Question

The Hilltop Corporation is considering (as of 1/1/12) the replacement of an old machine that is currently being used. The old machine is fully depreciated

The Hilltop Corporation is considering (as of 1/1/12) the replacement of an old machine that is currently being used. The old machine is fully depreciated but can be used by the corporation through 2016. If Hilltop decides to replace the old machine, Baker Company has offered to purchase the old machine for $40,000 on the replacement date. The disposal value of the old machine would be zero at the end of 2016. Hilltop uses the straight-line method of depreciation for all classes of machinery.

If the replacement occurs, a new machine would be acquired from Busby Industries on January 2, 2012. The purchase price of $500,000 for the new machine would be paid in cash at the time of acquisition. Due to the increased efficiency of the new machine, the estimated annual cash savings of $125,000 would be generated through to the end of 2016, the end of its expected useful life. The new machine is expected to have a zero disposal price at the end of 2016.

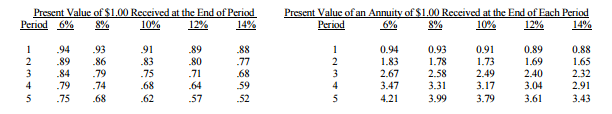

All operating cash receipts, operating cash expenditures, and applicable tax payments and credits are assumed to occur at the end of each year. Hilltop employs the calendar year for reporting purposes. Discount tables for several different interest (discount) rates that are to be used in any discounting calculations are given below.

a) If Hilltop requires investments to earn an 8% return p.a., calculate the net present value for replacing the old machine with the new machine.

b) Calculate the internal rate of return, to the nearest percent, to replace the old machine.

c) The payback period to replace the old machine with the new machine.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started