Answered step by step

Verified Expert Solution

Question

1 Approved Answer

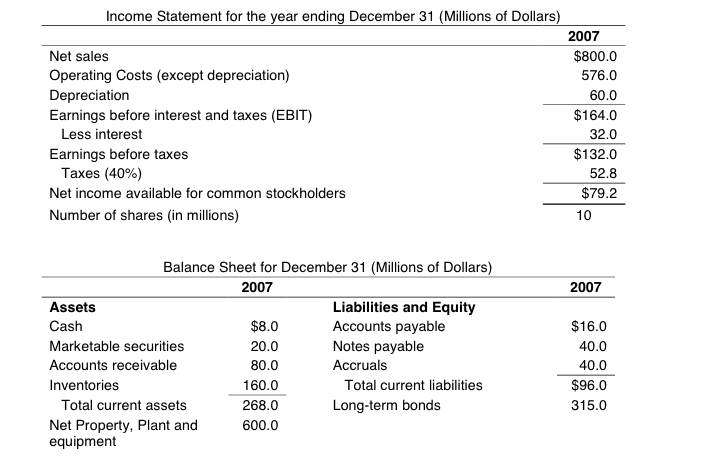

The Henley Corporation is a privately held company specializing in lawn care products and services. You are given data for the most recent fiscal year,

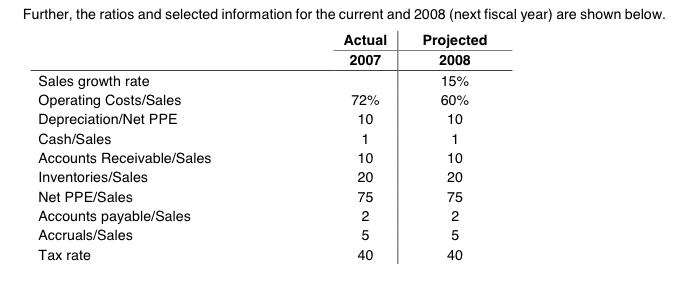

The Henley Corporation is a privately held company specializing in lawn care products and services. You are given data for the most recent fiscal year, 2007. Using the percent of sales method, forecast the external financing needs for 2008 (ignore, how financing is raised)

Income Statement for the year ending December 31 (Millions of Dollars) 2007 Net sales Operating Costs (except depreciation) Depreciation Earnings before interest and taxes (EBIT) $800.0 576.0 60.0 $164.0 32.0 $132.0 52.8 $79.2 Less interest Earnings before taxes Taxes (40%) Net income available for common stockholders Number of shares (in millions) Balance Sheet for December 31 (Millions of Dollars) 2007 2007 Assets Cash Marketable securities Accounts receivable Inventories $8.0 20.0 80.0 160.0 268.0 600.0 Liabilities and Equity Accounts payable Notes payable Accruals $16.0 40.0 40.0 $96.0 315.0 Total current liabilities Long-term bonds Total current assets Net Property, Plant and equipment Further, the ratios and selected information for the current and 2008 (next fiscal year) are shown below Actual Projected 2007 2008 15% 60% Sales growth rate Operating Costs/Sales Depreciation/Net PPE Cash/Sales Accounts Receivable/Sales Inventories/Sales Net PPE/Sales Accounts payable/Sales Accruals/Sales Tax rate 72% 20 75 20 75 2 40Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started