Answered step by step

Verified Expert Solution

Question

1 Approved Answer

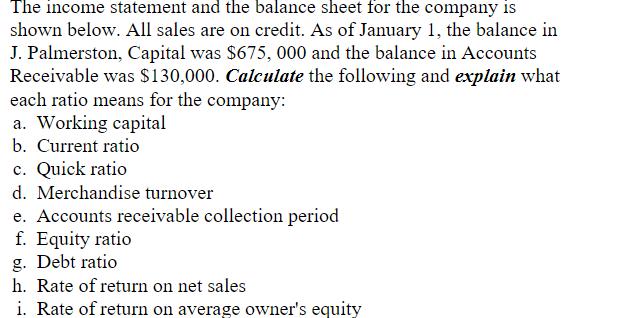

The income statement and the balance sheet for the company is shown below. All sales are on credit. As of January 1, the balance

The income statement and the balance sheet for the company is shown below. All sales are on credit. As of January 1, the balance in J. Palmerston, Capital was $675, 000 and the balance in Accounts Receivable was $130,000. Calculate the following and explain what each ratio means for the company: a. Working capital b. Current ratio c. Quick ratio d. Merchandise turnover e. Accounts receivable collection period f. Equity ratio g. Debt ratio h. Rate of return on net sales i. Rate of return on average owner's equity J. Palmerston Enterprises Income Statement For the year ended December 31, 20-1 Revenue Sales Sales Returns and Allowances Net Sales Cost of Goods Sold Inventory, January 1 Net Purchases Cost of Goods for Sale Less: Inventory, December 31 Cost of Goods Sold Gross Profit Operating Expenses Advertising Salaries Bad Debts Bank Charges and Interest Delivery Depreciation Building Depreciation Equipment Depreciation-Delivery Equipment Utilities Other Total Expenses Net Income $1 530 000 30 000 240 000 1 030 000 1 270 000 220 000 15 300 116 400 1 600 47 200 19 500 33 750 17 800 12 500 16 450 10 500 $1 500 000 1 050 000 450 000 291 000 $ 159 000 Current Assets Cash Marketable Securities Accounts Receivable Merchandise Inventory Prepaid Expenses Total Current Assets Plant and Equipment Land Building Equipment Delivery Equipment Total Plant and Equipment Total Assets Current Liabilities Accounts Payable Bank Loan Total Current Liabilities J. Palmerston Enterprises Balance Sheet As at December 31, 20-1 Assets Long-Term Liabilities Mortgage Total Liabilities $ 72 500 32 500 170 000 230 000 5.000 Owner's Equity J. Palmerston, Capital Total Liabilities and Owner's Equity 225 000 675 000 95 000 80 000 Liabilities and Owner's Equity $350 000 50 000 $ 510 000 1075 000 $1 585 000 $ 400 000 450 000 850 000 735 000 $1 585 000

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Working capital Current assets Cash Marketable Securities Accounts Receivable Merchandise Inventory Prepaid Expenses Current assets 72500 32500 170000 230000 5000 Current assets 510000 Current liabi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started