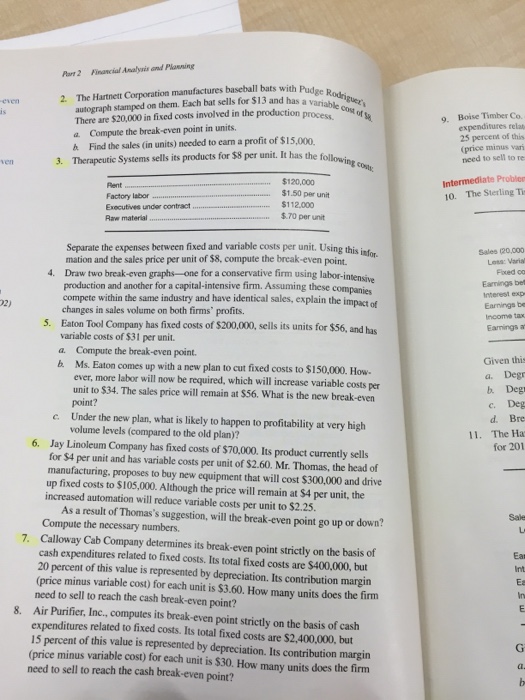

The Hartnett Corporation manufactures baseball bats with Pudge Rodriguer's autograph stamped on them. Each bat sells for $13 and has a variable cost of $8. There are $20,000 in fixed costs involved in the production process. Compute the break-even point in units. Find the sales (in units) needed to earn a profit of $15,000. Therapeutic Systems sells its products for $8 per unit. It has the following costs: Separate the expenses between fixed and variable costs per unit. Using this information and the sales price per unit of $8, compute the break-even point. Draw two break-even graphs-one for a conservative firm using labor-intensive production and another for a capital-intensive firm. Assuming these companies compete within the same industry and have identical sales, explain the impact of changes in sales volume on both firm's profits. Eaton Tool Company has fixed costs of $200,000,. sells its units tor $56, and has variable costs of $31 per unit. Compute the break-even point. Ms. Eaton comes up with a new plan to cut fixed costs to $150,000. However, more labor will now be required, which will increase variable costs per unit to $34. The sales price will remain at $56. What is the new break-even point? Under the new plan, what is likely to happen to profitability at very high volume levels (compared to the old plan)? Jay Linoleum Company has fixed costs of $70,000. Its product currently sells for $4 per unit and has variable costs per unit of $2.60. Mr. Thomas, the head of manufacturing, proposes to buy new equipment that will cost $300,000 and drive up fixed costs to $ 105,000. Although the price w ill remain at $4 per unit, the increased automation will reduce variable costs per unit to $2.25. As a result of Thomas's suggestion, will the break-even point go up or down? Compute the necessary numbers. Calloway Cab Company determines its break even point strictly on the basis of cash expenditures related to fixed costs. Its total fixed costs are $400,000 but 20 percent of this value is represented by depreciation. Its contribution margin (price minus variable cost) for each unit is $3.60. How many units does the firm need to sell to reach the cash break-even point? Air Purifier. Inc., computes its break-even point strictly on the basis of cash expenditures related to fixed costs. Its total fixed costs are $2,400,000, but 15 percent of this value is represented by depreciation. Its contribution margin (price minus variable cost) for each unit is $30. How many units does the firm need to sell to reach the cash break-even point