Question

The income statement of Supplements Plus, Inc. follows: Additional data follow: a. Acquisition of plant assets is $121,000. Of this amount, $104,000 is paid in

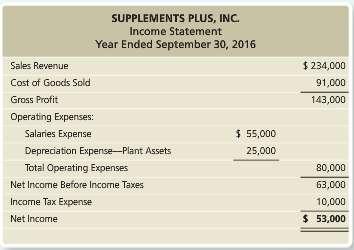

The income statement of Supplements Plus, Inc. follows:

Additional data follow:

a. Acquisition of plant assets is $121,000. Of this amount, $104,000 is paid in cash and $17,000 by signing a note payable.

b. Cash receipt from sale of land totals $26,000. There was no gain or loss.

c. Cash receipts from issuance of common stock total $30,000.

d. Payment of notes payable is $16,000.

e. Payment of dividends is $9,000.

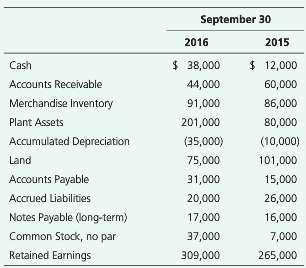

f. From the balance sheet:

Prepare Supplements Plus€™s statement of cash flows for the year ended September 30, 2016, using the indirect method. Include a separate section for non-cash investing and financing activities.

SUPPLEMENTS PLUS, INC. Income Statement Year Ended September 30, 2016 Sales Revenue $ 234,000 Cost of Goods Sold 91,000 Gross Profit 143,000 Operating Expenses: Salaries Expense $ 55,000 Depreciation Expense-Plant Assets 25,000 Total Operating Expenses 80,000 Net Income Before Incorne Taxes 63,000 Income Tax Expense 10,000 Net Income $ 53,000

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started