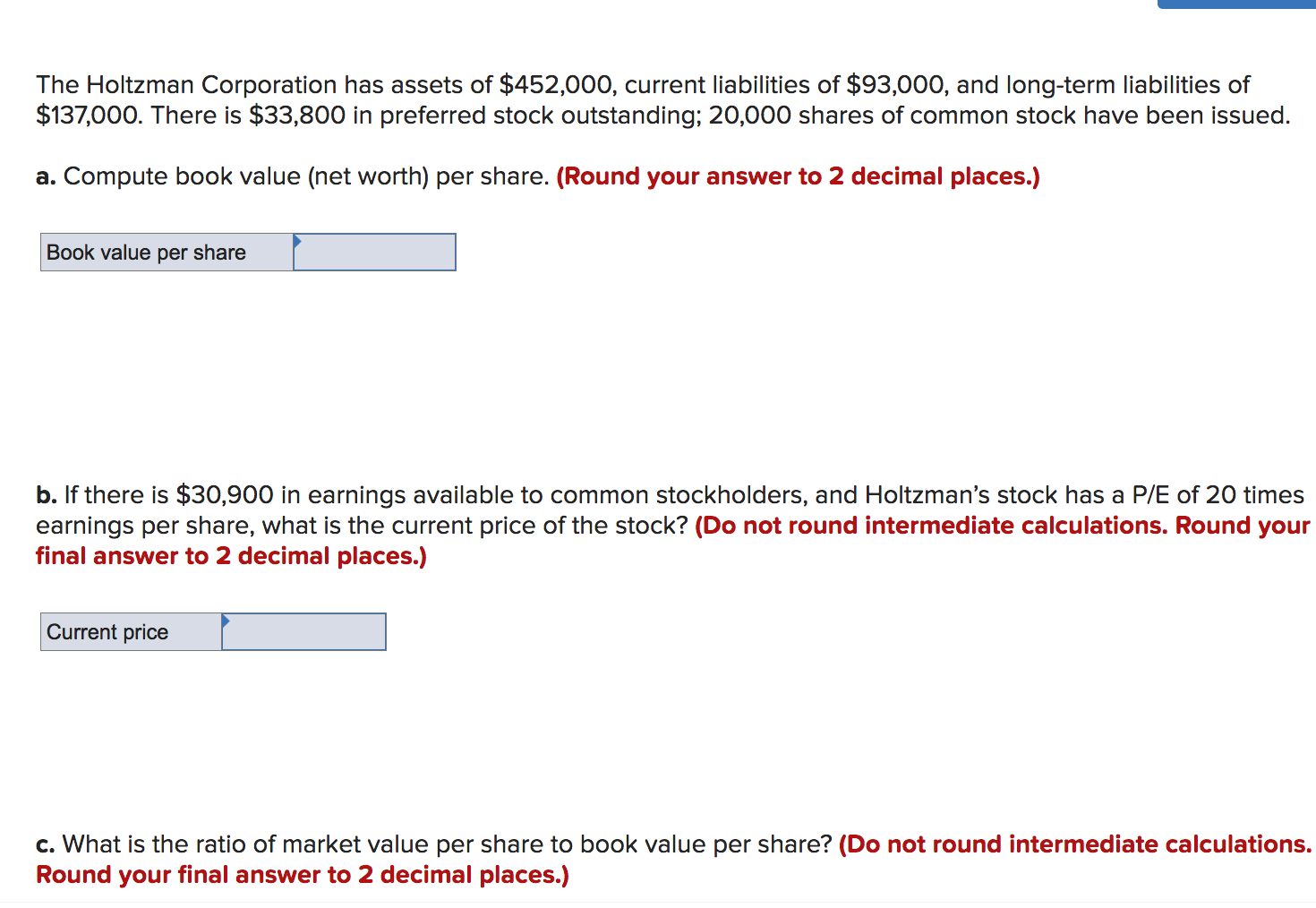

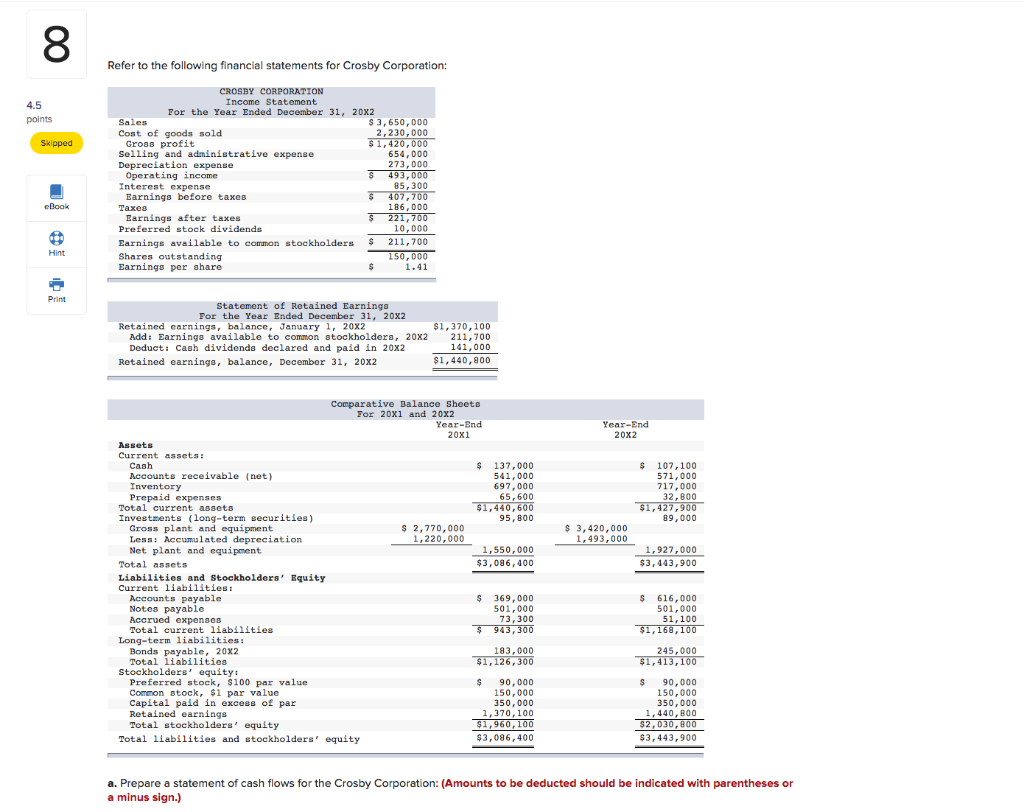

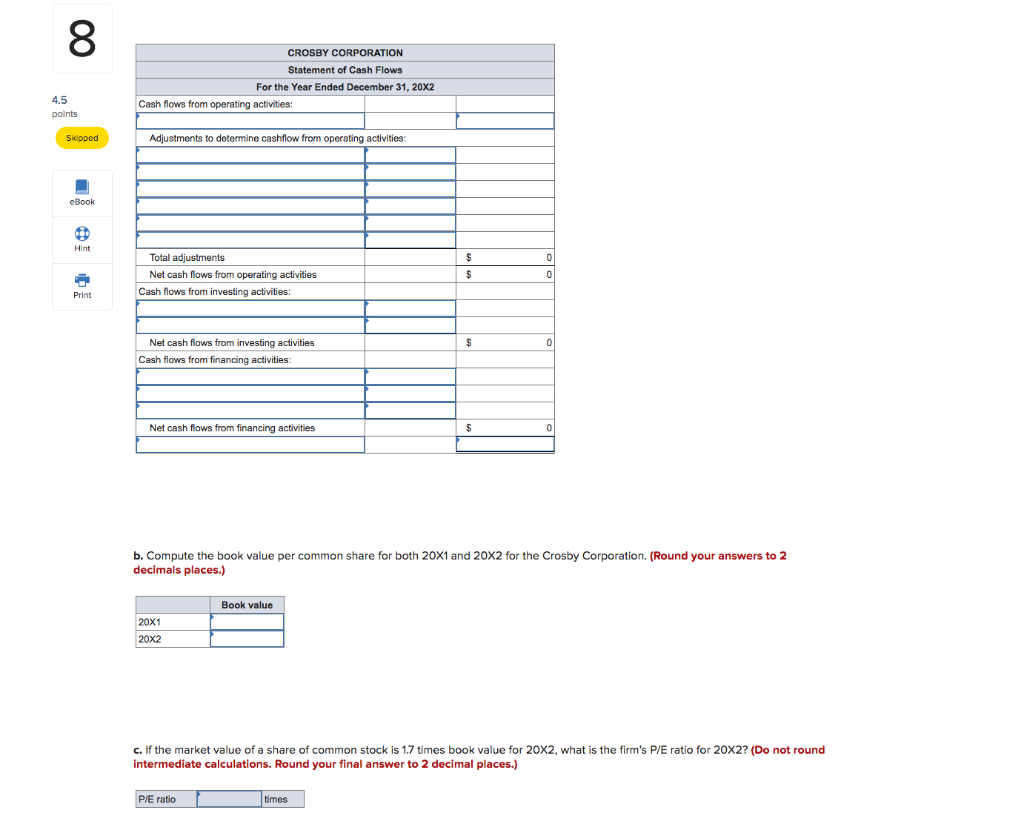

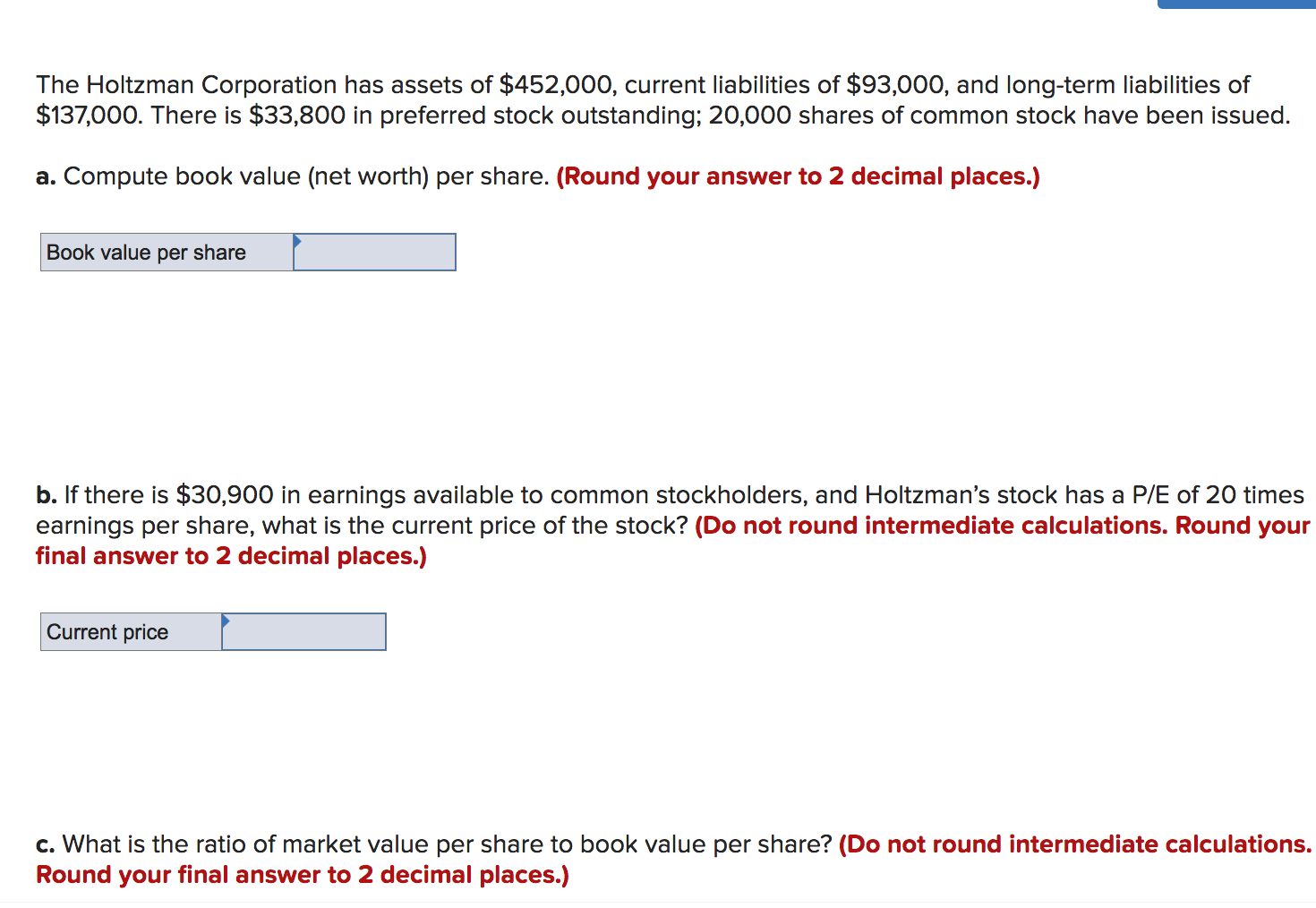

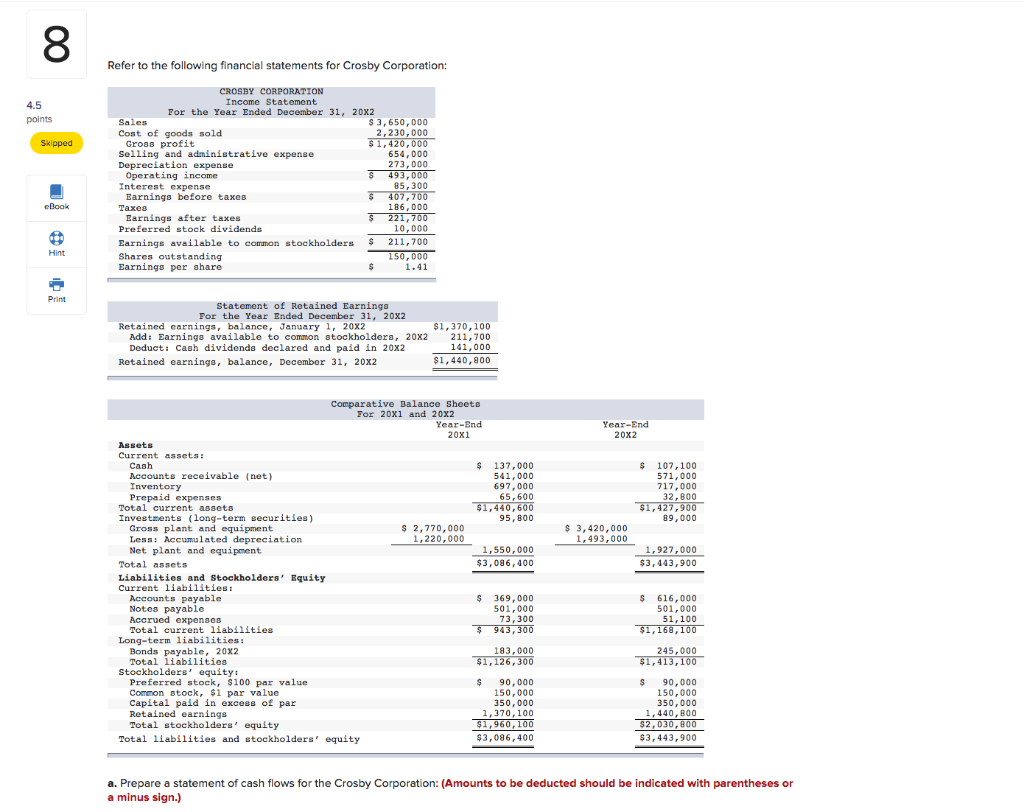

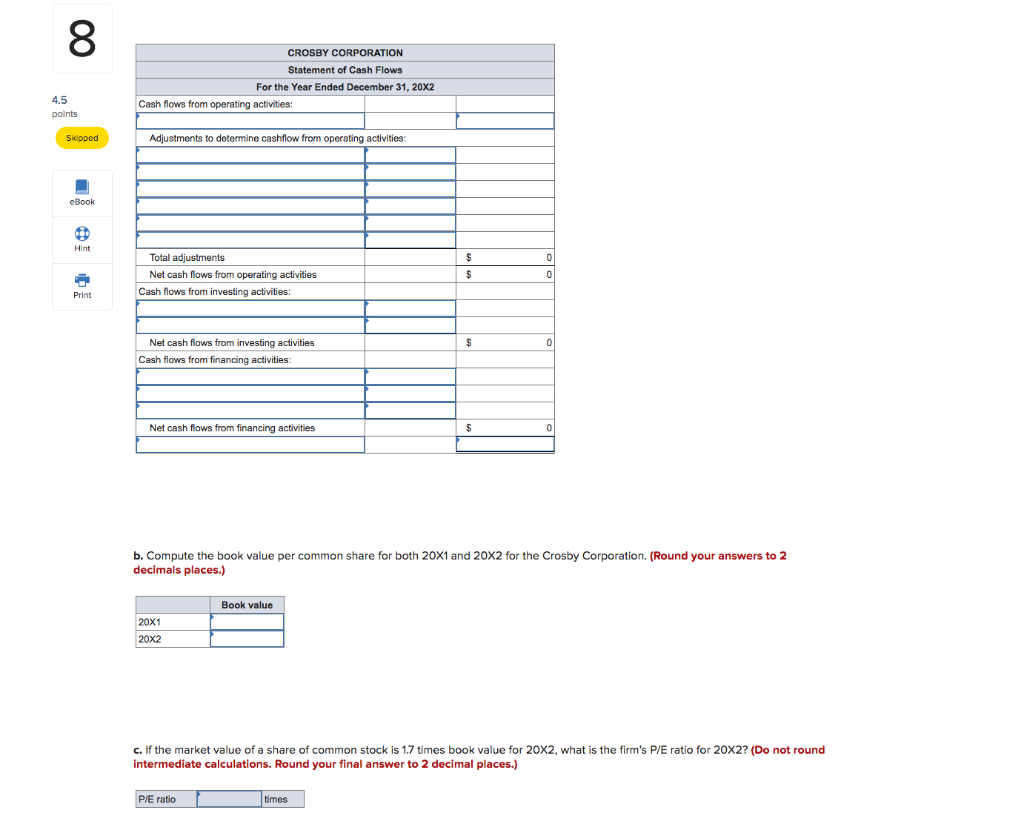

The Holtzman Corporation has assets of $452,000, current liabilities of $93,000, and long-term liabilities of $137,000. There is $33,800 in preferred stock outstanding; 20,000 shares of common stock have been issued. a. Compute book value (net worth) per share. (Round your answer to 2 decimal places.) Book value per share b. If there is $30,900 in earnings available to common stockholders, and Holtzman's stock has a P/E of 20 times earnings per share, what is the current price of the stock? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Current price c. What is the ratio of market value per share to book value per share? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) 8 Refer to the following financial statements for Crosby Corporation: 4.5 points Skipped CROSBY CORPORATION Income Statement For the Year Ended December 31, 20X2 Sales $ 3,650,000 Cost of goods sold 2,230,000 Gross profit $ 1,420,000 Selling and administrative expense 654,000 Depreciation expense 273,000 Operating income $ 493.000 Interest expense 85,300 Earnings before taxes $ 402.700 Taxes 186,000 Earnings after taxes $ 221,700 Preferred stock dividends 10,000 Earnings available to common stockholders $ 211,700 Shares outstanding 150,000 Earnings per share 1.41 eBook Print Statement of Retained Earnings For the Year Ended December 31, 20x2 Retained earnings, balance, January 1, 20X2 $1,370, 100 Add: Earnings available to common stockholders, 20x2 211,700 Deduct: Cash dividends declared and paid in 20x2 1 41,000 Retained earnings, balance, December 31, 20x2 $1,440, 800 Year-End 20x2 $ 107,100 571,000 717,000 32,800 $1,427,900 89,000 $ 3, 420,000 1,493,000 1,927,000 $3,443,900 Comparative Balance Sheets For 20X1 and 20x2 Year-End 20x1 Assets Current assets: Cash $ 137,000 Accounts receivable (net) 541,000 Inventory 697.000 Prepaid expenses 65,600 Total current assets $1,440,600 Investments (long-term securities) 95,800 Gross plant and equipment $ 2,770,000 Less: Accumulated depreciation 1,220,000 Net plant and equipment 1,550,000 Total assets $3,086,400 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 369,000 Notes payable 501,000 Accrued expenses 73,300 Total current liabilities $ 943,300 Long-term liabilities: Bonds payable, 20x2 183,000 Total liabilities $1,126,300 Stockholders' equity: Preferred stock, $100 par value $ 90.000 Common stock, $1 par valve 150,000 Capital paid in excess of par 350.000 Retained earnings 1,370, 100 Total stockholders' equity $1,960,100 Total liabilities and stockholders' equity $3,086,400 $ 616,000 501,000 51.100 $1,168,100 245,000 $1,413,100 $ 90,000 150,000 350.000 1,440, 800 $2,030,800 $3,443,900 a. Prepare a statement of cash flows for the Crosby Corporation: (Amounts to be deducted should be indicated with parentheses or a minus sign.) CROSBY CORPORATION Statement of Cash Flows For the Year Ended December 31, 20X2 Cash flows from operating activities: 4.5 points Skloped Adjustments to determine cashflow from operating activities: eBook Hint Total adiustments Net cash flows from operating activities Cash flows from investing activities: Print Net cash flows from investing activities Cash flows from financing activities: Net cash flows from financing activities b. Compute the book value per common share for both 20X1 and 20X2 for the Crosby Corporation. (Round your answers to 2 decimals places.) Book value 20X1 20x2 c. If the market value of a share of common stock is 1.7 times book value for 20X2, what is the firm's P/E ratio for 20x2? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) P/E ratio times