Answered step by step

Verified Expert Solution

Question

1 Approved Answer

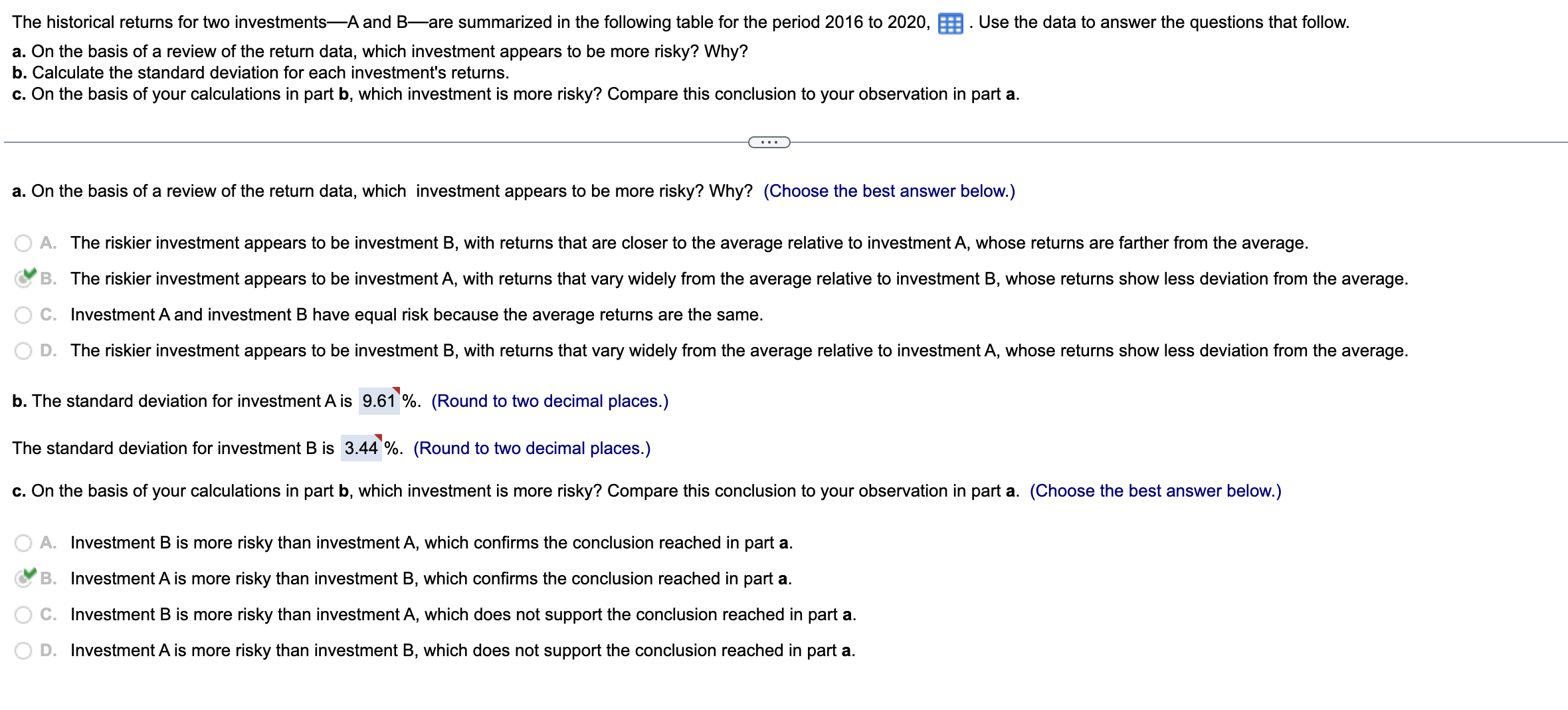

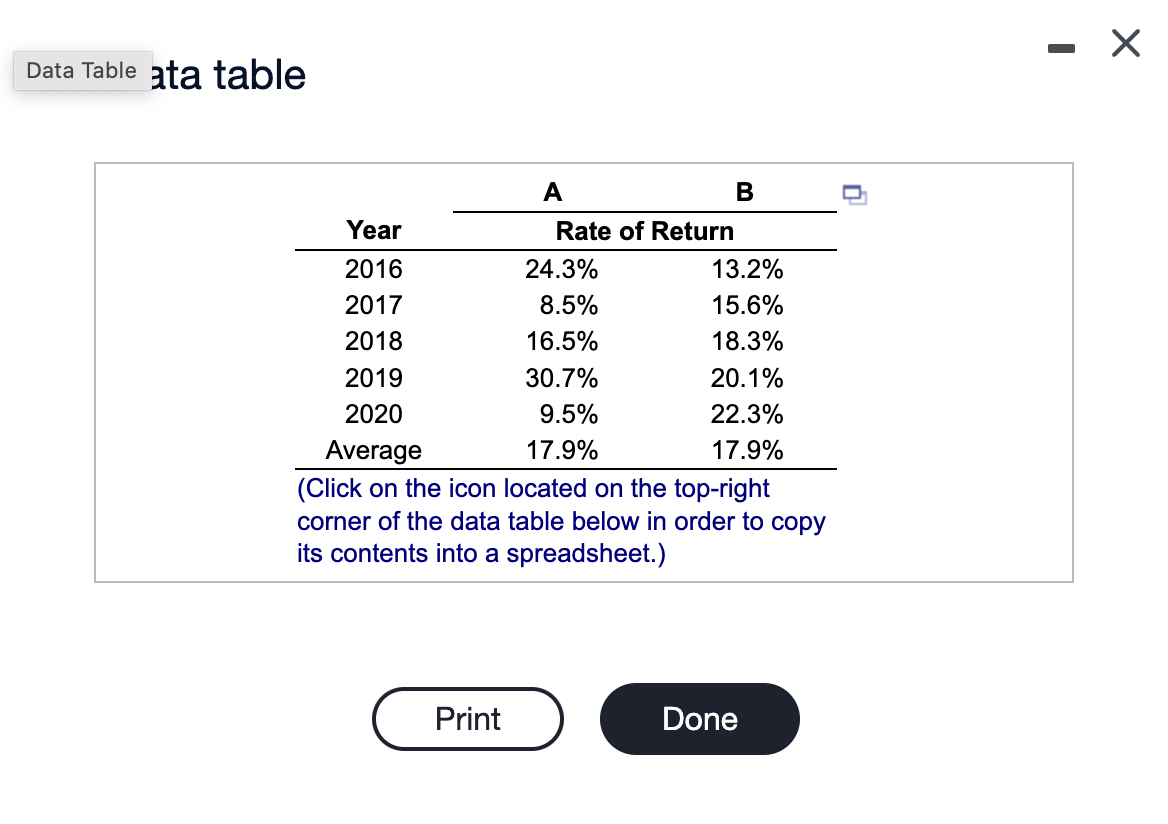

The historical returns for two investments-A and B-are summarized in the following table for the period 2016 to 2020 , Use the data to answer

The historical returns for two investments-A and B-are summarized in the following table for the period 2016 to 2020 , Use the data to answer the questions that follow. a. On the basis of a review of the return data, which investment appears to be more risky? Why? b. Calculate the standard deviation for each investment's returns. c. On the basis of your calculations in part b, which investment is more risky? Compare this conclusion to your observation in part a. a. On the basis of a review of the return data, which investment appears to be more risky? Why? (Choose the best answer below.) C. Investment A and investment B have equal risk because the average returns are the same. b. The standard deviation for investment A is 'o. (Round to two decimal places.) The standard deviation for investment B is 3.44%. (Round to two decimal places.) A. Investment B is more risky than investment A, which confirms the conclusion reached in part a. 'B. Investment A is more risky than investment B, which confirms the conclusion reached in part a. C. Investment B is more risky than investment A, which does not support the conclusion reached in part a. D. Investment A is more risky than investment B, which does not support the conclusion reached in part a. (Ulick on ule icon cated on tne top-rignt corner of the data table below in order to copy its contents into a spreadsheet.)

The historical returns for two investments-A and B-are summarized in the following table for the period 2016 to 2020 , Use the data to answer the questions that follow. a. On the basis of a review of the return data, which investment appears to be more risky? Why? b. Calculate the standard deviation for each investment's returns. c. On the basis of your calculations in part b, which investment is more risky? Compare this conclusion to your observation in part a. a. On the basis of a review of the return data, which investment appears to be more risky? Why? (Choose the best answer below.) C. Investment A and investment B have equal risk because the average returns are the same. b. The standard deviation for investment A is 'o. (Round to two decimal places.) The standard deviation for investment B is 3.44%. (Round to two decimal places.) A. Investment B is more risky than investment A, which confirms the conclusion reached in part a. 'B. Investment A is more risky than investment B, which confirms the conclusion reached in part a. C. Investment B is more risky than investment A, which does not support the conclusion reached in part a. D. Investment A is more risky than investment B, which does not support the conclusion reached in part a. (Ulick on ule icon cated on tne top-rignt corner of the data table below in order to copy its contents into a spreadsheet.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started