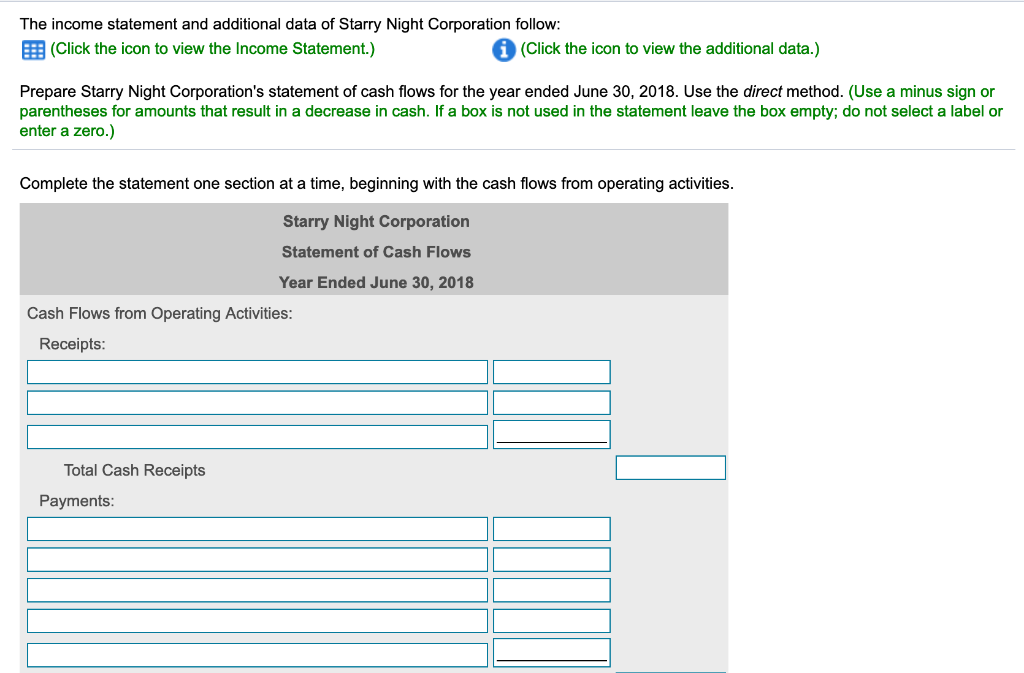

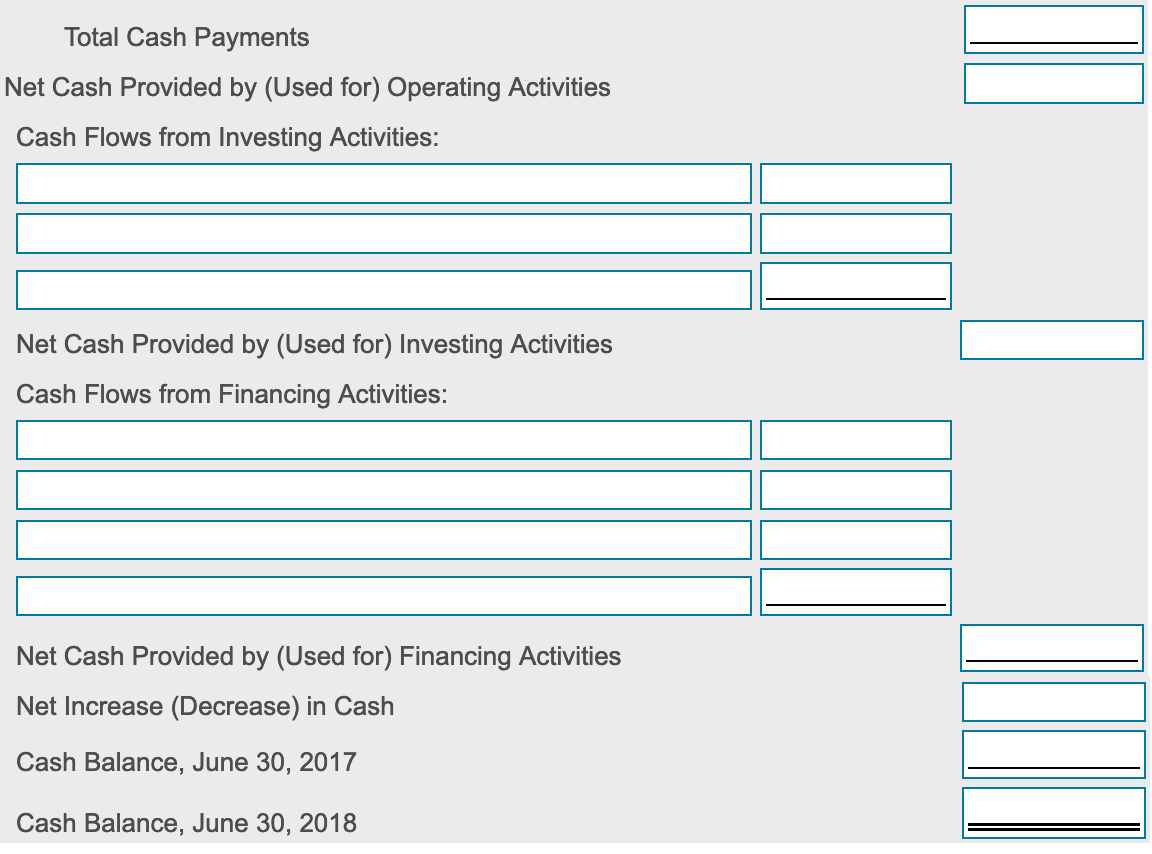

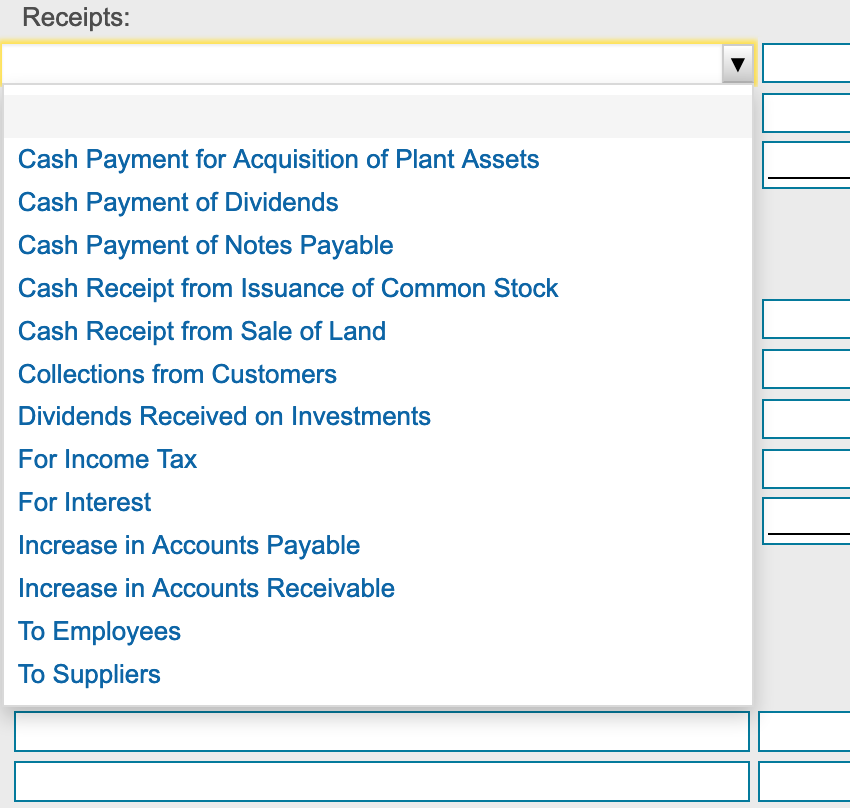

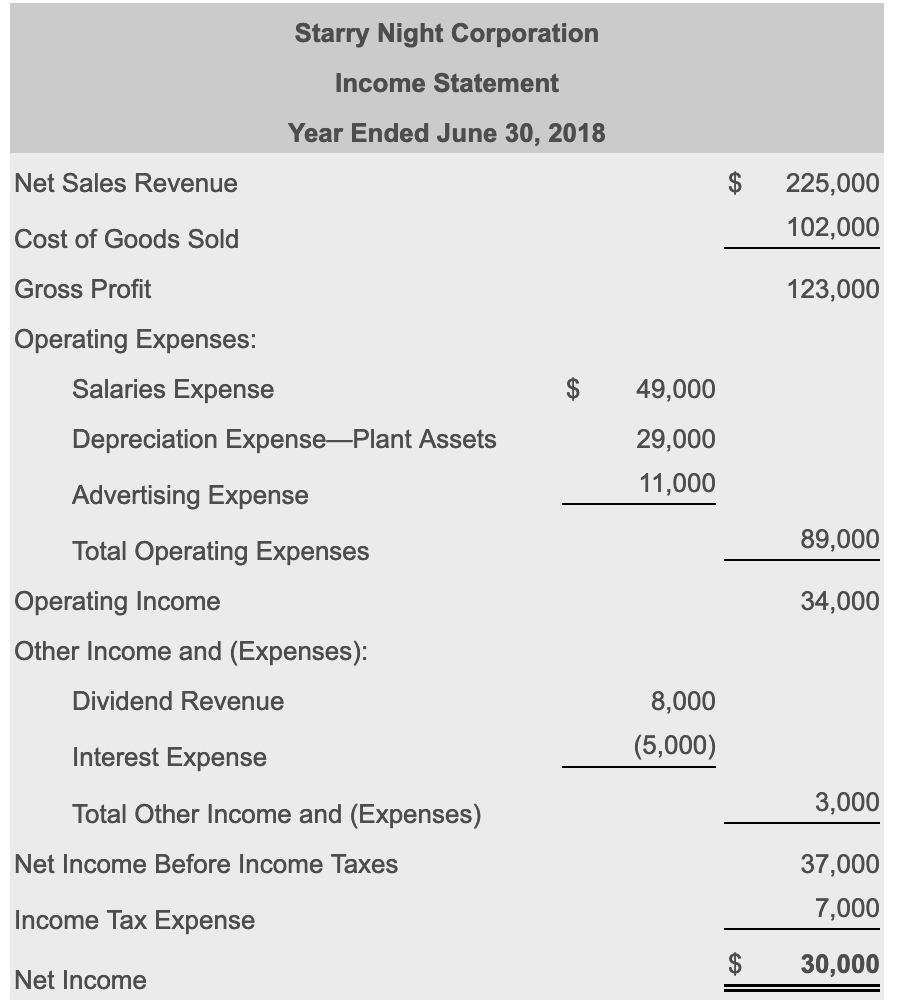

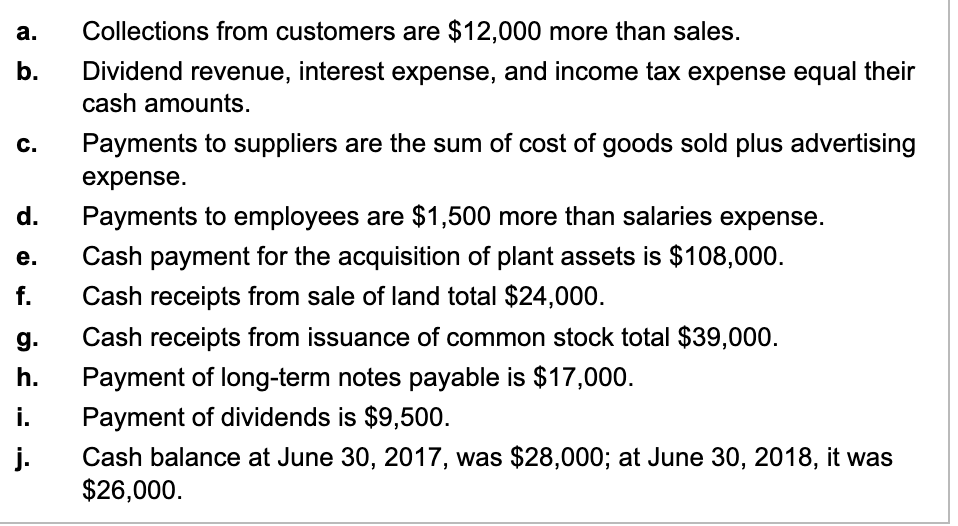

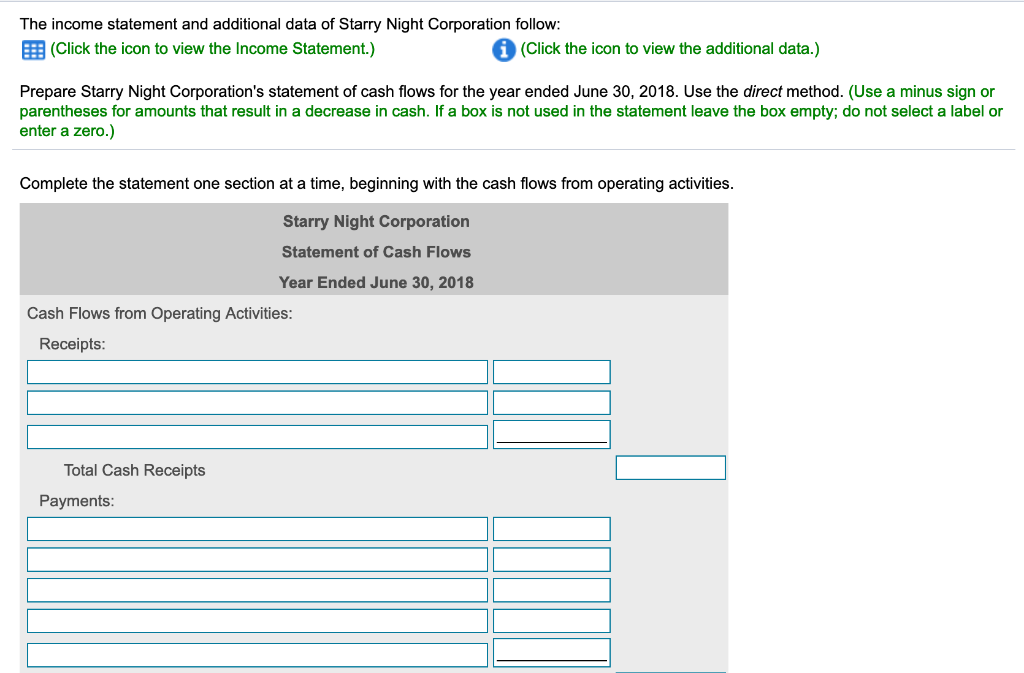

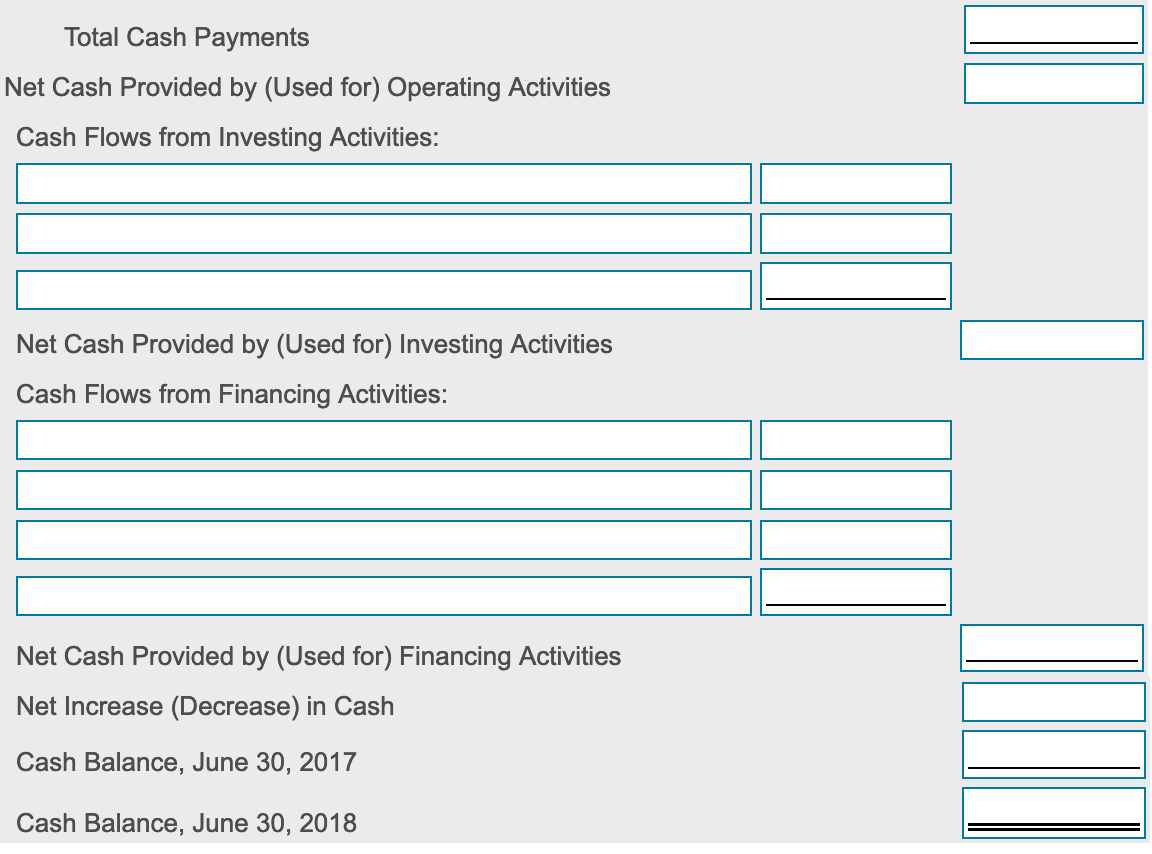

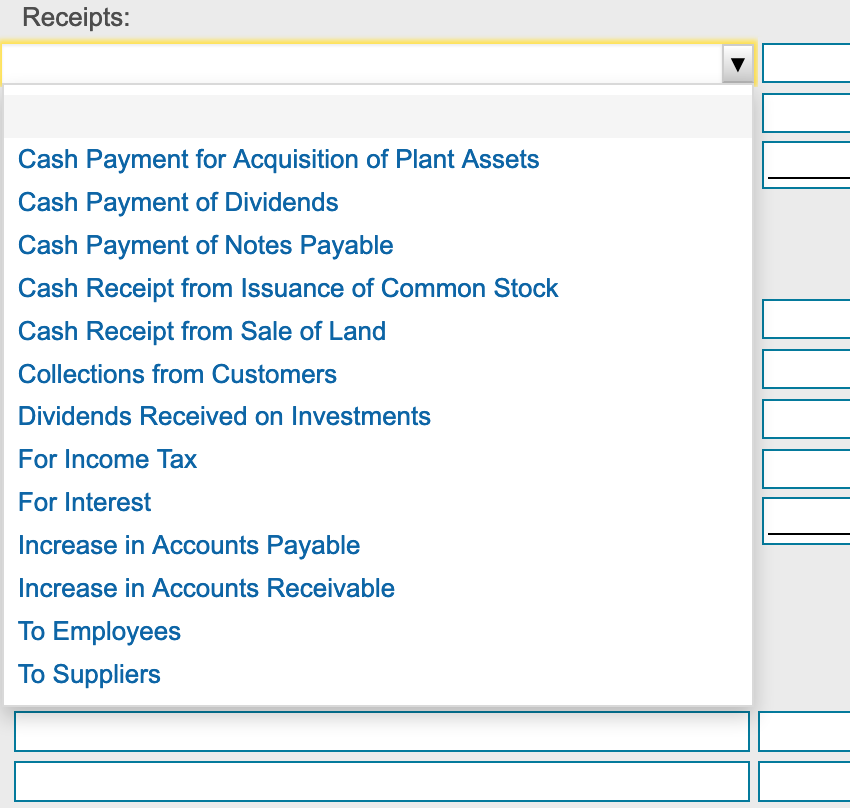

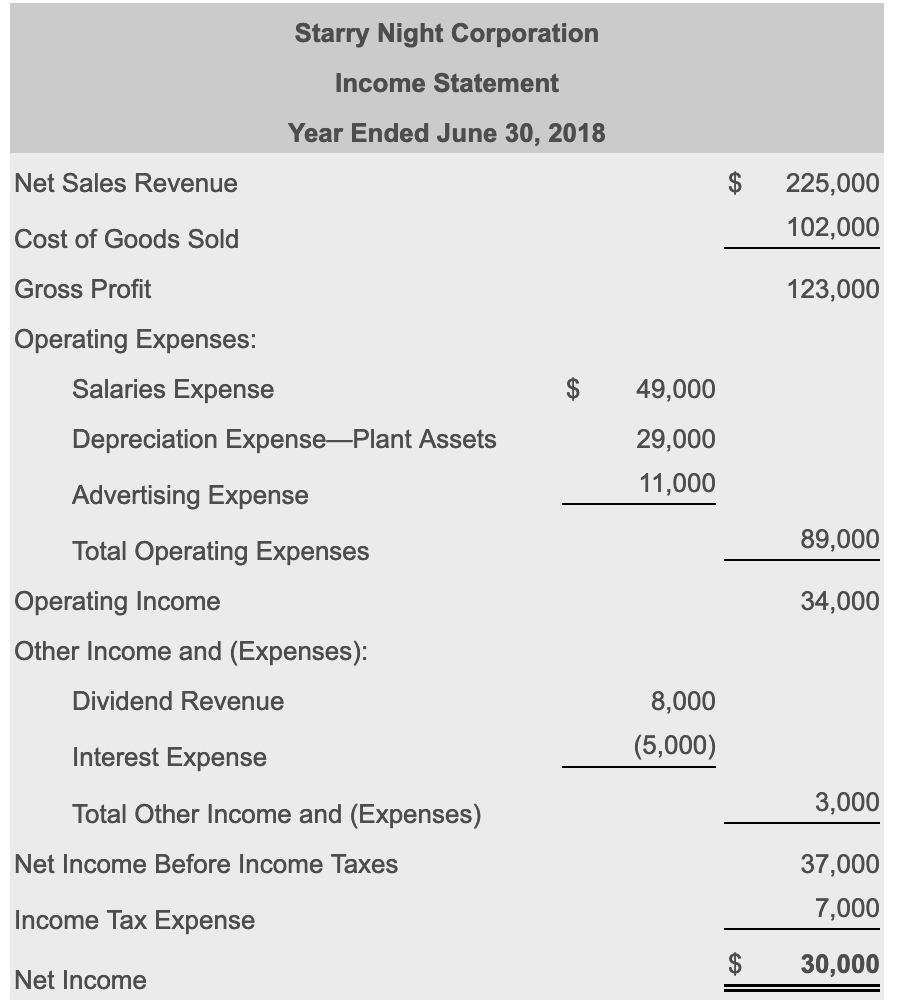

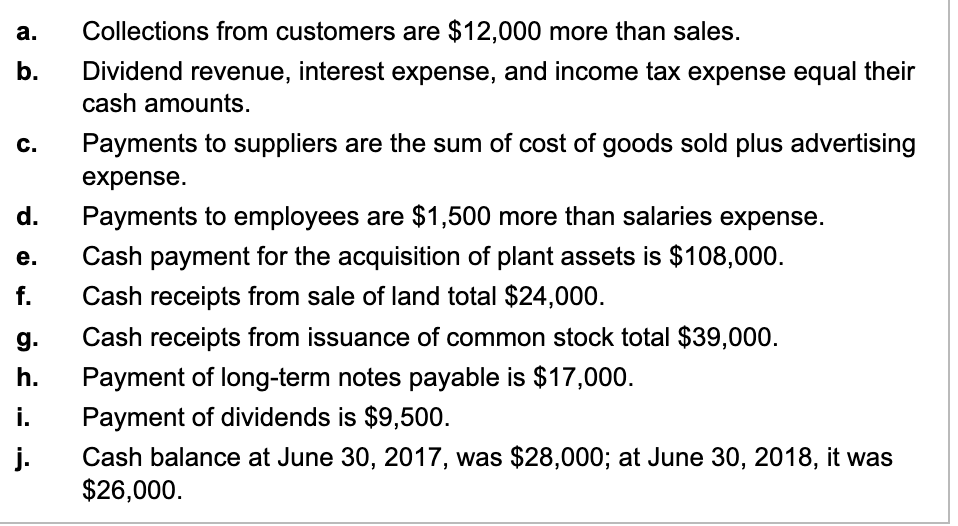

The income statement and additional data of Starry Night Corporation follow: (Click the icon to view the Income Statement.) (Click the icon to view the additional data.) Prepare Starry Night Corporation's statement of cash flows for the year ended June 30, 2018. Use the direct method. (Use a minus sign or parentheses for amounts that result in a decrease in cash. If a box is not used in the statement leave the box empty; do not select a label or enter a zero.) Complete the statement one section at a time, beginning with the cash flows from operating activities. Starry Night Corporation Statement of Cash Flows Year Ended June 30, 2018 Cash Flows from Operating Activities: Receipts: Total Cash Receipts Payments: Total Cash Payments Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Cash Balance, June 30, 2017 Cash Balance, June 30, 2018 Receipts: Cash Payment for Acquisition of Plant Assets Cash Payment of Dividends Cash Payment of Notes Payable Cash Receipt from Issuance of Common Stock Cash Receipt from Sale of Land Collections from Customers Dividends Received on Investments For Income Tax For Interest Increase in Accounts Payable Increase in Accounts Receivable To Employees To Suppliers Starry Night Corporation Income Statement Year Ended June 30, 2018 Net Sales Revenue $ 225,000 102,000 Cost of Goods Sold Gross Profit 123,000 Operating Expenses: Salaries Expense Depreciation ExpensePlant Assets 49,000 29,000 11,000 Advertising Expense 89,000 Total Operating Expenses Operating Income Other Income and (Expenses): 34,000 Dividend Revenue 8,000 (5,000) Interest Expense Total Other Income and (Expenses) 3,000 Net Income Before Income Taxes 37,000 7,000 Income Tax Expense $ 30,000 Net Income a. b. C. d. e. Collections from customers are $12,000 more than sales. Dividend revenue, interest expense, and income tax expense equal their cash amounts. Payments to suppliers are the sum of cost of goods sold plus advertising expense. Payments to employees are $1,500 more than salaries expense. Cash payment for the acquisition of plant assets is $108,000. Cash receipts from sale of land total $24,000. Cash receipts from issuance of common stock total $39,000. Payment of long-term notes payable is $17,000. Payment of dividends is $9,500. Cash balance at June 30, 2017, was $28,000; at June 30, 2018, it was $26,000. f. g. h. i. j