Answered step by step

Verified Expert Solution

Question

1 Approved Answer

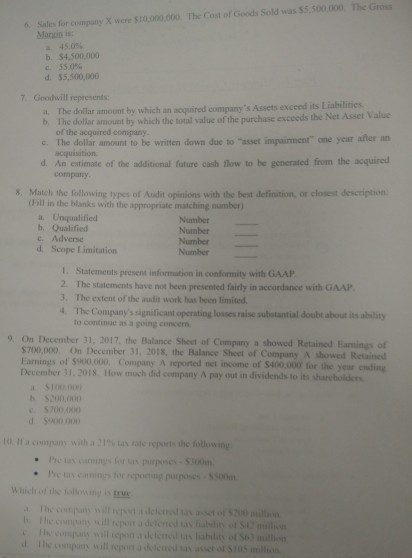

The Gris The Cost or Goods Sold was SSS00,000 Salesfor company X were S 10,000,000 Margin is 6. a. 45,0% b 54,500,000 c. 55.0% 7.

The Gris The Cost or Goods Sold was SSS00,000 Salesfor company X were S 10,000,000 Margin is 6. a. 45,0% b 54,500,000 c. 55.0% 7. Goodwill represents a. The doilar amount by which an scquired company's Assets exceed its Liabilities b. Th e dollar amount by which the total value of the purchase exceeds the Net Asset Value of the acquired company c. The dollar amount to be written down due to "asset impairment" one year afher an acquisition d. An estimate of the additional future cash flow to be generated from the acquired company 3 Match the following types of Audit opinions with the best definition, or closest description (Fill in the blanks with the appropriate matching number) a. Unqualified b. Qualified e. Adverse d. Scope Limitation Number Number Number Number I. Statements present information in confomity with GAAP 2. The statements have not been presented fairly in accordance with GAAP 3. The extent of the audit work has been limited 4 The Company's significant operating losses raise substantial doubt about its ability to continue as a going concen. 9. On December 31, 2017, the Balance Sheet of Company a showed Retained Eamings of 700,000 On December 31, 2018, the Balance Sheet of Company A showed Retained Earnings of S900,000 Company A reported net income of $400,000 for the year ending December 31.2018 How much did company A pay out in dividends to its sharcholdes 10 IH a compamy with a 21% as rate reports the following Pic tas camings or tas pures-300m Pic la camings for reporting purposes $500m Which ot ths tollowingiu

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started