Accounts payable days Cash conversion cycle (days) 35 37 39 c. The industry average days sales outstanding ratio is 30 days. What would the cash conversion cycle for The Greek Connection have been in 2009 had it matched the industry average days sales outstanding Industry accounts receivable days Cash conversion cycle (days) 42 30 43 45 47 Requirements 48 49 1. Start Excel completed. 2. In cell D31, by using cell references, calculate the company's net working capital (1 pt.) 3. To calculate the cash conversion cycle, you need to calculate accounts receivable days, inventory 50 51 52 53 54 days, and accounts payable days In cell D35, by using cell references, calculate the accounts receivable days (1 pt.) Note: Be sure to refer to cell G26 in your calculations 4. In cell D36, by using cell references, calculate the inventory days (1 pt.) Note: Be sure to refer to cell G26 in your calculations In cell D35, by using cell references, calculate the accounts receivable days (1 pt.). 51 52 53 54 4. In cell D36, by using cell references, calculate the inventory days (1 pt.). 5. In cell D37, by using cell references, calculate the accounts payable days (1 pt.). 6. In cell D38, by using cell references, calculate the cash conversion cycle (I pt.). Note: Be sure to refer to cell G26 in your calculations. Note: Be sure to refer to cell G26 in your calculations. Note: Be sure to refer to cell G26 in your calculations. 56 57 7. In cell D44, by using cell references, calculate the cash conversion cycle based on the industry 58 accounts receivable days (1 pt.). 59 8. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed