Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Harding Corporation has $52 million of bonds outstanding that were issued at a coupon rate of 13.25 percent seven years ago. Interest rates have

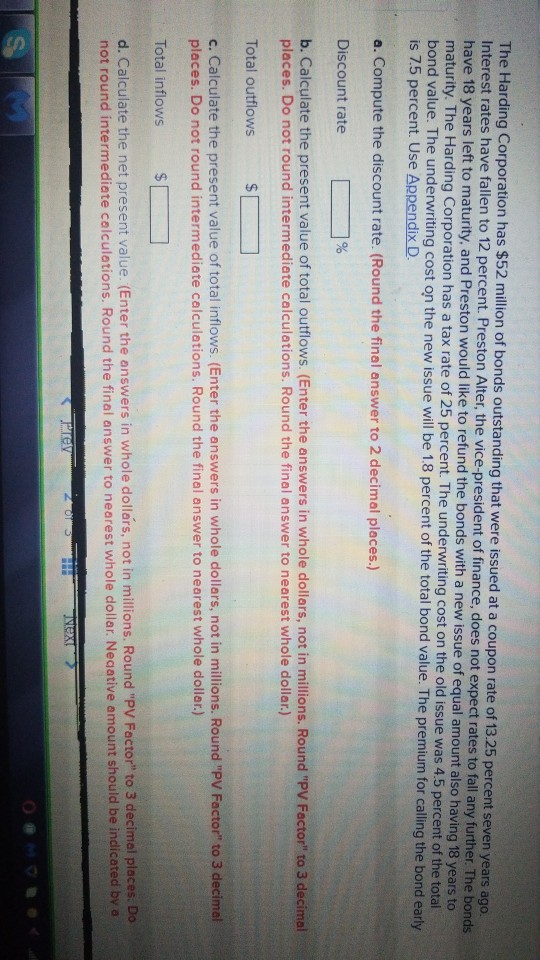

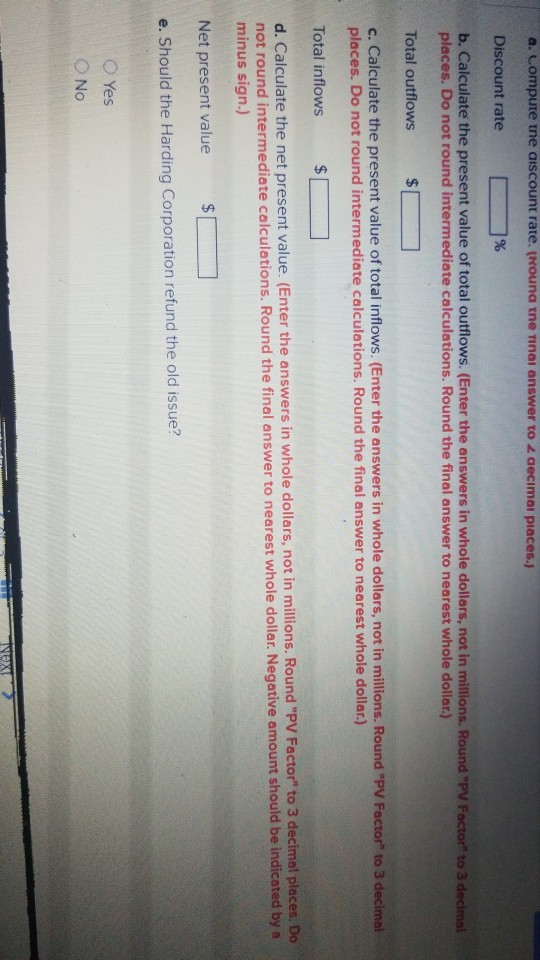

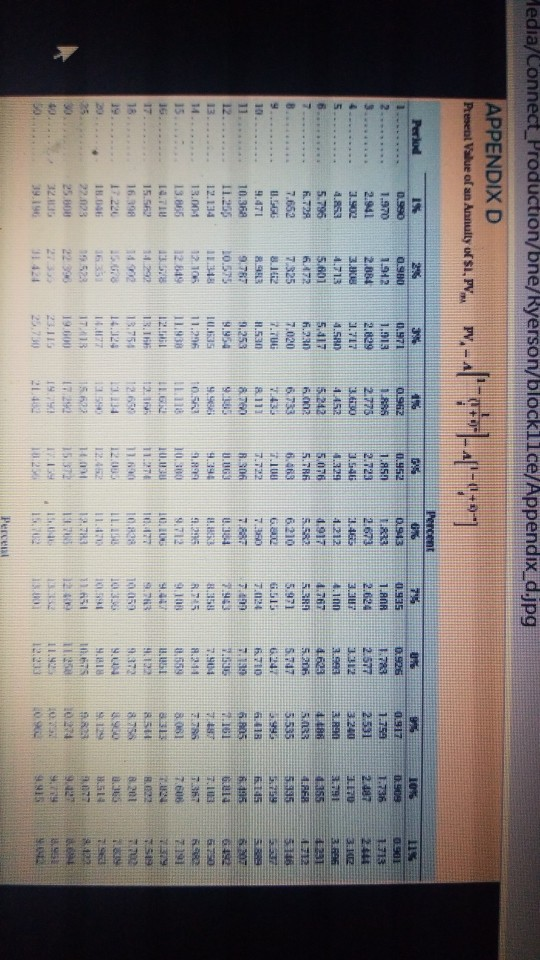

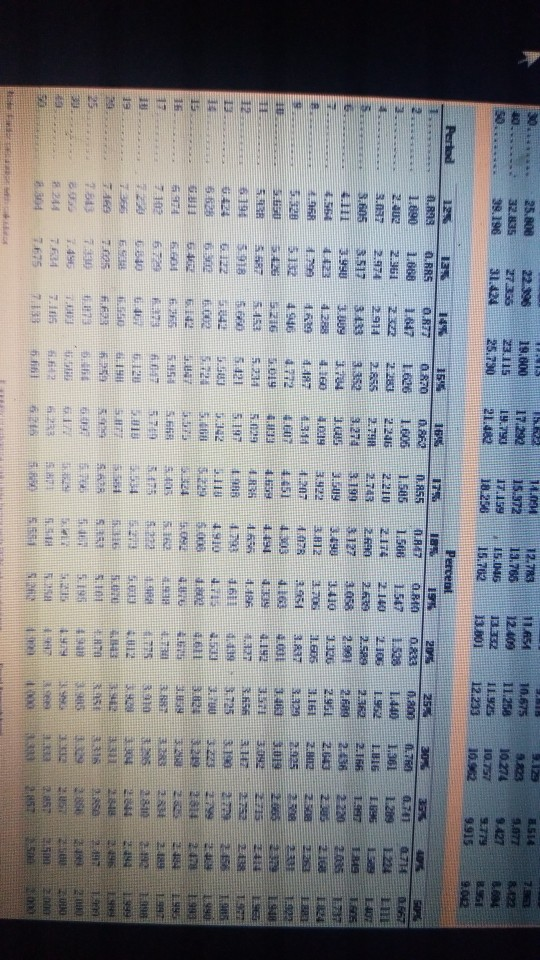

The Harding Corporation has $52 million of bonds outstanding that were issued at a coupon rate of 13.25 percent seven years ago. Interest rates have fallen to 12 percent. Preston Alter, the vice-president of finance, does not expect rates to fall any further. The bonds have 18 years left to maturity, and Preston would like to refund the bonds with a new issue of equal amount also having 18 years to maturity. The Harding Corporation has a tax rate of 25 percent. The underwriting cost on the old issue was 4.5 percent of the total bond value. The underwriting cost on the new issue will be 1.8 percent of the total bond value. The premium for calling the bond early is 7.5 percent. Use Appendix D. a. Compute the discount rate. (Round the final answer to 2 decimal places.) Discount rate | % b. Calculate the present value of total outflows. (Enter the answers in whole dollars, not in millions. Round "PV Factor" to 3 decimal places. Do not round intermediate calculations. Round the final answer to nearest whole dollar.) Total outflows $ c. Calculate the present value of total inflows. (Enter the answers in whole dollars, not in millions. Round "PV Factor" to 3 decimal places. Do not round intermediate calculations. Round the final answer to nearest whole dollar.) Total inflows $ d. Calculate the net present value. (Enter the answers in whole dollars, not in millions. Round "PV Factor" to 3 decimal places. Do not round intermediate calculations. Round the final answer to nearest whole dollar. Negative amount should be indicated by a Istex a. Compute the discount rate. (Rouna mne Tinai answer to 2 decimal places.) Discount rate % b. Calculate the present value of total outflows. (Enter the answers in whole dollars, not in millions. Round "PV Factor" to 3 decimal places. Do not round intermediate calculations. Round the final answer to nearest whole dollar.) Total outflows $ c. Calculate the present value of total inflows. (Enter the answers in whole dollars, not in millions. Round "PV Factor" to 3 decimal places. Do not round intermediate calculations. Round the final answer to nearest whole dollar.) Total inflows $ d. Calculate the net present value. (Enter the answers in whole dollars, not in millions. Round "PV Factor" to 3 decimal places. Do not round intermediate calculations. Round the final answer to nearest whole dollar. Negative amount should be indicated by a minus sign.) Net present value e. Should the Harding Corporation refund the old issue? Yes Media/Connect_Production/bne/Ryerson/blocklice/Appendix_d.jpg APPENDIX D Present Value of an Annully of S1, P. w-aq-ft-ap07 Percent Period 49 us 0901 1.713 0193 TAR33 2.673 2.466 1.212 1917 5.582 6.210 75 0.935 1.ANA 2.624 3.307 3.10 1.62 SERRA 5.971 G.513 T.024 2% OSHO 11912 2.884 3.10 1.713 5.801 162472 7 325 8.1.2 8996 9.TR 10.375 13-18 12.106 12.849 13:58 12 95 0.917 1.759 2531 3.240 2.9 1 ERR 5.433 5.535 993 6.418 BAS 10% 0:909 1.736 2.487 170 3.791 1.355 4.BER 3.IR 3.RO 231 712 11 GGREG 0.980 1.970 2.941 1.902 4.853 5.795 6.72 7.652 | BI 9.471 10.368 11.255 12.134 13.001 13.865 14.71 15.56 16.398 17.220 11.06 22.023 25.000 32.35 39.196 39 0.971 1.913 2.829 1.717 4.580 5.417 1.330 7.020 7.TUG 1.530 9.253 9.954 10.35 11.26 11.938 12. INI 19.750 14.124 UUT IT. 19.000 20.IL 28.730 1% 01952 TRAS 2.775 HO 1.452 5.242 A 6.733 435 8111 8.79 9.03 9.99 0.52 IL LL.GR 13 1265 11.14 125 156 22 19 21.400 PS 0,452 1.850 2.723 3.540 1.329 5076 5.TRG 6.663 1.10 7.72 RO U.UGU 9.39 9.896 10.30 0.03 11.ME 11 12.00 1 16 25 TR 12 WANT 0.004 01926 1.783 2577 2.312 3.99 2629 5.2006 5.72 6142 6.710 30 06 3.904 8.2.11 0.559 UUSI 12 1272 . 9.B ITS T2 11.92 12.200 1:15 195 GL T3 TO ART 6.SO 191 2.943 3.58 R.125 90B 9.00 3 10.05 10. 15 15. 17 18 19 1908 SIS 9.00 102 10.05 10.07 10.88 1.250 11. 123 7.68 24 B.022 201 3.365 7122 TY 8 85 8.758 3.900 SIS SR TO 122 11.45 1. OS IND 2017 9.22 99 9.915 21 TO 19. NO 260 50 Th. Percent SINI USLY 25.808 32.835 39.196 2295 2735 31.424 19.800 23.115 25.730 11.04 15.372 1719 18 208 171292 19.790 21.482 12.783 13.785 15.0MS 15.702 11.451 12009 10.675 11.258 11.925 12.233 5.123 5.203 10 274 10.757 102902 1514 5,077 9.427 9.779 9.915 z 8.122 8.60 13.B01 9.00 Period 12% A.R98 1.690 2.402 3.032 3.605 145 O.R72 1.847 155 @ 870 1.626 2 2.855 25% 1.800 1440 0.70 0.711 RRS 1.668 23961 2.974 3.517 3.990 0714 1693 08 1.606 2.246 2.798 9.278 . 2015 0.833 1.548 105 2.589 LUE 2.91 175 0.855 1.585 2210 2.743 199 09 3.922 1207 4.451 1.696 L.BG -2.166 236 2.043 FRE TRES 2220 28 1734 4.160 filia Percent 185 1910 0.87 O.RE 1.506 2.140 2. 3.127 2058 3.698 10 3112 1.705 2951 303 91 1.596 196 13 1613 19T 43 1 SONE . 1.799 2.32 FRG 2.931 31.161 3.324 1483 216 22 Z SOB 4 546 26 153 2.326 1.605 3.8 4.00 4193 3.32 FCB 712 19 5.231 5.121 5.2.3R SER 3.192 SUD 2215 5918 E 5.02 5.197 42 19 3.190 CATE 19B 119 29 52 . 2.500 10 lab HO 3.65 1725 3. Tu 3.82 23 BRE 3911 3.9 BE 3219 32 THE SOS 6165 990 1993 1995 1997 109 182 6 . 5.7 13 2.189 fi IFE SU US SNE 28.11 14 19 20 1961 O 2494 1999 12 4. ATA PES FLES SB RO 5101 S SI ISE SEE Lli LE HE G 5 1.490 1999 LUD 244 SU 350 2.57 2.857 -257 SH 5 ETTE 2K 7675 7 138 ti 19 U

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started