Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Horizon Healthcare Foundation was formed to solicit donations that support certain initiatives of the Horizon Hospital. The Foundation is a separate legal entity that

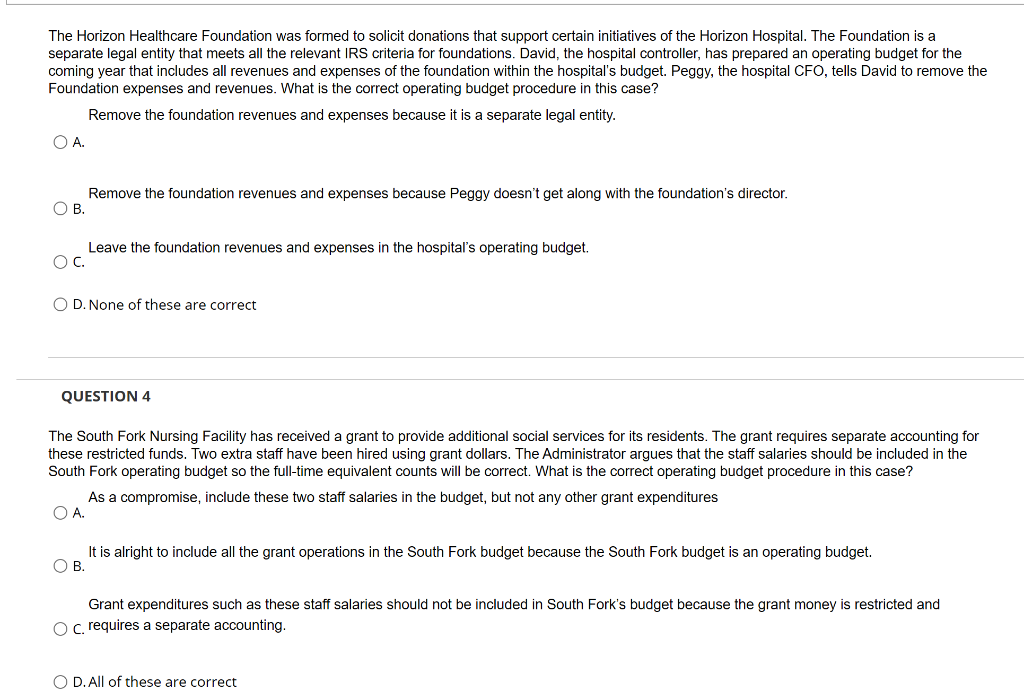

The Horizon Healthcare Foundation was formed to solicit donations that support certain initiatives of the Horizon Hospital. The Foundation is a separate legal entity that meets all the relevant IRS criteria for foundations. David, the hospital controller, has prepared an operating budget for the coming year that includes all revenues and expenses of the foundation within the hospital's budget. Peggy, the hospital CFO, tells David to remove the Foundation expenses and revenues. What is the correct operating budget procedure in this case? Remove the foundation revenues and expenses because it is a separate legal entity. OA. Remove the foundation revenues and expenses because Peggy doesn't get along with the foundation's director. OB. Leave the foundation revenues and expenses in the hospital's operating budget. OC. OD. None of these are correct QUESTION 4 The South Fork Nursing Facility has received a grant to provide additional social services for its residents. The grant requires separate accounting for these restricted funds. Two extra staff have been hired using grant dollars. The Administrator argues that the staff salaries should be included in the South Fork operating budget so the full-time equivalent counts will be correct. What is the correct operating budget procedure in this case? As a compromise, include these two staff salaries in the budget, but not any other grant expenditures OA. It is alright to include all the grant operations in the South Fork budget because the South Fork budget is an operating budget. OB. Grant expenditures such as these staff salaries should not be included in South Fork's budget because the grant money is restricted and O c. requires a separate accounting. O D. All of these are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started