Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The income statement approach to estimating uncollectible accounts expense is used by Landis Company. On February 28, the firm had accounts receivable in the

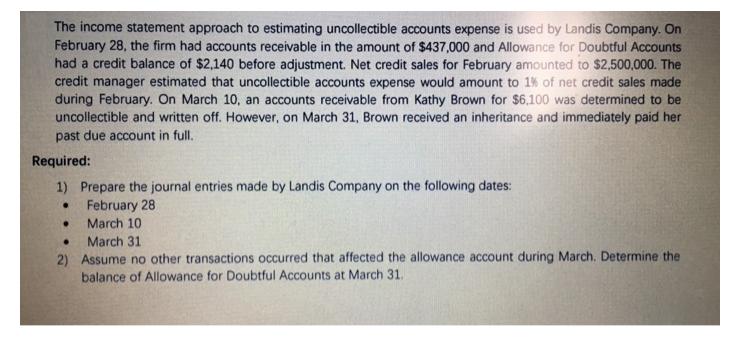

The income statement approach to estimating uncollectible accounts expense is used by Landis Company. On February 28, the firm had accounts receivable in the amount of $437,000 and Allowance for Doubtful Accounts had a credit balance of $2,140 before adjustment. Net credit sales for February amounted to $2,500,000. The credit manager estimated that uncollectible accounts expense would amount to 1% of net credit sales made during February. On March 10, an accounts receivable from Kathy Brown for $6,100 was determined to be uncollectible and written off. However, on March 31, Brown received an inheritance and immediately paid her past due account in full. Required: 1) Prepare the journal entries made by Landis Company on the following dates: February 28 March 10 March 31 2) Assume no other transactions occurred that affected the allowance account during March. Determine the balance of Allowance for Doubtful Accounts at March 31.

Step by Step Solution

★★★★★

3.44 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

1 Accounts Dr Cr 28Feb Accounts Receivable 2500000 Sales Revenue 2500000 Sales made on credi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started