Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Hong Kong and Shanghai Banking Corpora- tion was created in Shanghai in 1865. Its primary business was to finance trade with China. Up

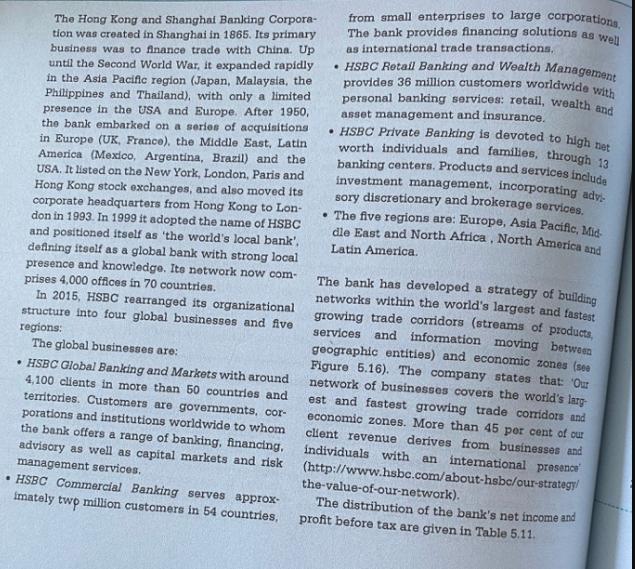

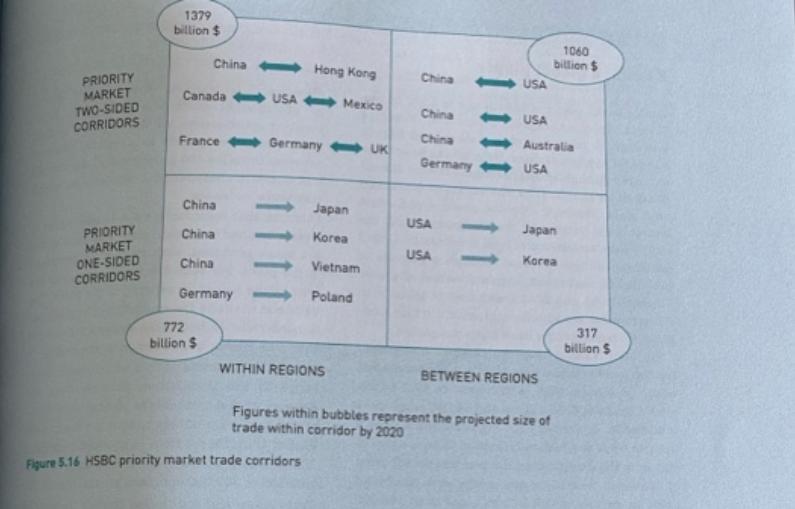

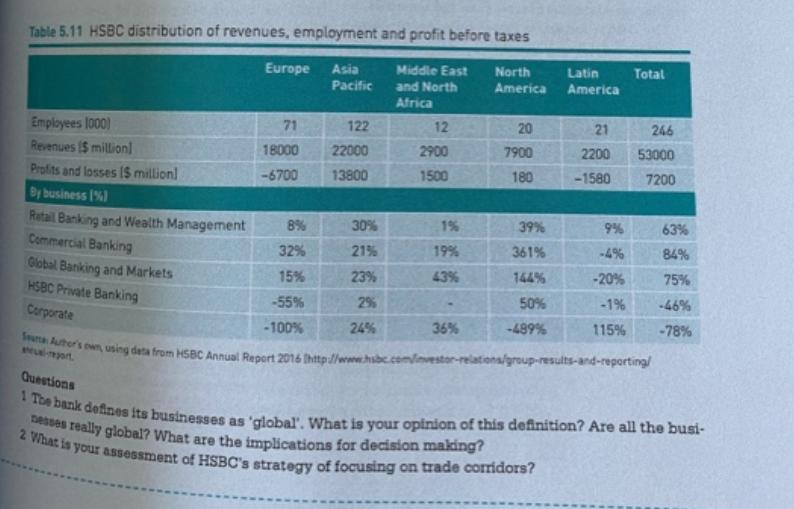

The Hong Kong and Shanghai Banking Corpora- tion was created in Shanghai in 1865. Its primary business was to finance trade with China. Up until the Second World War, it expanded rapidly in the Asia Pacific region (Japan, Malaysia, the Philippines and Thailand), with only a limited presence in the USA and Europe. After 1950, the bank embarked on a series of acquisitions in Europe (UK, France), the Middle East, Latin America (Mexico, Argentina, Brazil) and the USA. It listed on the New York, London, Paris and Hong Kong stock exchanges, and also moved its corporate headquarters from Hong Kong to Lon- don in 1993. In 1999 it adopted the name of HSBC and positioned itself as 'the world's local bank', defining itself as a global bank with strong local presence and knowledge. Its network now com- prises 4,000 offices in 70 countries. In 2015, HSBC rearranged its organizational structure into four global businesses and five regions: The global businesses are: HSBC Global Banking and Markets with around 4,100 clients in more than 50 countries and territories. Customers are governments, cor- porations and institutions worldwide to whom the bank offers a range of banking, financing, advisory as well as capital markets and risk management services. HSBC Commercial Banking serves approx- imately two million customers in 54 countries, from small enterprises to large corporations. The bank provides financing solutions as well as international trade transactions, HSBC Retail Banking and Wealth Management provides 36 million customers worldwide with personal banking services: retail, wealth and asset management and insurance. HSBC Private Banking is devoted to high net worth individuals and families, through 13 banking centers. Products and services include investment management, incorporating adv sory discretionary and brokerage services. The five regions are: Europe, Asia Pacific, Mid dle East and North Africa, North America and Latin America. The bank has developed a strategy of building networks within the world's largest and fastest growing trade corridors (streams of products, services and information moving between geographic entities) and economic zones (see Figure 5.16). The company states that: Our network of businesses covers the world's larg- est and fastest growing trade corridors and economic zones. More than 45 per cent of our client revenue derives from businesses and individuals with an international presence (http://www.hsbc.com/about-hsbc/our-strategy/ the-value-of-our-network). The distribution of the bank's net income and profit before tax are given in Table 5.11. PRIORITY MARKET TWO-SIDED CORRIDORS PRIORITY MARKET ONE-SIDED CORRIDORS 1379 billion $ China Canada France Germany UK China China China Germany 772 billion $ Hong Kong USA Mexico Japan Korea Vietnam Poland WITHIN REGIONS Figure 5.16 HSBC priority market trade corridors China China China Germany USA USA USA USA Australia USA 1060 billion $ Japan Korea BETWEEN REGIONS Figures within bubbles represent the projected size of trade within corridor by 2020 317 billion $ Table 5.11 HSBC distribution of revenues, employment and profit before taxes Europe Asia North America Employees 1000) Revenues ($ millionl Profits and losses I$ million] By business (%) Retail Banking and Wealth Management Commercial Banking Global Banking and Markets HSBC Private Banking Corporate 71 18000 -6700 8% 32% Pacific 122 22000 13800 30% 21% 23% 2% 24% Middle East and North Africa 12 2900 1500 1% 19% 43% 20 7900 180 36% 39% 361% 144% 50% -489% Latin America Total 21 246 2200 53000 -1580 7200 9% -4% -20% -1% 115% 15% -55% -100% Author's own, using data from HSBC Annual Report 2016 http://www.hsbc.com/investor-relations/group-results-and-reporting/ 63% 84% 75% -46% -78% Questions 1 The bank defines its businesses as 'global'. What is your opinion of this definition? Are all the busi- 2 What is your assessment of HSBC's strategy of focusing on trade corridors? nesses really global? What are the implications for decision making?

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 The bank defines its businesses as global What is your opinion of this definition Are all the businesses really global What are the implica...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started