Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The holder of a credit card is provided with two basic services: the ability to purchase goods without cash and the ability to obtain

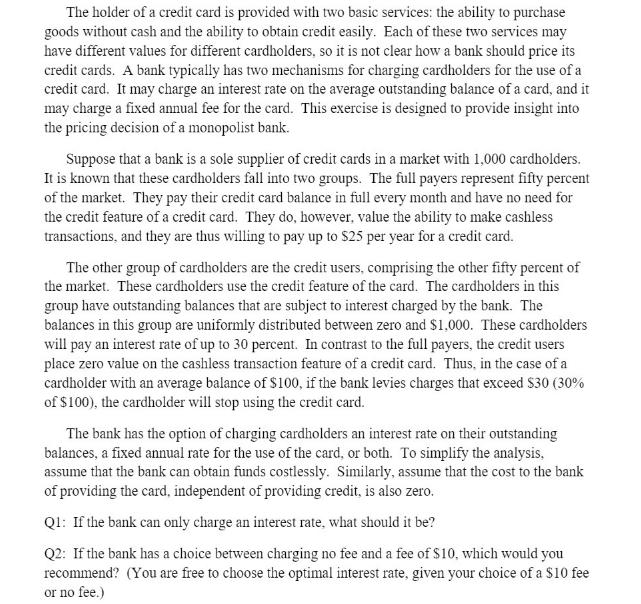

The holder of a credit card is provided with two basic services: the ability to purchase goods without cash and the ability to obtain credit easily. Each of these two services may have different values for different cardholders, so it is not clear how a bank should price its credit cards. A bank typically has two mechanisms for charging cardholders for the use of a credit card. It may charge an interest rate on the average outstanding balance of a card, and it may charge a fixed annual fee for the card. This exercise is designed to provide insight into the pricing decision of a monopolist bank. Suppose that a bank is a sole supplier of credit cards in a market with 1,000 cardholders. It is known that these cardholders fall into two groups. The full payers represent fifty percent of the market. They pay their credit card balance in full every month and have no need for the credit feature of a credit card. They do, however, value the ability to make cashless transactions, and they are thus willing to pay up to $25 per year for a credit card. The other group of cardholders are the credit users, comprising the other fifty percent of the market. These cardholders use the credit feature of the card. The cardholders in this group have outstanding balances that are subject to interest charged by the bank. The balances in this group are uniformly distributed between zero and $1,000. These cardholders will pay an interest rate of up to 30 percent. In contrast to the full payers, the credit users place zero value on the cashless transaction feature of a credit card. Thus, in the case of a cardholder with an average balance of $100, if the bank levies charges that exceed $30 (30% of $100), the cardholder will stop using the credit card. The bank has the option of charging cardholders an interest rate on their outstanding balances, a fixed annual rate for the use of the card, or both. To simplify the analysis, assume that the bank can obtain funds costlessly. Similarly, assume that the cost to the bank of providing the card, independent of providing credit, is also zero. Q1: If the bank can only charge an interest rate, what should it be? Q2: If the bank has a choice between charging no fee and a fee of $10, which would you recommend? (You are free to choose the optimal interest rate, given your choice of a $10 fee or no fee.) Q3: If you could design an optimal pricing mechanism for a credit card, what would it be?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Credit Card Pricing Strategies for a Monopolistic Bank Q1 If the bank can only charge an interest rate what should it be In this scenariothe bank need...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started