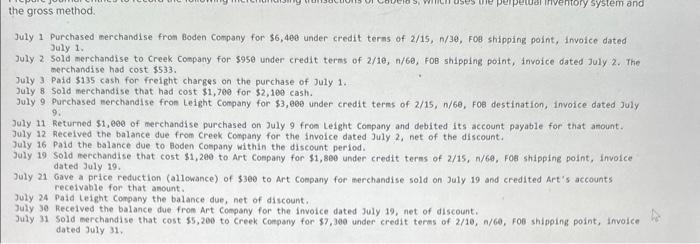

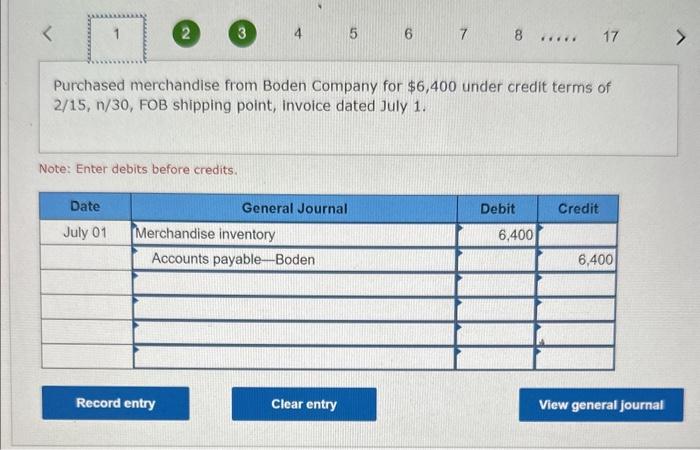

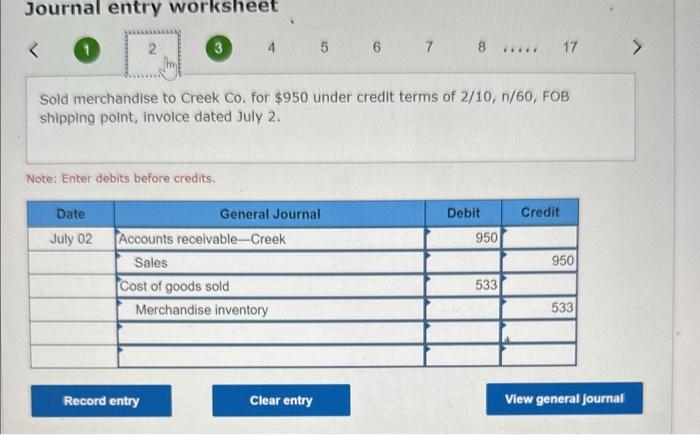

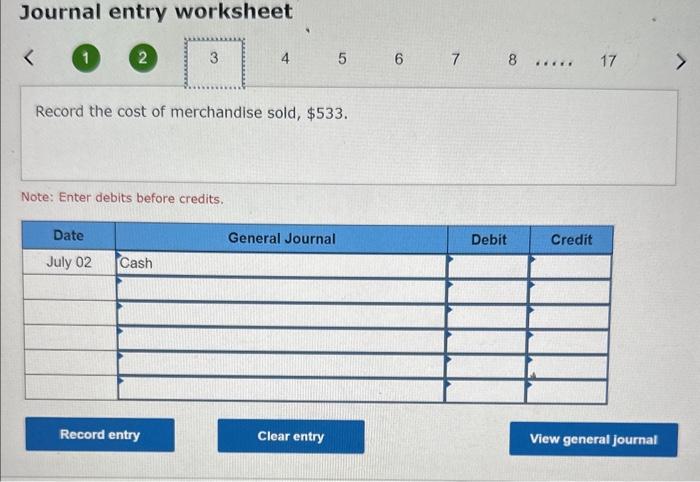

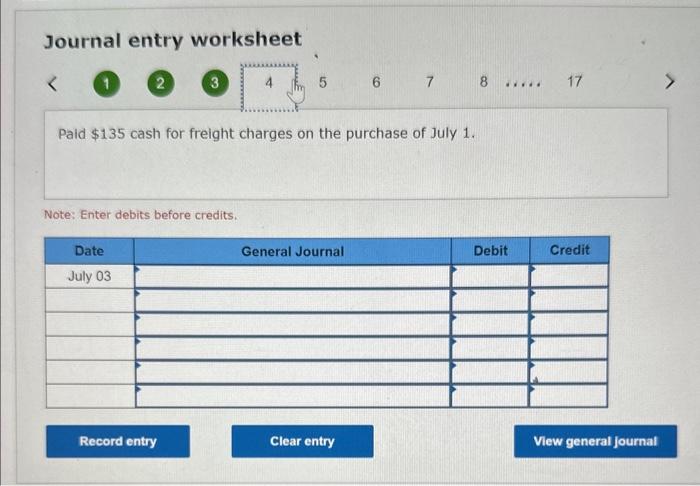

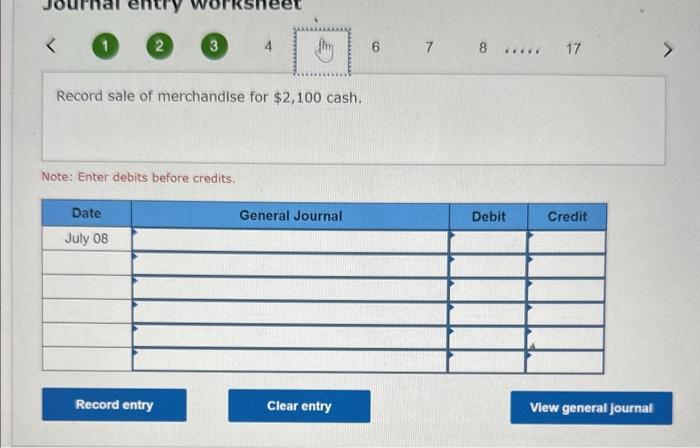

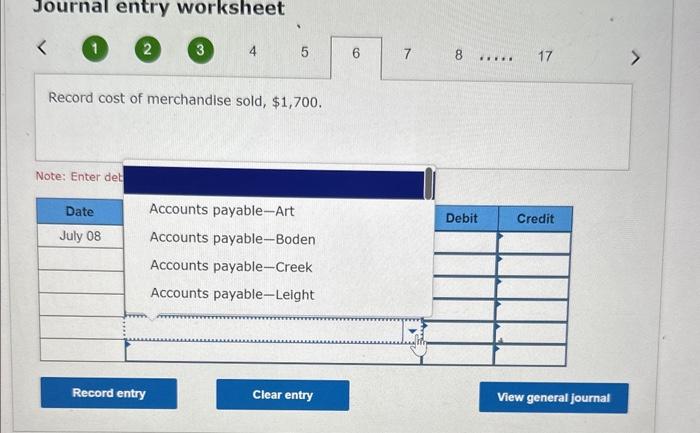

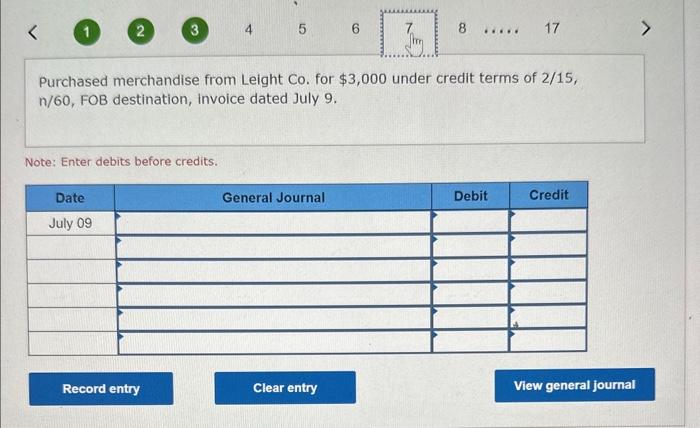

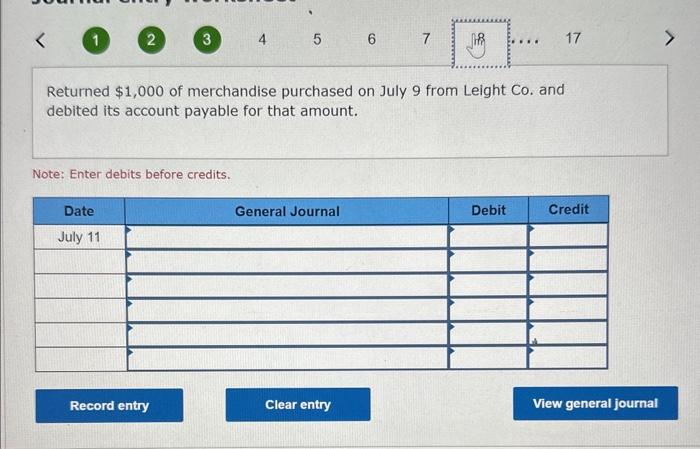

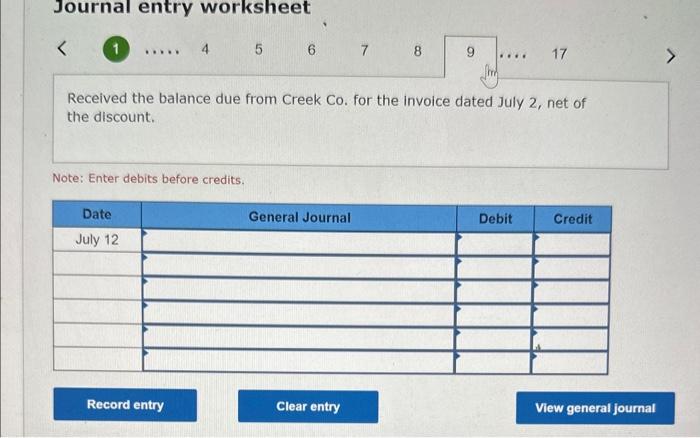

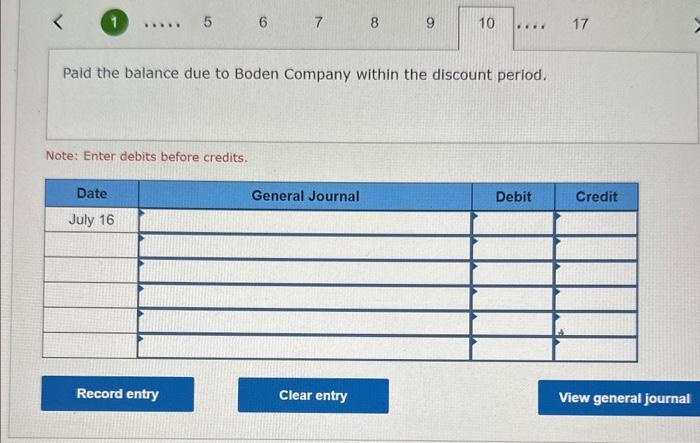

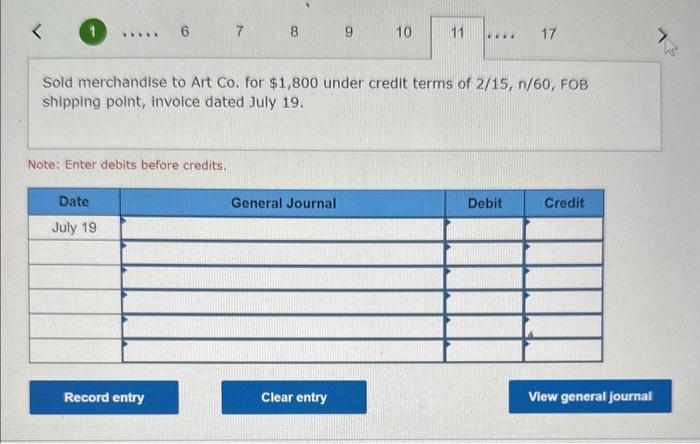

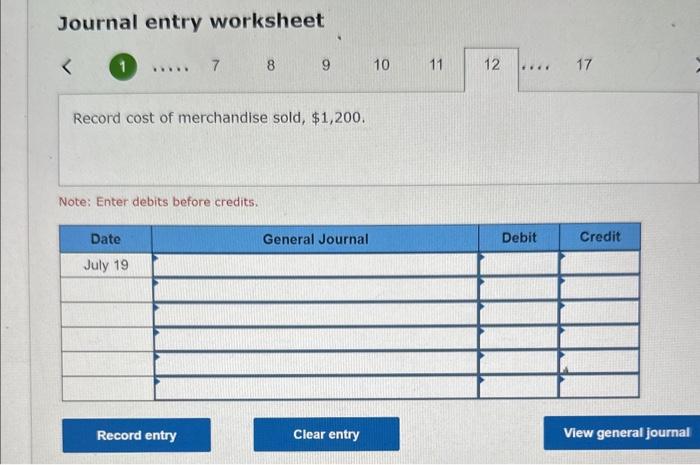

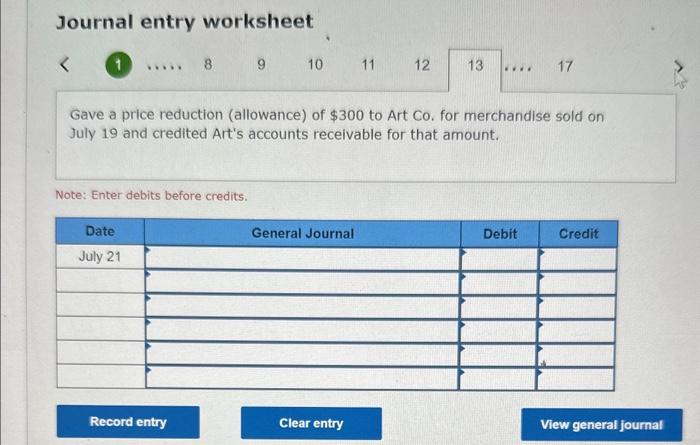

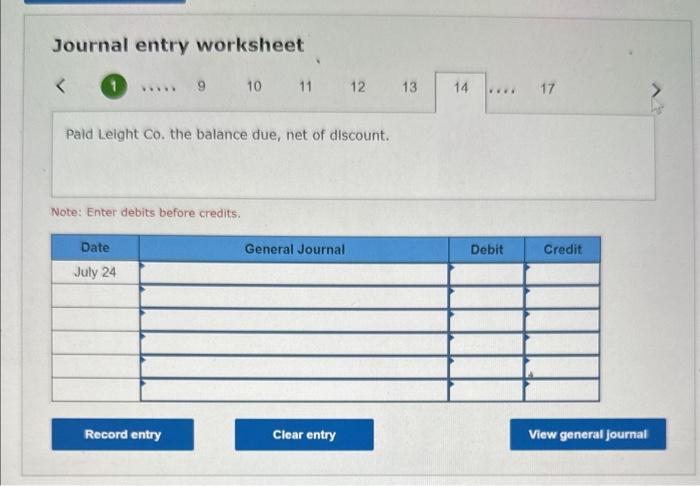

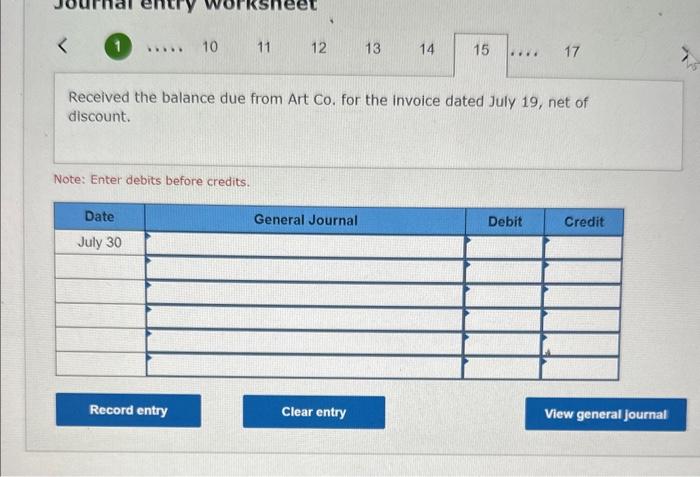

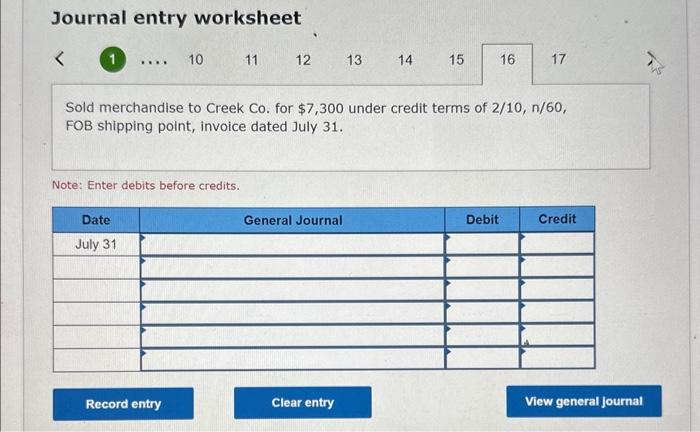

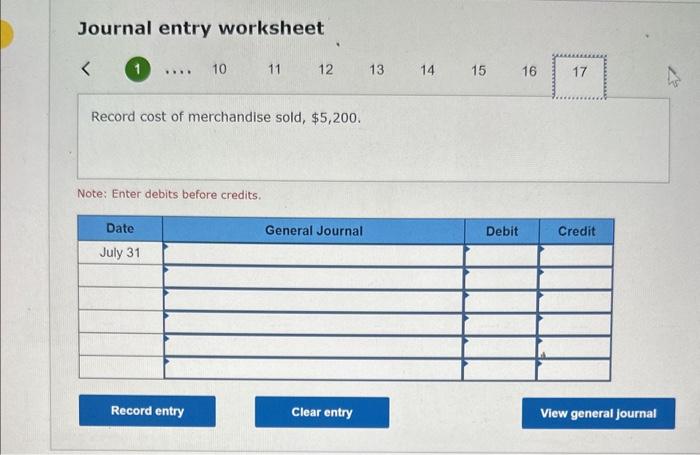

the gross method. July 1 Purchased merchandise from Boden Company for $6,40e under credit terns of 2/15,n/30, F0e shipping point, invoice dated July 1. July 2 Sold merchandise to Creek Company for $95 under credit terms of 2/10,n/60, fOB shipping point, invoice dated July 2 . The merchandise had cost $533. Joly 3 Paid $135 cash for freight charges on the purchase of July 1. July 8 sold merchandise that had cost $1,700 for $2,100 cash. July 9 Purchased nerchandise fron Leight Company for $3,600 under credit terms of 2/15, n/68, F08 destination, invoice dated July 9. July 11 Returned $1,600 of merchandise purchased on July 9 from Leight conpany and debited its account payable for that anount. July 12 Recelved the balance due from creek conpany for the invoice dated July 2 , net of the discount, July 16 paid the balance due to Boden cospany within the discount period. July 19 Sold merchandise that cost $1,200 to Art Company for $1,800 under credit terms of 2/15, n/6e, Fo8 shipping point, invoice dated July 19. July 21 Gave a price reduction (allowance) of $300 to Art Company for merchandise sold on July 19 and credited Art's accounts receivable for that anount. July 24 Paid teight Conpany the balance due, net of discount. July 30 Received the balance due from Art Company for the invoice dated July 19, net of discount. July 31 Sold merchandise that cost 55,200 to Creek Company for $7,300 under credit terms of 2/10, n/60, fo0 shipping point, invoice dated July 31. Purchased merchandise from Boden Company for $6,400 under credit terms of 2/15,n/30,FOB shipping point, invoice dated July 1. Note: Enter debits before credits. Journal entry worksheet 4567817 Sold merchandise to Creek Co. for $950 under credit terms of 2/10,n/60, FOB shipping point, invoice dated July 2. Note: Enter debits before credits. Journal entry worksheet 4 5 Record the cost of merchandise sold, $533. Note: Enter debits before credits. Journal entry worksheet 1 567 Paid $135 cash for freight charges on the purchase of July 1. Note: Enter debits before credits. 1 2 Record sale of merchandise for $2,100 cash. Note: Enter debits before credits. Journal entry worksheet 1 2 (3) 4 5 Record cost of merchandise sold, $1,700. Note: Purchased merchandise from Leight Co. for $3,000 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9. Note: Enter debits before credits. Returned $1,000 of merchandise purchased on July 9 from Leight Co. and debited its account payable for that amount. Note: Enter debits before credits. Journal entry worksheet 1 6 78 17 Received the balance due from Creek Co. for the invoice dated July 2, net of the discount. Note: Enter debits before credits. Paid the balance due to Boden Company within the discount period. Note: Enter debits before credits. Sold merchandise to Art Co. for $1,800 under credit terms of 2/15,n/60,FOB shipping point, invoice dated July 19. Note: Enter debits before credits. Journal entry worksheet ( 13789 Record cost of merchandise sold, $1,200. Note: Enter debits before credits. Journal entry worksheet (1) .88910 Gave a price reduction (allowance) of $300 to Art Co. for merchandise sold on July 19 and credited Art's accounts receivable for that amount. Note: Enter debits before credits. Journal entry worksheet ( 1112 Paid Leight Co. the balance due, net of discount. Note: Enter debits before credits. Received the balance due from Art Co. for the invoice dated July 19 , net of discount. Note: Enter debits before credits. Journal entry worksheet 1 Sold merchandise to Creek Co. for $7,300 under credit terms of 2/10,n/60, FOB shipping point, invoice dated July 31. Note: Enter debits before credits. Journal entry worksheet