Answered step by step

Verified Expert Solution

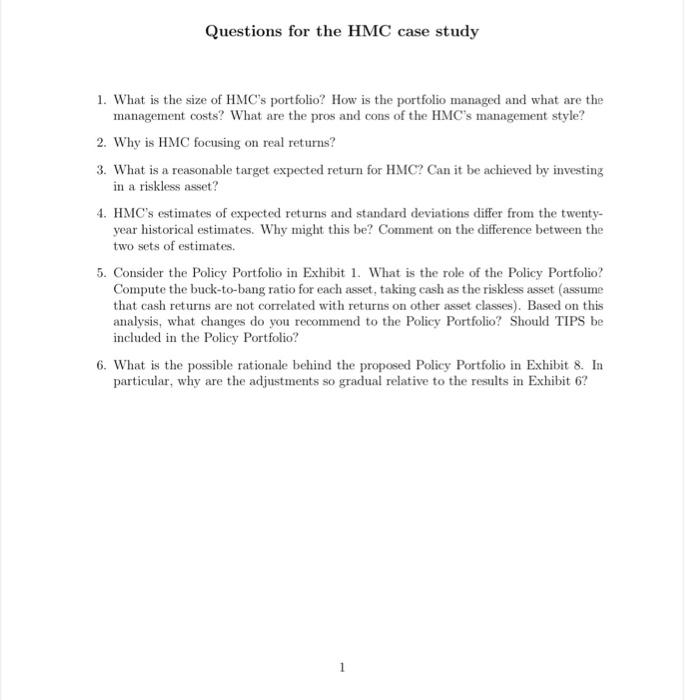

Question

1 Approved Answer

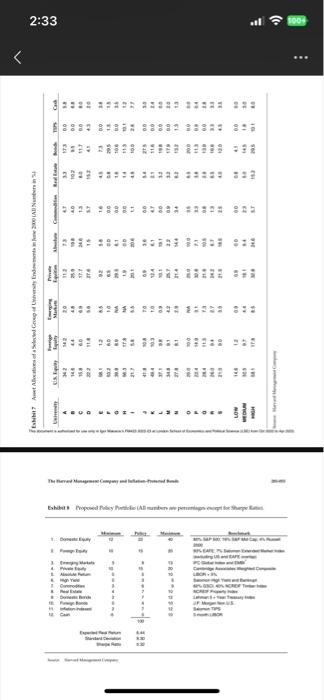

The Harvard Management Company and InflationProtected Bonds 7 Truma ulthe b0-wwat ina whet entervile ta an 1HL nint bariufio di timidation it thent on T.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started