Answered step by step

Verified Expert Solution

Question

1 Approved Answer

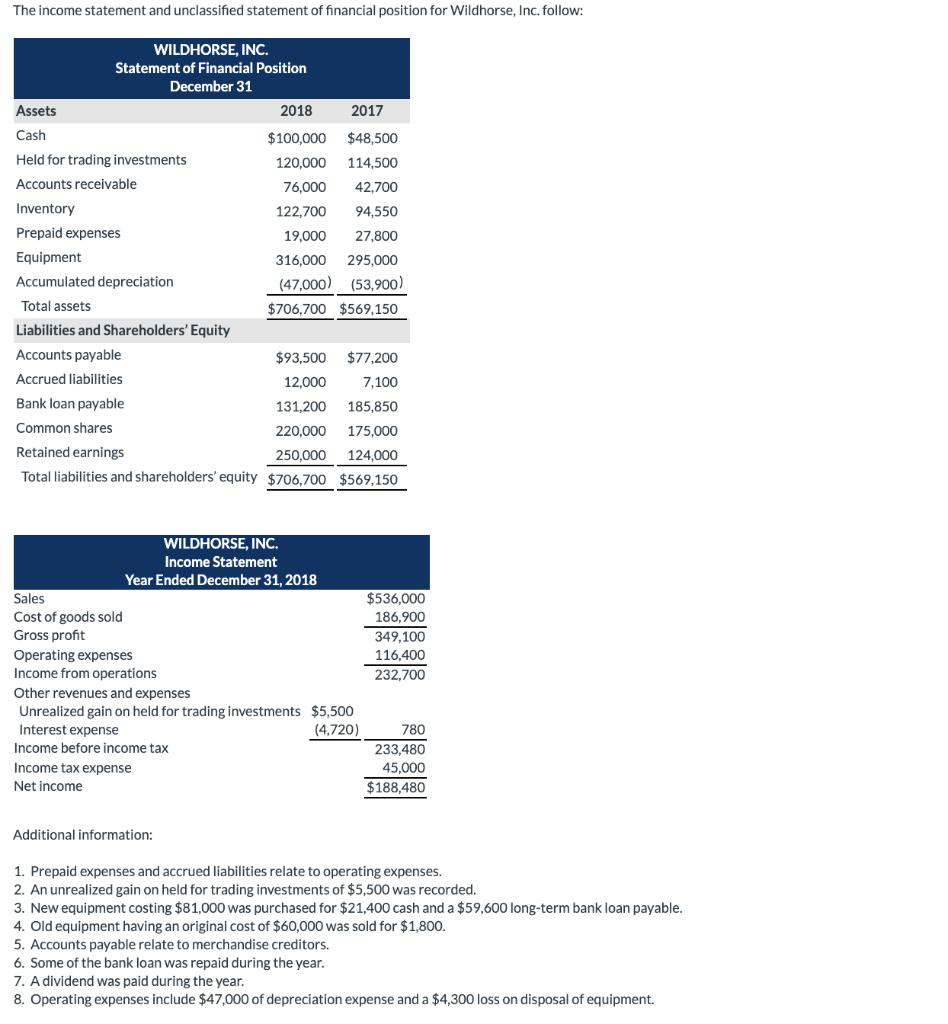

The income statement and unclassified statement of financial position for Wildhorse, Inc. follow: WILDHORSE, INC. Statement of Financial Position December 31 Assets 2018 2017

The income statement and unclassified statement of financial position for Wildhorse, Inc. follow: WILDHORSE, INC. Statement of Financial Position December 31 Assets 2018 2017 Cash $100,000 $48,500 Held for trading investments 120,000 114,500 Accounts receivable 76,000 42,700 Inventory 122,700 94,550 Prepaid expenses 19,000 27,800 Equipment 316,000 295,000 Accumulated depreciation (47,000) (53,900) Total assets $706,700 $569,150 Liabilities and Shareholders' Equity Accounts payable $93,500 $77,200 Accrued liabilities 12,000 7,100 Bank loan payable 131,200 185,850 Common shares 220,000 175.000 Retained earnings 250,000 124.000 Total liabilities and shareholders' equity $706.700 $569,150 WILDHORSE, INC. Income Statement Year Ended December 31, 2018 Sales $536,000 Cost of goods sold 186,900 Gross profit 349,100 Operating expenses Income from operations 116,400 232,700 Other revenues and expenses Unrealized gain on held for trading investments $5,500 Interest expense (4,720) 780 Income before income tax Income tax expense Net income 233,480 45,000 $188,480 Additional information: 1. Prepaid expenses and accrued liabilities relate to operating expenses. 2. An unrealized gain on held for trading investments of $5,500 was recorded. 3. New equipment costing $81,000 was purchased for $21,400 cash and a $59,600 long-term bank loan payable. 4. Old equipment having an original cost of $60,000 was sold for $1,800. 5. Accounts payable relate to merchandise creditors. 6. Some of the bank loan was repaid during the year. 7. Adividend was paid during the year. 8. Operating expenses include $47,000 of depreciation expense and a $4,300 loss on disposal of equipment. (a) Prepare the statement of cash flows, using the indirect method. (Show amounts that decrease cash flow with either a- sign e.g. -15,000 or in parenthesis e.g. (15,000).) WILDHORSE, INC. Statement of Cash Flows-Indirect Method Adjustments to reconcile net income to $ Note X to the Statement of Cash Flows: During the year, the company purchased equipment costing $ and issuing a $59,600 bank loan payable. by paying $21,400 cash > > > > > >

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635ddcb46bd7b_179494.pdf

180 KBs PDF File

635ddcb46bd7b_179494.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started