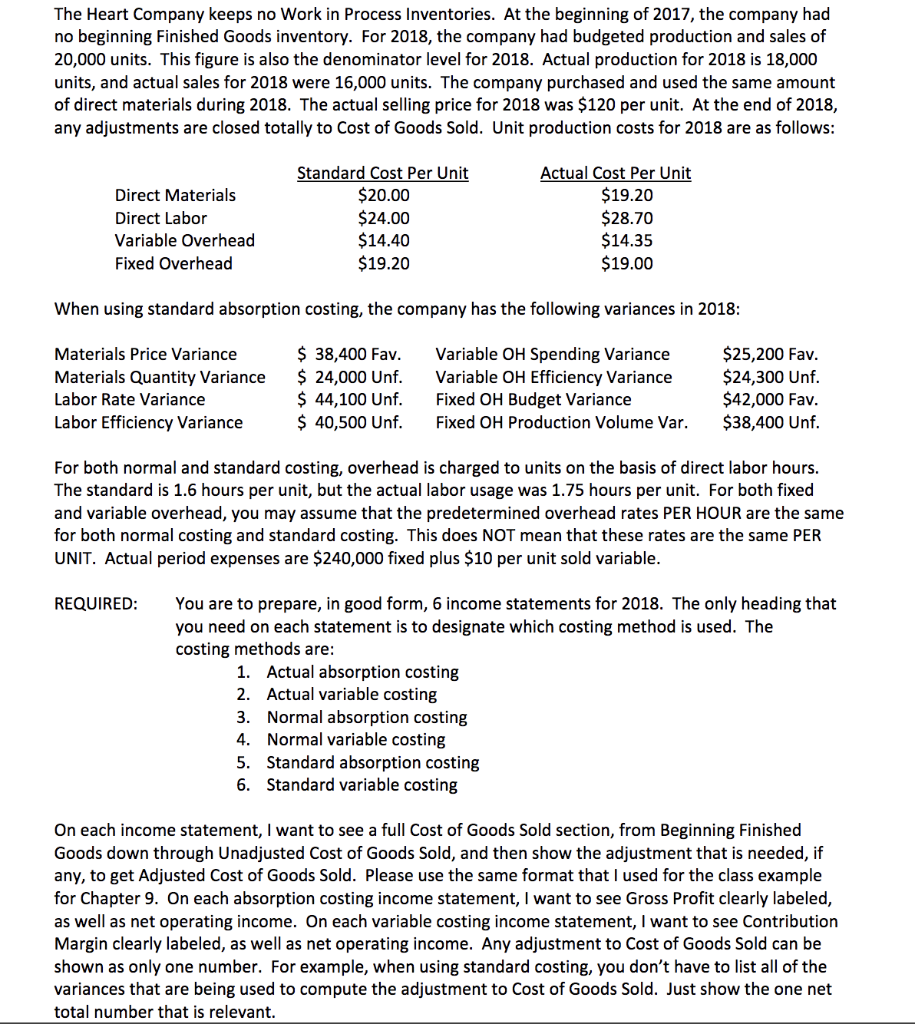

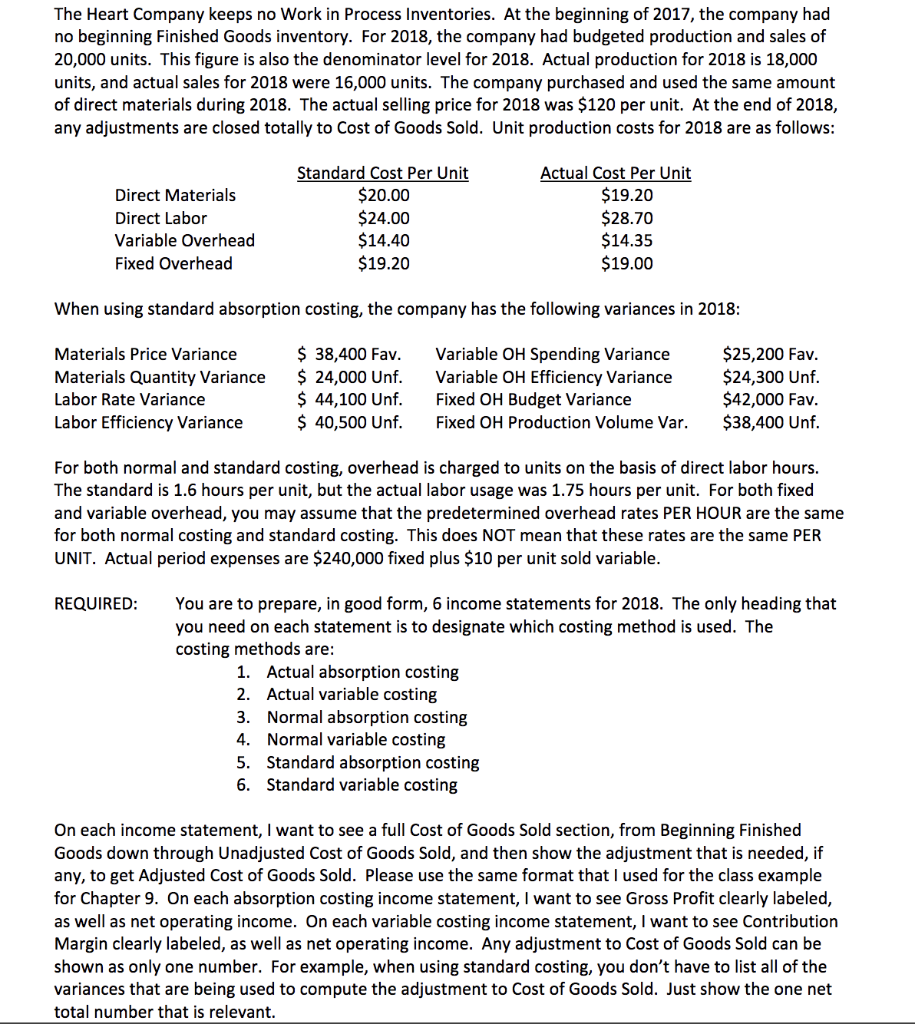

The Heart Company keeps no Work in Process Inventories. At the beginning of 2017, the company had no beginning Finished Goods inventory. For 2018, the company had budgeted production and sales of 20,000 units. This figure is also the denominator level for 2018. Actual production for 2018 is 18,000 units, and actual sales for 2018 were 16,000 units. The company purchased and used the same amount of direct materials during 2018. The actual selling price for 2018 was $120 per unit. At the end of 2018, any adjustments are closed totally to Cost of Goods Sold. Unit production costs for 2018 are as follows: Standard Cost Per Unit $20.00 $24.00 $14.40 $19.20 Actual Cost Per Unit Direct Materials $19.20 $28.70 $14.35 $19.00 Direct Labor Variable Overhead Fixed Overhead When using standard absorption costing, the company has the following variances in 2018: $25,200 Fav $24,300 Unf $42,000 Fav $38,400 Unf $ 38,400 Fav. $ 24,000 Unf $ 44,100 Unf $ 40,500 Unf Materials Price Variance Variable OH Spending Variance Variable OH Efficiency Variance Fixed OH Budget Variance Materials Quantity Variance Labor Rate Variance Labor Efficiency Variance Fixed OH Production Volume Var. For both normal and standard costing, overhead is charged to units on the basis of direct labor hours. The standard is 1.6 hours per unit, but the actual labor usage was 1.75 hours per unit. For both fixed and variable overhead, you may assume that the predetermined overhead rates PER HOUR are the same for both normal costing and standard costing. This does NOT mean that these rates are the same PER UNIT. Actual period expenses are $240,000 fixed plus $10 per unit sold variable. REQUIRED: You are to prepare, in good form, 6 income statements for 2018. The only heading that you need on each statement is to designate which costing method is used. The costing methods are 1. Actual absorption costing 2. Actual variable costing 3. Normal absorption costing 4. Normal variable costing 5. Standard absorption costing 6. Standard variable costing On each income statement, I want to see a full Cost of Goods Sold section, from Beginning Finished Goods down through Unadjusted Cost of Goods Sold, and then show the adjustment that is needed, if any, to get Adjusted Cost of Goods Sold. Please use the same for Chapter 9 On each absorption costing income statement, I want to see Gross Profit clearly labeled, as well as net operating income. On each variable costing income statement, I want to see Contribution Margin clearly labeled, as well as net operating income. Any adjustment to Cost of Goods Sold can be shown as only one number. For example, when using standard costing, you don't have to list all of the variances that are being used to compute the adjustment to Cost of Goods Sold. Just show the one net total number that is relevant rmat that I used for the class example The Heart Company keeps no Work in Process Inventories. At the beginning of 2017, the company had no beginning Finished Goods inventory. For 2018, the company had budgeted production and sales of 20,000 units. This figure is also the denominator level for 2018. Actual production for 2018 is 18,000 units, and actual sales for 2018 were 16,000 units. The company purchased and used the same amount of direct materials during 2018. The actual selling price for 2018 was $120 per unit. At the end of 2018, any adjustments are closed totally to Cost of Goods Sold. Unit production costs for 2018 are as follows: Standard Cost Per Unit $20.00 $24.00 $14.40 $19.20 Actual Cost Per Unit Direct Materials $19.20 $28.70 $14.35 $19.00 Direct Labor Variable Overhead Fixed Overhead When using standard absorption costing, the company has the following variances in 2018: $25,200 Fav $24,300 Unf $42,000 Fav $38,400 Unf $ 38,400 Fav. $ 24,000 Unf $ 44,100 Unf $ 40,500 Unf Materials Price Variance Variable OH Spending Variance Variable OH Efficiency Variance Fixed OH Budget Variance Materials Quantity Variance Labor Rate Variance Labor Efficiency Variance Fixed OH Production Volume Var. For both normal and standard costing, overhead is charged to units on the basis of direct labor hours. The standard is 1.6 hours per unit, but the actual labor usage was 1.75 hours per unit. For both fixed and variable overhead, you may assume that the predetermined overhead rates PER HOUR are the same for both normal costing and standard costing. This does NOT mean that these rates are the same PER UNIT. Actual period expenses are $240,000 fixed plus $10 per unit sold variable. REQUIRED: You are to prepare, in good form, 6 income statements for 2018. The only heading that you need on each statement is to designate which costing method is used. The costing methods are 1. Actual absorption costing 2. Actual variable costing 3. Normal absorption costing 4. Normal variable costing 5. Standard absorption costing 6. Standard variable costing On each income statement, I want to see a full Cost of Goods Sold section, from Beginning Finished Goods down through Unadjusted Cost of Goods Sold, and then show the adjustment that is needed, if any, to get Adjusted Cost of Goods Sold. Please use the same for Chapter 9 On each absorption costing income statement, I want to see Gross Profit clearly labeled, as well as net operating income. On each variable costing income statement, I want to see Contribution Margin clearly labeled, as well as net operating income. Any adjustment to Cost of Goods Sold can be shown as only one number. For example, when using standard costing, you don't have to list all of the variances that are being used to compute the adjustment to Cost of Goods Sold. Just show the one net total number that is relevant rmat that I used for the class example