Answered step by step

Verified Expert Solution

Question

1 Approved Answer

With this investment philosophy in mind, select one investment from the list above that you feel is the best match for your philosophy. Please explain

With this investment philosophy in mind, select one investment from the list above that you feel is the best match for your philosophy. Please explain why you feel this is the best match.

Identify an investment that would best suit Samantha's and Martin's level of risk.

Contrast your investment risk tolerance level with Martin and Samantha. What is different about the investment that you advise for each of them?

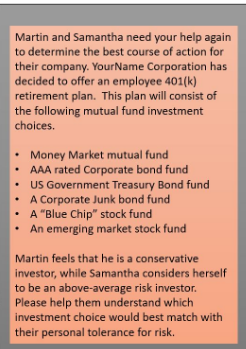

Martin and Samantha need your help again to determine the best course of action for their company. YourName Corporation has decided to offer an employee 401(k) retirement plan. This plan will consist of the following mutual fund investment choices. Money Market mutual fund .AAA rated Corporate bond fund US Government Treasury Bond fund A Corporate Junk bond fund .A "Blue Chip" stock fund An emerging market stock fund Martin feels that he is a conservative investor, while Samantha considers herself to be an above-average risk investor. Please help them understand which investment choice would best match with their personal tolerance for risk. Martin and Samantha need your help again to determine the best course of action for their company. YourName Corporation has decided to offer an employee 401(k) retirement plan. This plan will consist of the following mutual fund investment choices. Money Market mutual fund .AAA rated Corporate bond fund US Government Treasury Bond fund A Corporate Junk bond fund .A "Blue Chip" stock fund An emerging market stock fund Martin feels that he is a conservative investor, while Samantha considers herself to be an above-average risk investor. Please help them understand which investment choice would best match with their personal tolerance for riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started