Question

The Green Energy company is evaluating an investment of building a new production plant. The cost of the new plant is $500k with an estimated

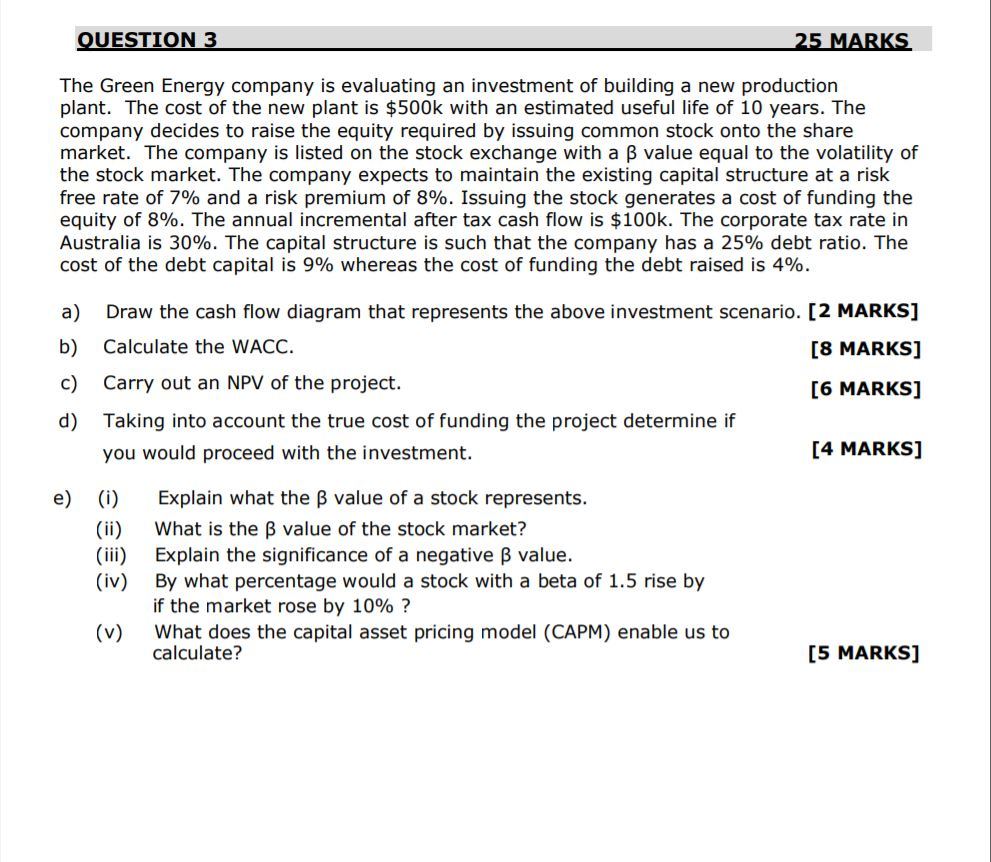

The Green Energy company is evaluating an investment of building a new production plant. The cost of the new plant is $500k with an estimated useful life of 10 years. The company decides to raise the equity required by issuing common stock onto the share market. The company is listed on the stock exchange with a value equal to the volatility of the stock market. The company expects to maintain the existing capital structure at a risk free rate of 7% and a risk premium of 8%. Issuing the stock generates a cost of funding the equity of 8%. The annual incremental after tax cash flow is $100k. The corporate tax rate in Australia is 30%. The capital structure is such that the company has a 25% debt ratio. The cost of the debt capital is 9% whereas the cost of funding the debt raised is 4%. a) Draw the cash flow diagram that represents the above investment scenario. [2 MARKS] b) Calculate the WACC. c) Carry out an NPV of the project. [8 MARKS] [6 MARKS] d) Taking into account the true cost of funding the project determine if you would proceed with the investment. [4 MARKS] e) (i) Explain what the value of a stock represents. [5 MARKS] (ii) What is the value of the stock market? (iii) Explain the significance of a negative value. (iv) By what percentage would a stock with a beta of 1.5 rise by if the market rose by 10% ? (v) What does the capital asset pricing model (CAPM) enable us t

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started