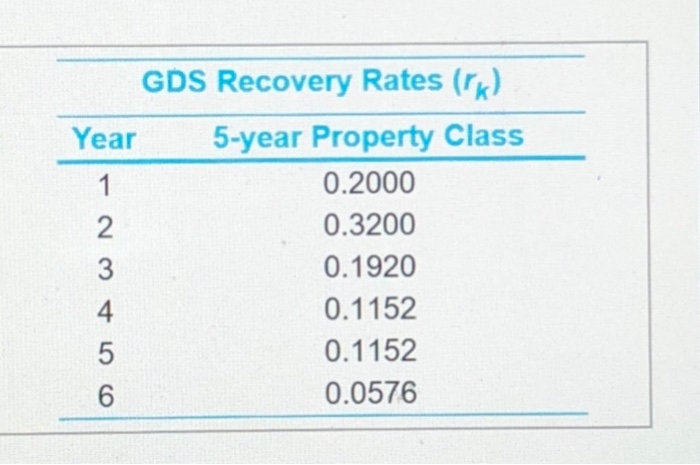

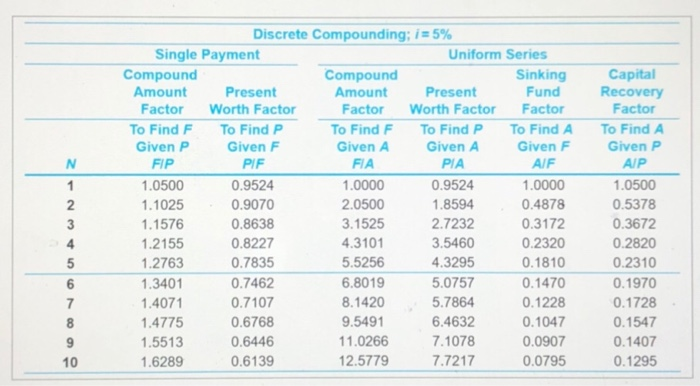

The Greentree Lumber Company is attempting to evaluate the profitability of adding another cutting line to its present sawmill operations. T two more acres of land for $32,000 (total). The equipment would cost $120,000 and could be depreciated over a five-year recovery period Gross revenue is expected to be $49,000 per year for five years, and operating expenses will be $14,000 annually for five years. It is expec closed down after five years. The firm's effective income tax rate is 55%. If the company's after-tax MARR is 5% per year, is this a profitable land recovered at original cost of $32,000 at the end of five years. The market value of equipment is negligible at the end of year 5. 1 GDS Recovery Rates (mk) Year 5-year Property Class 0.2000 2 0.3200 3 0.1920 4 0.1152 5 0.1152 6 0.0576 N 1 2 3 Discrete Compounding; i = 5% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AF 1.0500 0.9524 1.0000 0.9524 1.0000 1.1025 0.9070 2.0500 1.8594 0.4878 1.1576 0.8638 3.1525 2.7232 0.3172 1.2155 0.8227 4.3101 3.5460 0.2320 1.2763 0.7835 5.5256 4.3295 0.1810 1.3401 0.7462 6.8019 5.0757 0.1470 1.4071 0.7107 8.1420 5.7864 0.1228 1.4775 0.6768 9.5491 6.4632 0.1047 1.5513 0.6446 11.0266 7.1078 0.0907 1.6289 0.6139 12.5779 7.7217 0.0795 Capital Recovery Factor To Find A Given P AIP 1.0500 0.5378 0.3672 0.2820 0.2310 0.1970 0.1728 0.1547 0.1407 0.1295 5 6 7 8 9 10 The Greentree Lumber Company is attempting to evaluate the profitability of adding another cutting line to its present sawmill operations. They would need to purchase two more acres of land for $32,000 (total). The equipment would cost $120,000 and could be depreciated over a five-year recovery period with the MACRS method Gross revenue is expected to be $49,000 per year for five years, and operating expenses will be 514,000 annually for five years. It is expected that this cutting line will be closed down after five years. The firm's effective income tax rate is 55%. If the company's after-tax MARR is 5% per year is this a profitable investment? Assume that land recovered at original cost of $32,000 at the end of five years. The market value of equipment is negligible at the end of year 5