Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Hicks have provided you some additional information pertaining to a construction business Pete started. This business, MountainCloud, Inc. (MCI), is a sole proprietorship

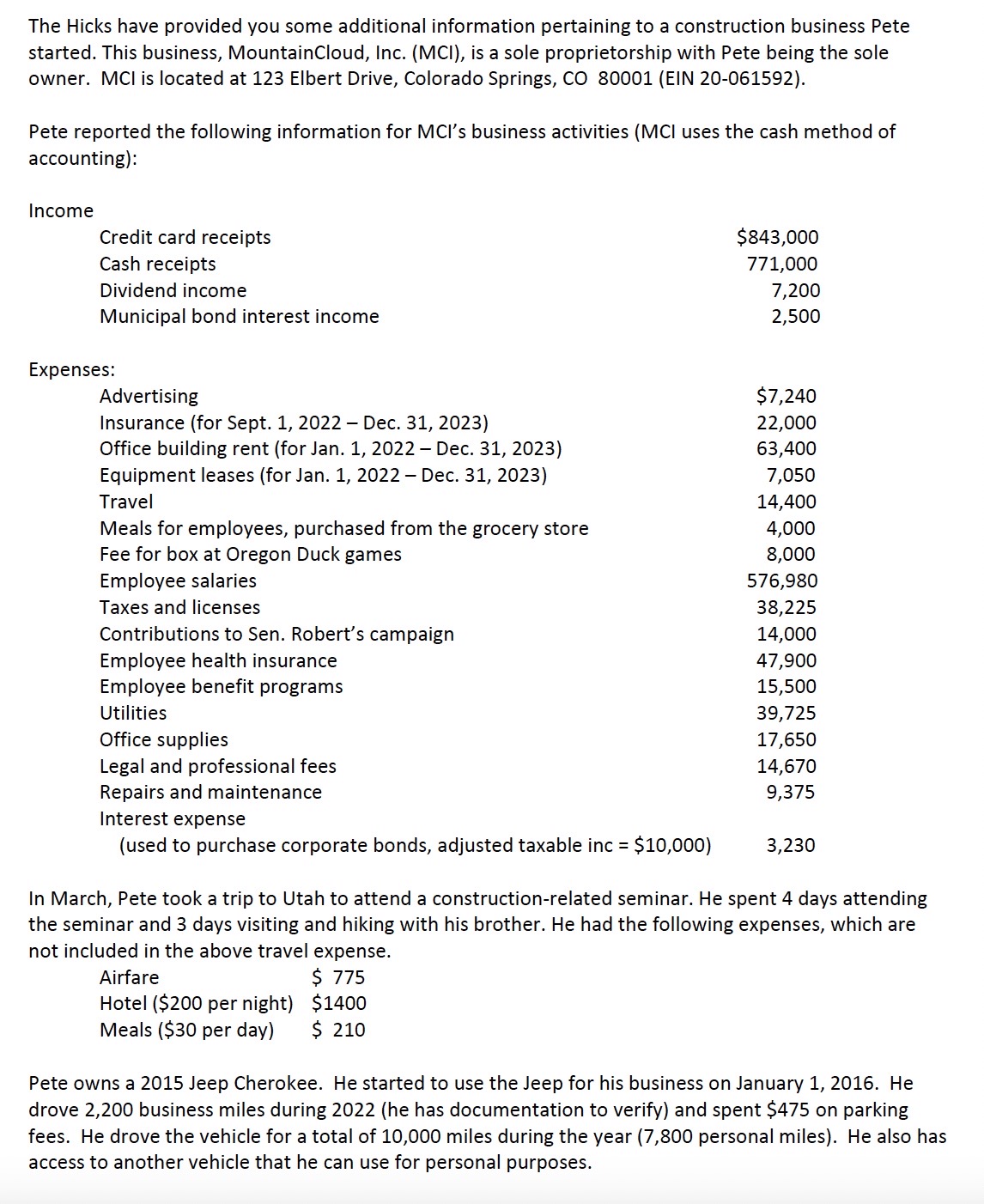

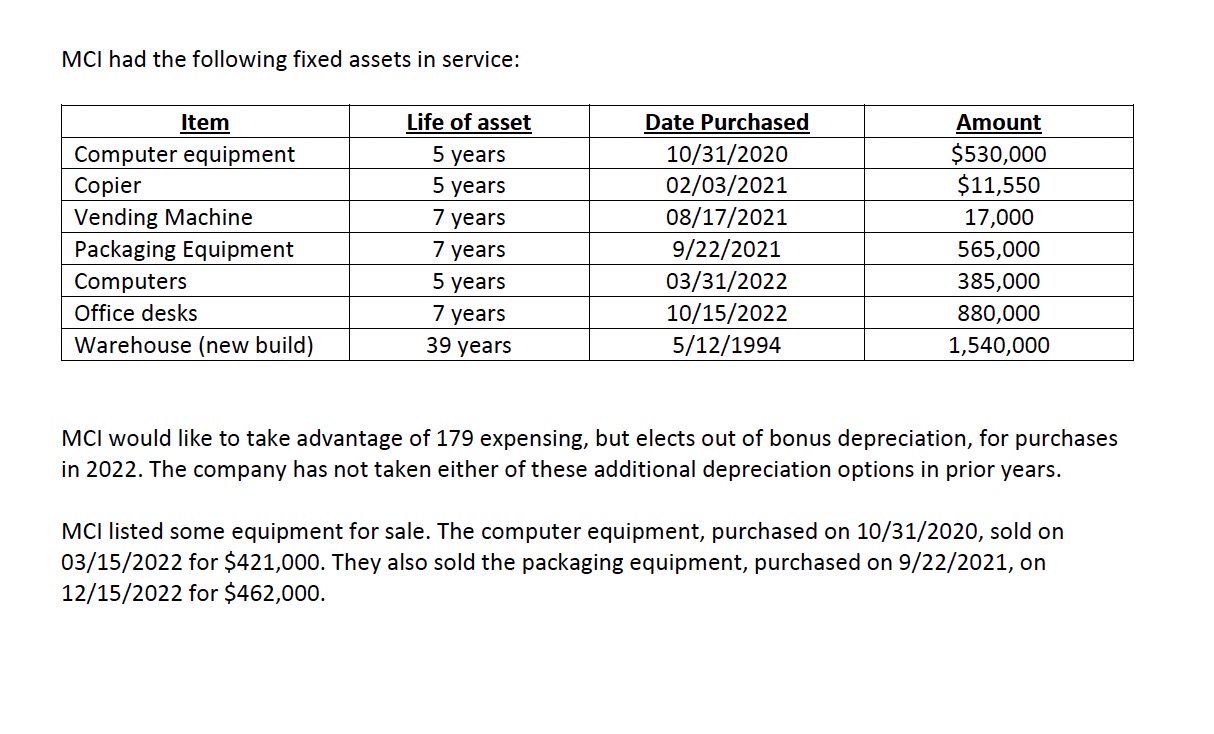

The Hicks have provided you some additional information pertaining to a construction business Pete started. This business, MountainCloud, Inc. (MCI), is a sole proprietorship with Pete being the sole owner. MCI is located at 123 Elbert Drive, Colorado Springs, CO 80001 (EIN 20-061592). Pete reported the following information for MCI's business activities (MCI uses the cash method of accounting): Income Credit card receipts Cash receipts Dividend income Municipal bond interest income Expenses: Advertising Insurance (for Sept. 1, 2022 - Dec. 31, 2023) Office building rent (for Jan. 1, 2022 - Dec. 31, 2023) $843,000 771,000 7,200 2,500 $7,240 22,000 63,400 Equipment leases (for Jan. 1, 2022 - Dec. 31, 2023) 7,050 Travel 14,400 Meals for employees, purchased from the grocery store 4,000 Fee for box at Oregon Duck games 8,000 Employee salaries 576,980 Taxes and licenses 38,225 Contributions to Sen. Robert's campaign 14,000 Employee health insurance 47,900 Employee benefit programs 15,500 Utilities 39,725 Office supplies 17,650 Legal and professional fees 14,670 Repairs and maintenance 9,375 Interest expense (used to purchase corporate bonds, adjusted taxable inc = $10,000) 3,230 In March, Pete took a trip to Utah to attend a construction-related seminar. He spent 4 days attending the seminar and 3 days visiting and hiking with his brother. He had the following expenses, which are not included in the above travel expense. Airfare $ 775 Hotel ($200 per night) $1400 Meals ($30 per day) $ 210 Pete owns a 2015 Jeep Cherokee. He started to use the Jeep for his business on January 1, 2016. He drove 2,200 business miles during 2022 (he has documentation to verify) and spent $475 on parking fees. He drove the vehicle for a total of 10,000 miles during the year (7,800 personal miles). He also has access to another vehicle that he can use for personal purposes. MCI had the following fixed assets in service: Item Life of asset Date Purchased Computer equipment 5 years 10/31/2020 Copier 5 years 02/03/2021 Vending Machine 7 years 08/17/2021 Amount $530,000 $11,550 17,000 Packaging Equipment 7 years 9/22/2021 565,000 Computers 5 years 03/31/2022 385,000 Office desks 7 years Warehouse (new build) 39 years 10/15/2022 5/12/1994 880,000 1,540,000 MCI would like to take advantage of 179 expensing, but elects out of bonus depreciation, for purchases in 2022. The company has not taken either of these additional depreciation options in prior years. MCI listed some equipment for sale. The computer equipment, purchased on 10/31/2020, sold on 03/15/2022 for $421,000. They also sold the packaging equipment, purchased on 9/22/2021, on 12/15/2022 for $462,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started