The idea is set up a new business and do a budgeting plan for it. Please estimate the revenues based on market research. Set prices

The idea is set up a new business and do a budgeting plan for it.

Please estimate the revenues based on market research.

Set prices according to the market prices.

Cost of goods sold (COGS) could be estimated as 20% of the Prices per unit.

While they were doing their Business Plan, they took the following decisions:

Then plan to run the business at least, for 10 years.

The prices and wages have to be adjusted to the inflation. The European Central Bank has estimated the long-run inflation in the Euro-zone to be an annual 2%. They estimate that revenues can grow twice inflation rate

Things to keep in mind:

Initial Marketing (launching) Campaign and its estimation cost

Loan under French system. Consult the % interest rate

To evaluate the investment project, students have to do the following:

For assessing this investment, the required rate will be estimated using CAPM, considering Risk free rate as German federal Bonds, 10 years maturity (0.95%), market rate, as Ibex-35, last years return 7%, and risk will be considered by using a Beta of 1.60 (slightly above industry average)

For all the other assumptions, please clearly state them on the report.

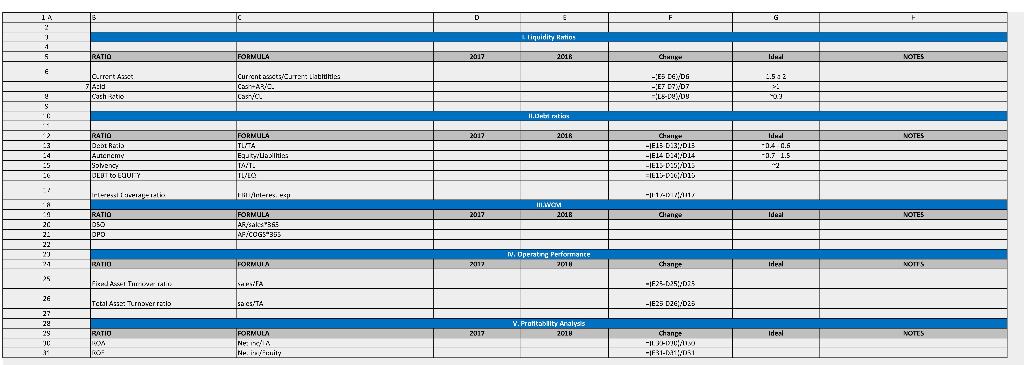

14 2 1 1 5 E 2 S C A 12 + 3 24 25 26 A a 4 21 20 22 22 23 21 25 26 27 22 29 JC 31 RATIO Current Asset Cash to RATIO Debt Racio Autenemy Solvency DEBT to EQUITY Interess! I ageratka RATIO DE www OPO RATIO Fiend Rost The tali Total Ass: Turnover radio RATIO HOS DOF 7:10 C FORMULA Current acts/CT Labhas CAR/C CasyC. FORMULA TUITA Equity/Ushies TAT. TLVEC Aeteres FORMULA AR/saks 365 AF/COGS 355 FORMULA SAPTA sa c/TA FORMULA Ne inca Ne.is/unity D 2017 2017 2017 2017 2017 L Liquidity Ratios 2016 11.Bebrations 2018 IVOM 2018 N. Operating Performance 2018 Y.Profitability Analysis 2018 F CHINH -ES DE DG -E7 07/07 -15-009 Change -IE13 01 -IE14 D14;/D14 -IE15-D15/013 =1E15-01G/015 -11144411/ Change Change -JF25-D25025 -1E25 D26/02 Chance -11-150 -1831-1051 G Idual 2.52 X 07 Idmal www -0.4 0.5 -0.7 1.5 Ideal Ideal Ideal NOTES NOTES NOTES NOTTS NOTES 14 2 1 1 5 E 2 S C A 12 + 3 24 25 26 A a 4 21 20 22 22 23 21 25 26 27 22 29 JC 31 RATIO Current Asset Cash to RATIO Debt Racio Autenemy Solvency DEBT to EQUITY Interess! I ageratka RATIO DE www OPO RATIO Fiend Rost The tali Total Ass: Turnover radio RATIO HOS DOF 7:10 C FORMULA Current acts/CT Labhas CAR/C CasyC. FORMULA TUITA Equity/Ushies TAT. TLVEC Aeteres FORMULA AR/saks 365 AF/COGS 355 FORMULA SAPTA sa c/TA FORMULA Ne inca Ne.is/unity D 2017 2017 2017 2017 2017 L Liquidity Ratios 2016 11.Bebrations 2018 IVOM 2018 N. Operating Performance 2018 Y.Profitability Analysis 2018 F CHINH -ES DE DG -E7 07/07 -15-009 Change -IE13 01 -IE14 D14;/D14 -IE15-D15/013 =1E15-01G/015 -11144411/ Change Change -JF25-D25025 -1E25 D26/02 Chance -11-150 -1831-1051 G Idual 2.52 X 07 Idmal www -0.4 0.5 -0.7 1.5 Ideal Ideal Ideal NOTES NOTES NOTES NOTTS NOTESStep by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started