Answered step by step

Verified Expert Solution

Question

1 Approved Answer

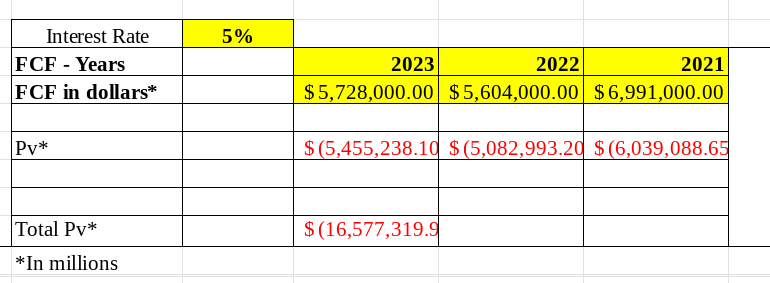

The image shows the calculations of a company's present value. What are the implications of the change in present value based on risk? In other

The image shows the calculations of a company's present value.

What are the implications of the change in present value based on risk? In other words, what does the change mean to your selected company, and how would you, as a financial manager, interpret it?

Based on the present value of the company, and being mindful of the need to effectively balance portfolio risk with return, what recommendation would you make about purchasing the company as an investment at that price?

\begin{tabular}{|c|c|c|c|c|} \hline Interest Rate & 5% & & & \\ \hline FCF - Years & & 2023 & 2022 & 2021 \\ \hline FCF in dollars* & & $5,728,000.00 & $5,604,000.00 & $6,991,000.00 \\ \hline PV & & $(5,455,238.10 & $(5,082,993.20 & $(6,039,088.65 \\ \hline Total Pv & & $(16,577,319.9 & & \\ \hline *In millions & & & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started