Answered step by step

Verified Expert Solution

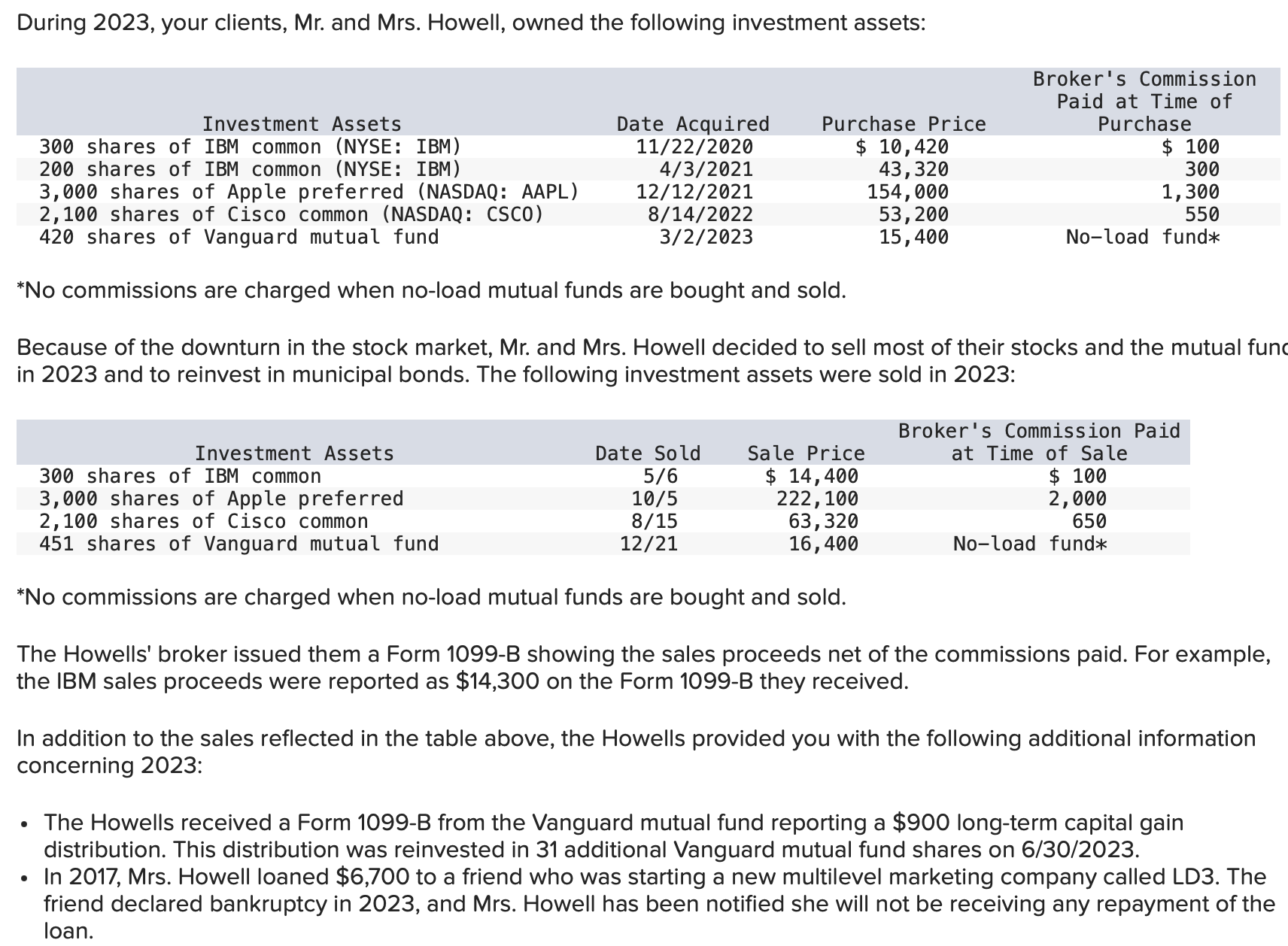

Question

1 Approved Answer

The Howells have a $ 3 , 0 0 0 short - term capital loss carryover and a $ 5 , 5 0 0 long

The Howells have a $ shortterm capital loss carryover and a $ longterm capital loss carryover from prior years.

The Howls did net sut therer one anest suas to rames rom corporate bonds, and $ in qualfeid dividense

Assume the Howells have $ of wage income during the year.

the howells did not instruct thier broker to sell any particular lot of IBM stock

c Assume the Howells' shortterm capital loss carryover from prior years is $ rather than $ as indicated above. If this is the case, how much shortterm and longterm capital loss carryovers remain to be carried beyond to future tax years?

Shortterm capital loss

Longterm capital loss

a Compute the Howells' tax liability for the year ignoring the alternative minimum tax and any phaseout provisions assuming they file a joint return, they have no dependents, they don't make any special tax elections, and their itemized deductions total $

Use the tax rate schedules, Dividends and Capital Gains Tax Rates.

Howells' tax liability for the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started