Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The income scalar is = 6.133 please provide a detailed solution for the above question Your elients (a married couple), both turn 38 today, have

The income scalar is = 6.133

please provide a detailed solution for the above question

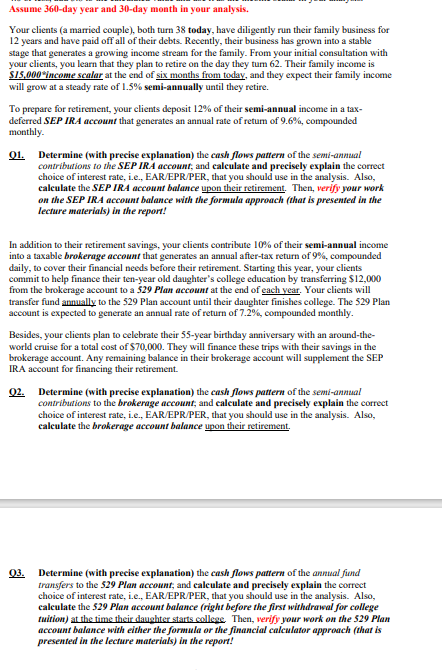

Your elients (a married couple), both turn 38 today, have diligently run their family business for 12 years and have paid off all of their debts. Recently, their business has grown into a stable stage that generates a growing income stream for the family. From your initial consultation with your clients, you learn that they plan to retire on the day they tum 62 . Their family income is $15,000 income scalar at the end of six months from today, and they expect their family income will grow at a steady rate of 1.5% semi-annually until they retire. To prepare for retirement, your clients deposit 12% of their semi-annual income in a taxdeferred SEP IRA account that generates an annual rate of retum of 9.6%, compounded monthly. Q1. Determine (with precise explanation) the cash flows pattern of the semi-annual contributions to the SEP IRA account, and calculate and precisely explain the correct choice of interest rate, i.e., EAR/EPR/PER, that you should use in the analysis. Also, calculate the SEP IRA account balance upon their retirement. Then, verify your work on the SEP IR.A account balance with the formula approach (that is presented in the lecture materials) in the report! In addition to their retirement savings, your clients contribute 10% of their semi-annual income into a taxable brokerage account that generates an annual after-tax return of 9%, compounded daily, to cover their financial needs before their retirement. Starting this year, your clients commit to help finance their ten-year old daughter's college education by transferring $12,000 from the brokerage account to a 529 Plan account at the end of each vear. Your clients will transfer fund annually to the 529 Plan account until their daughter finishes college. The 529 Plan account is expected to generate an annual rate of return of 7.2%, compounded monthly. Besides, your clients plan to celebrate their 55-year birthday anniversary with an around-theworld cruise for a total cost of $70,000. They will finance these trips with their savings in the brokerage account. Any remaining balance in their brokerage account will supplement the SEP IRA account for financing their retirement. Q2. Determine (with precise explanation) the cash flows pattern of the semi-annual contributions to the brokerage account; and calculate and precisely explain the correct choice of interest rate, i.e., EAR/EPR/PER, that you should use in the analysis. Also, calculate the brokerage account balance upon their retirement. Q3. Determine (with precise explanation) the cash flows pattern of the annual find transfers to the 529 Plan account; and calculate and precisely explain the correct choice of interest rate, i.e., EAR/EPR/PER, that you should use in the analysis. Also, calculate the 529 Plan account balance (right before the first withdrawal for college tuition) at the time their daughter starts college. Then, verify your work on the 529 Plan account balance with either the formula or the financial calculator approach (that is presented in the lecture materials) in the report! Today, annual college expenses are running at $35,000, and are expected to grow at an annual rate of 3%. Their daughter, who just turned 10 , will enter college when she turns 18 , and complete her undergraduate study in FIVE years. Your clients expect their daughter to be responsible for 25% of her college expenses by participating in the Federal Work-Study Program. All annual college expenses will be due at the beginning of each year. Your clients will tap into the 529 Plan account for paying their share of their daughter's college expenses. Q4. Will there be sufficient fund in the 529 Plan account to finance their daughter's college expenses? If not, when will the 529 Plan account run out of money? Support your answer numerically by showing the annual balances of the 529 Plan account through their daughter's college years. If there is a positive balance in the 529 Plan account at their daughter's college graduation, your clients will partially support her graduate study with money left in the 529 Plan account. Their daughter plans to work for THREE years before returning to graduate school for an MBA. Today, annual expenses for a competitive full-time 2-year MBA program are running at $58,000, and are expected to grow at an annual rate of 3.3%. Your clients will want to offer assistance to their daughter's pursuit of graduate education with available fund (if any) in the 529 Plan account by subsidizing one-fifth of the annual expenses during her MBA study. If there is a positive balance in the 529 Plan after subsidizing their daughter's 2-year MBA study, the remaining balance will be added to their brokerage account. Q5. Will there be sufficient fund in the 529 Plan account for subsidizing their daughter's MBA program's expenses? If not, when will the 529 Plan account run out of money? Support your answer numerically numerically by showing the annual balances of the 529 Plan account through their daughter's MBA study. Upon their retirement, your clients will roll over the entire balance of their SEP IRA account into the Roth IRA account by paying a 24% tax rate on the balance upon conversion. Q6. How large will be the after-tax nest egg upon the retirement of your clients? In other words, calculate the combined balance of the Roth IRA account and their brokerage account as they start enjoying their retirement. Also, offer THREE distinctively different recommendations (with precise explanations) to your clients that could increase their nest egg

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started