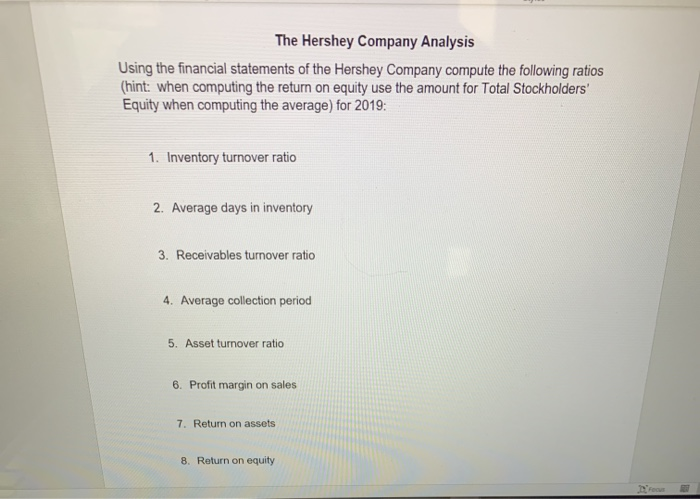

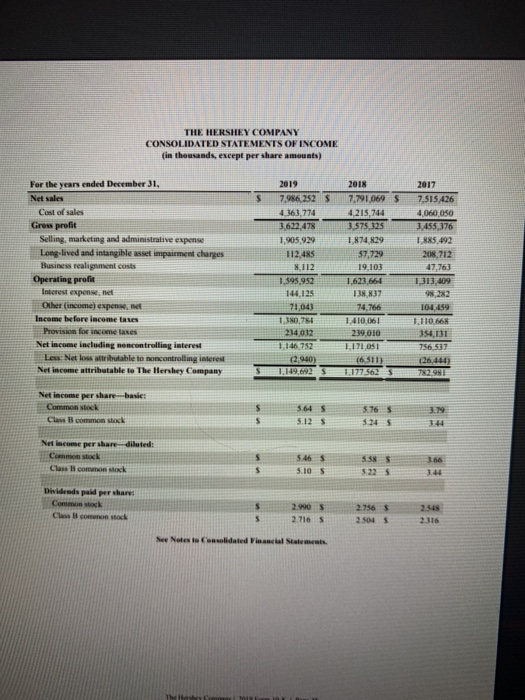

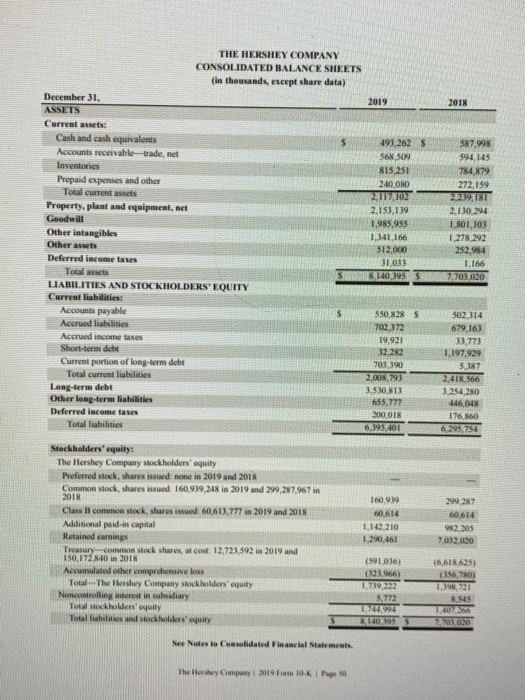

The Hershey Company Analysis Using the financial statements of the Hershey Company compute the following ratios (hint: when computing the return on equity use the amount for Total Stockholders' Equity when computing the average) for 2019: 1. Inventory turnover ratio 2. Average days in inventory 3. Receivables turnover ratio 4. Average collection period 5. Asset turnover ratio 6. Profit margin on sales 7. Return on assets 8. Return on equity THE HERSHEY COMPANY CONSOLIDATED STATEMENTS OF INCOME in thousands, except per share amounts) For the years ended December 31, Net sales Cost of sales Grow profit Selling, marketing and administrative expense Long-lived and intangible asset impairment charges Business realignment costs Operating profil Interest expense, nel Other (income) expense met Income before income tanes Provision for income taxes Net income including mencontrolling interest Less Netloss attributable to noncontrolling interest Net income attributable to The Hershey Company 2019 7,986 2525 4.363,774 3.622.478 1,905,929 112,485 8112 1.595.952 144.125 71003 1,380,754 234012 | 146.752 (2.940) 1,149,792 2018 7,791 069 4,215,744 3.575.325 1874 829 57,729 19.103 1,623,666 138,837 74.766 1,410,061 239.010 1.171.051 (6.51) 1.1775625 2017 7,515 426 4 060 050 3.455 376 1,885,492 208,712 47,763 1313409 IOL 459 1.110,668 354,131 756 537 26.444) 72,981 Net income per share-basie: Commons Claus common stock 3,645 5.125 5.76 $245 S Net income per share-diluted: Common stock Class common stock 5.46 5 5.10 558S $225 366 3:44 Dividends paid per share Como sack Class common stock 2.990 S 2.716 S 2.7565 2.5045 2.548 2315 5 See Notes to Convidated Financial Statema. This 2019 2018 THE HERSHEY COMPANY CONSOLIDATED BALANCE SHEETS (in thousands, except share data) December 31. ASSETS Current assets: Cash and cash equivalents Accounts receivable trade, net Inventories Prepaid expenses and other Total current assets Property, plant and equipment, net Goodwill Other intangibles Other assets Deferred income taxes Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Accrued income taxes Short-term dett Current portion of long-term debt Total current liabilities Long-term debt Other long-term liabilities Deferred income tales Total liabilities 493,262 S 568,500 815,251 240.NO 2, ZALOZ 2.153,139 1,985,955 1,341,166 512,000 31.013 8.140 395 587,998 594,145 784,879 272,159 21239, IST 2.130.294 1.1 103 1.278,292 252984 L.166 7,703,020 S 550,828 702 372 19,921 32.282 703,390 2.008793 3,530,813 655,777 200018 6.19501 502 314 679,163 33.773 1.197,929 5,387 2,418 566 3.254,230 446,048 176.860 6.295.754 Stockholders' equity: The Hershey Company stockholders' equity Preferred stock, shares issued: none in 2019 and 2018 Common stock, shares issued: 160,939,248 in 2019 and 299,287,967 in 2018 Class B common stock, shares issued 60,613,777 in 2019 and 2018 Additional paid-in capital Retained earnings Treasury common stock shares, al cost 12,723,592 in 2019 and 150,172.40 in 2018 Accumulated other comprehensive loss Total The Hershey Company stockholders' equity Noncontrolling interest in subsidiary Total eckholders equity Total abilities and stockholders' equity 160.919 60,614 1.142.210 1.290.461 299,287 60 614 982,205 7,032.020 (591,036) (323.966) 1.73922 5,772 w (6,618.625) (356,780) 1.39721 8.54 1407206 2701.00 See Notes to Consolidated Financial Statements The Flash Cam 2019 Form 10-K Pages